Answered step by step

Verified Expert Solution

Question

1 Approved Answer

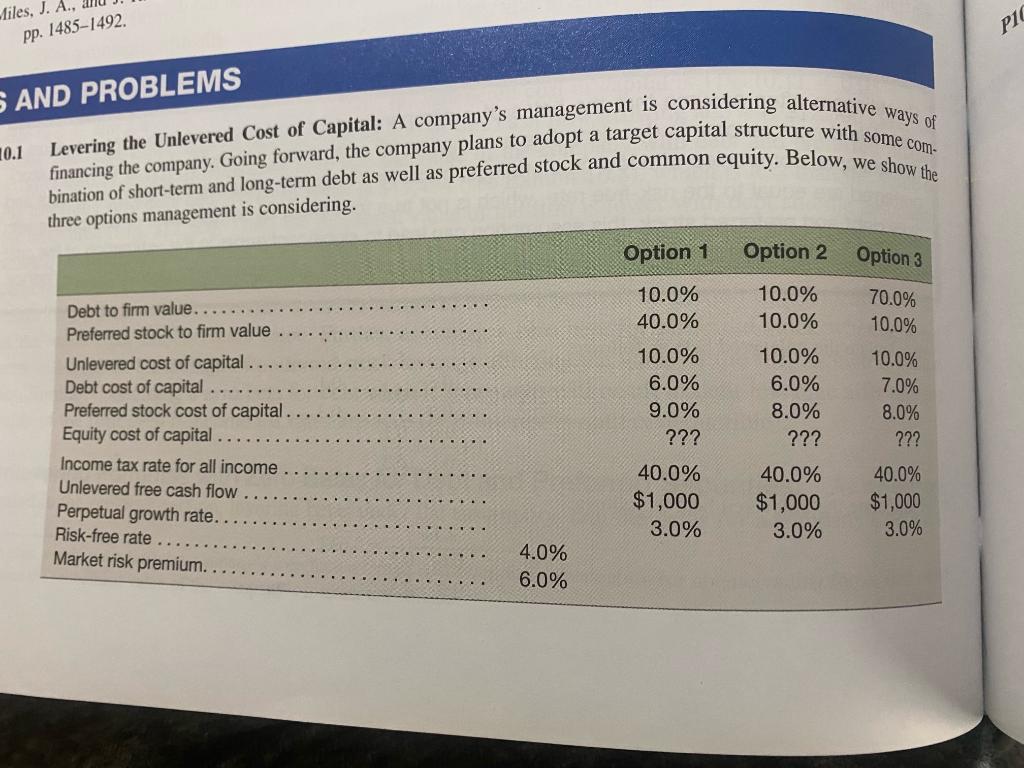

only 10.1 a and b (i-iv) Levering the Unlevered Cost of Capital: A company's management is considering alternative ways of financing the company. Going forward,

only 10.1 a and b (i-iv)

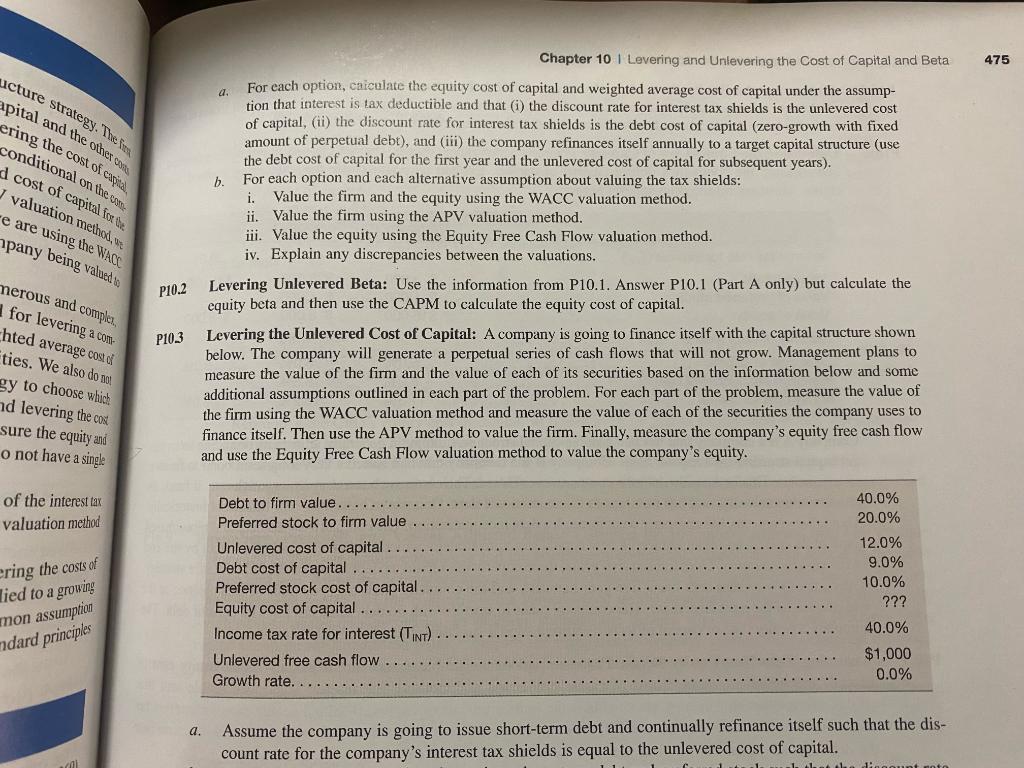

Levering the Unlevered Cost of Capital: A company's management is considering alternative ways of financing the company. Going forward, the company plans to adopt a target capital structure with some com. bination of short-term and long-term debt as well as preferred stock and common equity. Below, we show the three options management is considering. a. For each option, caiculate the equity cost of capital and weighted average cost of capital under the assumption that interest is tax deductible and that (i) the discount rate for interest tax shields is the unlevered cost of capital, (ii) the discount rate for interest tax shields is the debt cost of capital (zero-growth with fixed amount of perpetual debt), and (iii) the company refinances itself annually to a target capital structure (use the debt cost of capital for the first year and the unlevered cost of capital for subsequent years). b. For each option and each alternative assumption about valuing the tax shields: i. Value the firm and the equity using the WACC valuation method. ii. Value the firm using the APV valuation method. iii. Value the equity using the Equity Free Cash Flow valuation method. iv. Explain any discrepancies between the valuations. Levering Unlevered Beta: Use the information from P10.1. Answer P10.1 (Part A only) but calculate the equity beta and then use the CAPM to calculate the equity cost of capital. Levering the Unlevered Cost of Capital: A company is going to finance itself with the capital structure shown below. The company will generate a perpetual series of cash flows that will not grow. Management plans to measure the value of the firm and the value of each of its securities based on the information below and some additional assumptions outlined in each part of the problem. For each part of the problem, measure the value of the firm using the WACC valuation method and measure the value of each of the securities the company uses to finance itself. Then use the APV method to value the firm. Finally, measure the company's equity free cash flow and use the Equity Free Cash Flow valuation method to value the company's equity. a. Assume the company is going to issue short-term debt and continually refinance itself such that the discount rate for the company's interest tax shields is equal to the unlevered cost of capital. Levering the Unlevered Cost of Capital: A company's management is considering alternative ways of financing the company. Going forward, the company plans to adopt a target capital structure with some com. bination of short-term and long-term debt as well as preferred stock and common equity. Below, we show the three options management is considering. a. For each option, caiculate the equity cost of capital and weighted average cost of capital under the assumption that interest is tax deductible and that (i) the discount rate for interest tax shields is the unlevered cost of capital, (ii) the discount rate for interest tax shields is the debt cost of capital (zero-growth with fixed amount of perpetual debt), and (iii) the company refinances itself annually to a target capital structure (use the debt cost of capital for the first year and the unlevered cost of capital for subsequent years). b. For each option and each alternative assumption about valuing the tax shields: i. Value the firm and the equity using the WACC valuation method. ii. Value the firm using the APV valuation method. iii. Value the equity using the Equity Free Cash Flow valuation method. iv. Explain any discrepancies between the valuations. Levering Unlevered Beta: Use the information from P10.1. Answer P10.1 (Part A only) but calculate the equity beta and then use the CAPM to calculate the equity cost of capital. Levering the Unlevered Cost of Capital: A company is going to finance itself with the capital structure shown below. The company will generate a perpetual series of cash flows that will not grow. Management plans to measure the value of the firm and the value of each of its securities based on the information below and some additional assumptions outlined in each part of the problem. For each part of the problem, measure the value of the firm using the WACC valuation method and measure the value of each of the securities the company uses to finance itself. Then use the APV method to value the firm. Finally, measure the company's equity free cash flow and use the Equity Free Cash Flow valuation method to value the company's equity. a. Assume the company is going to issue short-term debt and continually refinance itself such that the discount rate for the company's interest tax shields is equal to the unlevered cost of capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started