Question

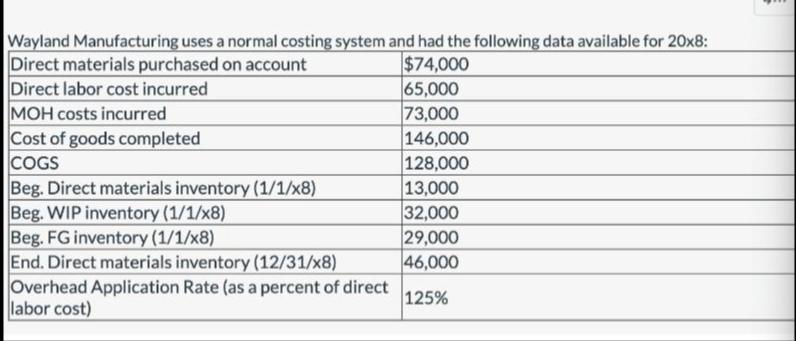

Wayland Manufacturing uses a normal costing system and had the following data available for 20x8: Direct materials purchased on account $74,000 Direct labor cost

Wayland Manufacturing uses a normal costing system and had the following data available for 20x8: Direct materials purchased on account $74,000 Direct labor cost incurred 65,000 73,000 146,000 128,000 13,000 32,000 29,000 46,000 125% MOH costs incurred Cost of goods completed COGS Beg. Direct materials inventory (1/1/x8) Beg. WIP inventory (1/1/x8) Beg. FG inventory (1/1/x8) End. Direct materials inventory (12/31/x8) Overhead Application Rate (as a percent of direct labor cost) What is the cost of direct materials put into production during 20x8? What is the balance in WIP inventory (12/31/x8)? What is the ending balance in FG inventory (12/31/x8)?

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To determine the cost of direct materials put into production during 20x8 we need to calculate the d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting What the Numbers Mean

Authors: David H. Marshall, Wayne W. McManus, Daniel F. Viele,

9th Edition

978-0-07-76261, 0-07-762611-7, 9780078025297, 978-0073527062

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App