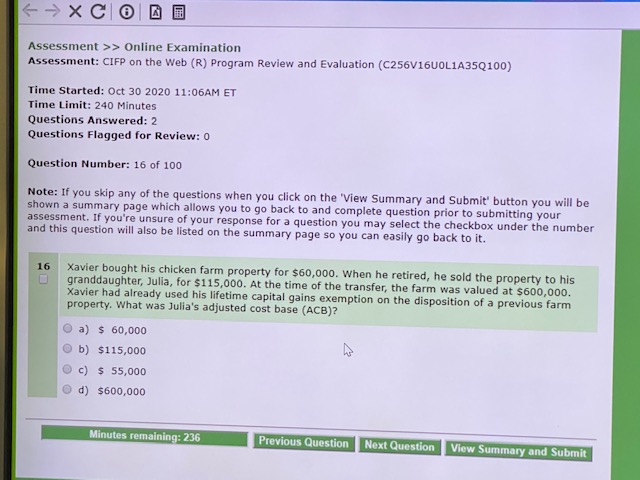

Question: > Online Examination Assessment: CIFP on the Web (R) Program Review and Evaluation (C256V16U0L1A35Q100) Time Started: Oct 30 2020 11:06AM ET Time Limit: 240

> Online Examination Assessment: CIFP on the Web (R) Program Review and Evaluation (C256V16U0L1A35Q100) Time Started: Oct 30 2020 11:06AM ET Time Limit: 240 Minutes Questions Answered: 2 Questions Flagged for Review: 0 Question Number: 16 of 100 Note: If you skip any of the questions when you click on the 'View Summary and Submit' button you will be shown a summary page which allows you to go back to and complete question prior to submitting your assessment. If you're unsure of your response for a question you may select the checkbox under the number and this question will also be listed on the summary page so you can easily go back to it. 16 Xavier bought his chicken farm property for $60,000. When he retired, he sold the property to his granddaughter, Julia, for $115,000. At the time of the transfer, the farm was valued at $600,000. Xavier had already used his lifetime capital gains exemption on the disposition of a previous farm property. What was Julia's adjusted cost base (ACB)? a) $ 60,000 b) $115,000 c) $ 55,000 d) $600,000 Minutes remaining: 236 Previous Question Next Question View Summary and Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts