Question

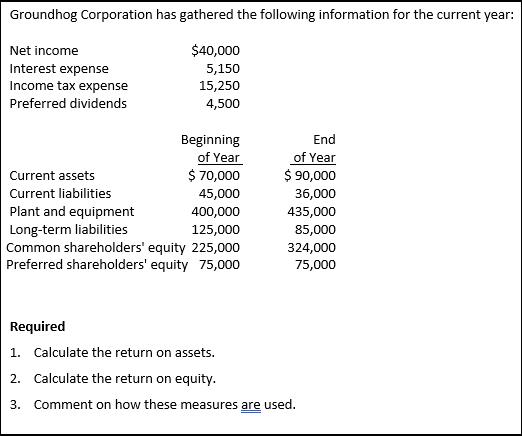

Groundhog Corporation has gathered the following information for the current year: $40,000 5,150 15,250 4,500 Net income Interest expense Income tax expense Preferred dividends

Groundhog Corporation has gathered the following information for the current year: $40,000 5,150 15,250 4,500 Net income Interest expense Income tax expense Preferred dividends Current assets Current liabilities Plant and equipment Long-term liabilities Beginning of Year $ 70,000 45,000 400,000 125,000 Common shareholders' equity 225,000 Preferred shareholders' equity 75,000 End of Year $ 90,000 36,000 435,000 85,000 324,000 75,000 Required 1. Calculate the return on assets. 2. Calculate the return on equity. 3. Comment on how these measures are used.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the return on assets ROA and return on equity ROE well use the following formulas Return on Assets ROA Net Income Average Total Assets Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2020 Comprehensive

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

33rd Edition

0135196272, 978-0135196274

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App