Answered step by step

Verified Expert Solution

Question

1 Approved Answer

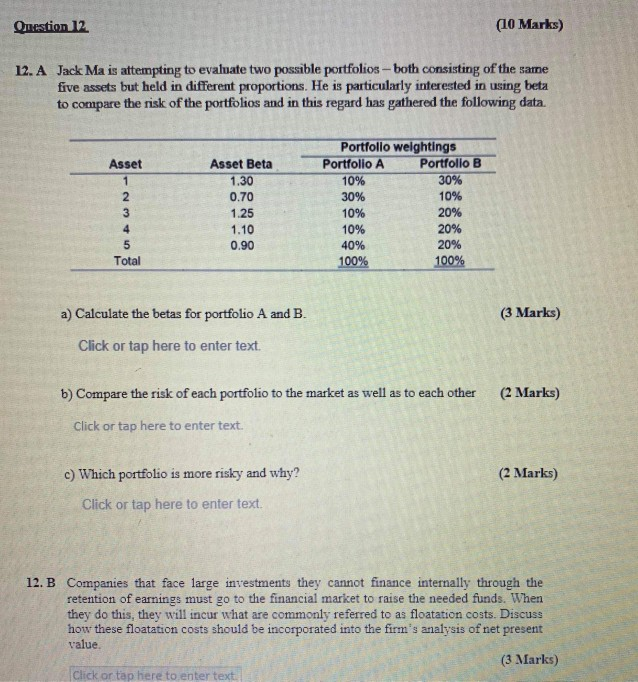

Onestion 12 (10 Marks) 12. A Jack Ma is attempting to evaluate two possible portfolios - both consisting of the same five assets but held

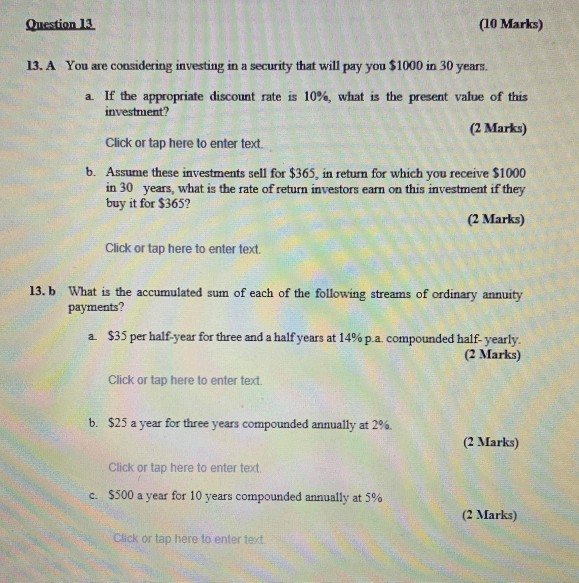

Onestion 12 (10 Marks) 12. A Jack Ma is attempting to evaluate two possible portfolios - both consisting of the same five assets but held in different proportions. He is particularly interested in using beta to compare the risk of the portfolios and in this regard has gathered the following data. Asset 1 2 3 4 5 Total Asset Beta 1.30 0.70 1.25 1.10 0.90 Portfolio weightings Portfolio A Portfolio B 10% 30% 30% 10% 10% 20% 10% 20% 40% 20% 100% 100% (3 Marks) a) Calculate the betas for portfolio A and B. Click or tap here to enter text. (2 Marks) b) Compare the risk of each portfolio to the market as well as to each other Click or tap here to enter text. c) Which portfolio is more risky and why? (2 Marks) Click or tap here to enter text. 12. B Companies that face large investments they cannot finance internally through the retention of earnings must go to the financial market to raise the needed funds. When they do this, they will incur what are commonly referred to as floatation costs. Discuss how these floatation costs should be incorporated into the firm's analysis of net present value (3 Marks) Click or tap here to enter text: Question 13 (10 Marks) 13. A You are considering investing in a security that will pay you $1000 in 30 years. a If the appropriate discount rate is 10%, what is the present value of this investment? (2 Marks) Click or tap here to enter text. B. Assume these investments sell for $365, in return for which you receive $1000 in 30 years, what is the rate of return investors earn on this investment if they buy it for $365? (2 Marks) Click or tap here to enter text. 13.b What is the accumulated sum of each of the following streams of ordinary annuity payments? a $35 per half-year for three and a half years at 14%p.a. compounded half-yearly (2 Marks) Click or tap here to enter text. 6. $25 a year for three years compounded annually at 2%. (2 Marks) Click or tap here to enter text c. $500 a year for 10 years compounded annually at 5% (2 Marks) Click or tap here to enter text

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started