Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Onjuly 1 of Year 1, West Company purchased for cash, 8,$10,000 bonids of North Corporation to yield 104 Whe bonds pay 93 interest, payable one

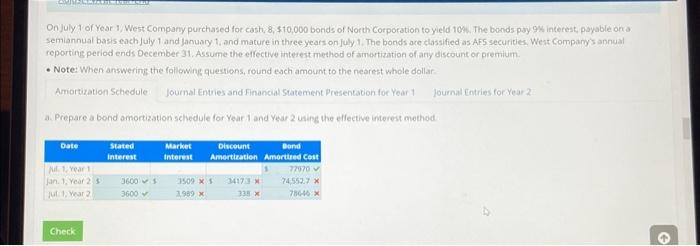

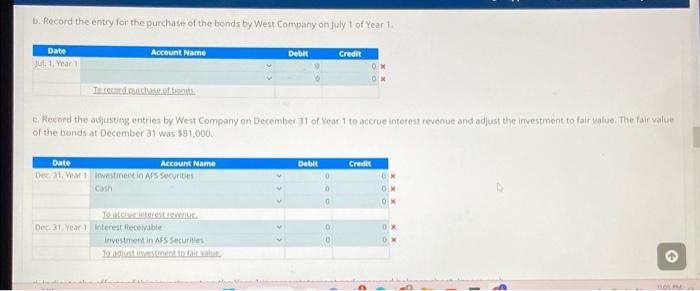

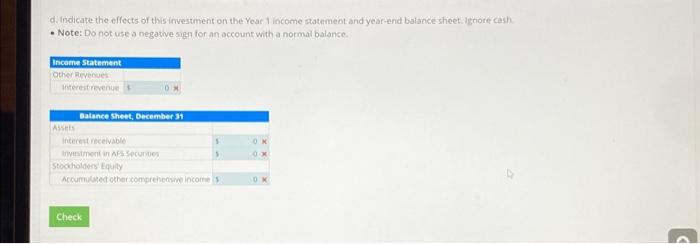

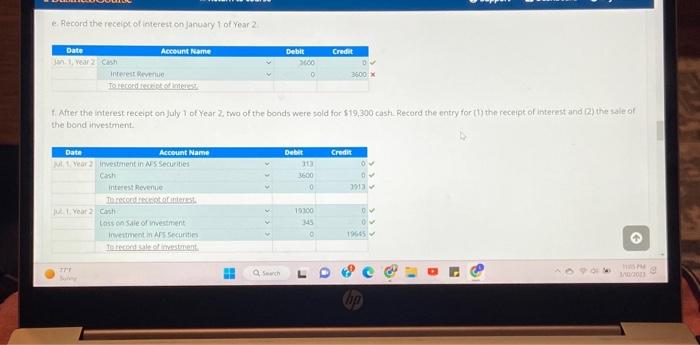

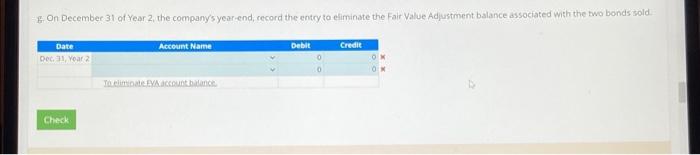

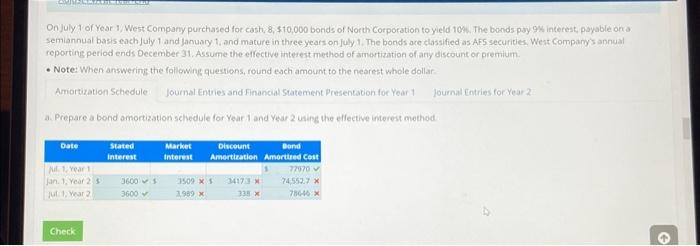

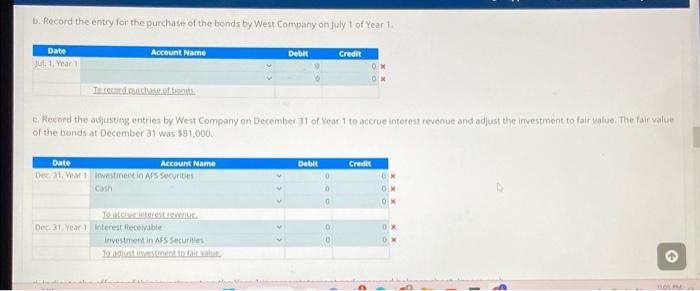

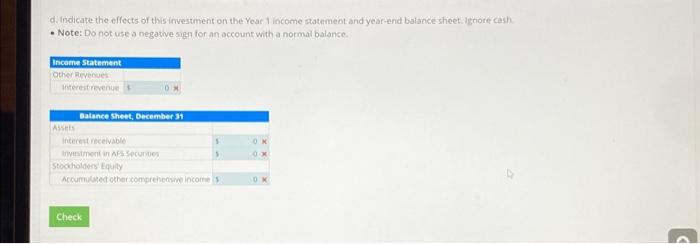

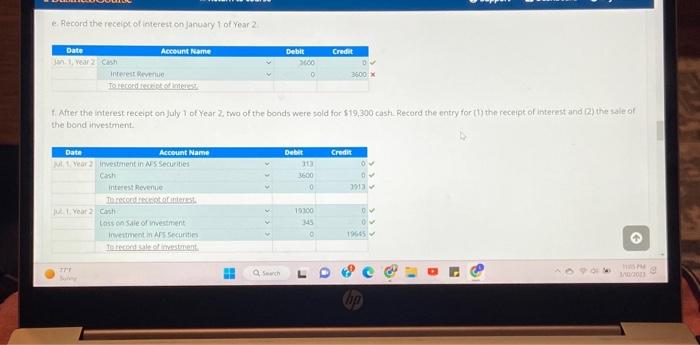

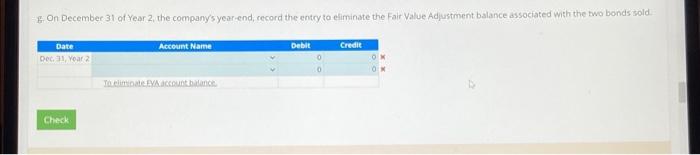

Onjuly 1 of Year 1, West Company purchased for cash, 8,$10,000 bonids of North Corporation to yield 104 Whe bonds pay 93 interest, payable one semiannual basis each july 1 and january 1 , and mature in three years on july 1. The bonds are classified as AF5 securities, Wert Comparys annual reporting period ends December 31 . Assume the effective interest method of amartization of any discount or premium. - Note: When answering the followng queations, round esch amount to the nearest whole dollar Amortization Schedule: Journal Entries and Financial Statement Presentation for Year 1 fournal Entries for Year 2 a. Prepare a bond amortization sehedule for Year 1 and year 2 usies the eflective interest method b. Record the entry for the purchase of the bonds by West Company on july 1 of Year 1 . C. Record the adjusting entries by West Company on December 31 of Year 1 to accrue interest revenue and adjust the investment to fair valu. The fair value of the bonds at December 31 was $88,000. d. Indicate the effects of this investment on the Yeae 1 income statement and year-end balance sheet:lgnore cash - Note: Do not use a negative sigar for an account with a normal balance. e. Record the receipt ofinteren on jantary 1 of Yoar 2 f. After the interest receipt onjuly i of Year 2 , two of the bonds were sold for 519,200 cash Record the entry for (1) the receipt of interest and (2) the sule of the bond ifvestment. E. On December 31 of Year 2, the company's year-end, record the entcy to eliminate the Fair Value Adjustment balance associated wishithe two bonds sold

Onjuly 1 of Year 1, West Company purchased for cash, 8,$10,000 bonids of North Corporation to yield 104 Whe bonds pay 93 interest, payable one semiannual basis each july 1 and january 1 , and mature in three years on july 1. The bonds are classified as AF5 securities, Wert Comparys annual reporting period ends December 31 . Assume the effective interest method of amartization of any discount or premium. - Note: When answering the followng queations, round esch amount to the nearest whole dollar Amortization Schedule: Journal Entries and Financial Statement Presentation for Year 1 fournal Entries for Year 2 a. Prepare a bond amortization sehedule for Year 1 and year 2 usies the eflective interest method b. Record the entry for the purchase of the bonds by West Company on july 1 of Year 1 . C. Record the adjusting entries by West Company on December 31 of Year 1 to accrue interest revenue and adjust the investment to fair valu. The fair value of the bonds at December 31 was $88,000. d. Indicate the effects of this investment on the Yeae 1 income statement and year-end balance sheet:lgnore cash - Note: Do not use a negative sigar for an account with a normal balance. e. Record the receipt ofinteren on jantary 1 of Yoar 2 f. After the interest receipt onjuly i of Year 2 , two of the bonds were sold for 519,200 cash Record the entry for (1) the receipt of interest and (2) the sule of the bond ifvestment. E. On December 31 of Year 2, the company's year-end, record the entcy to eliminate the Fair Value Adjustment balance associated wishithe two bonds sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started