Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only accept hand-written assignment. Use pen and paper, ipad or tablet, save as pdf file and upload. After uploading your assignment, download and open it

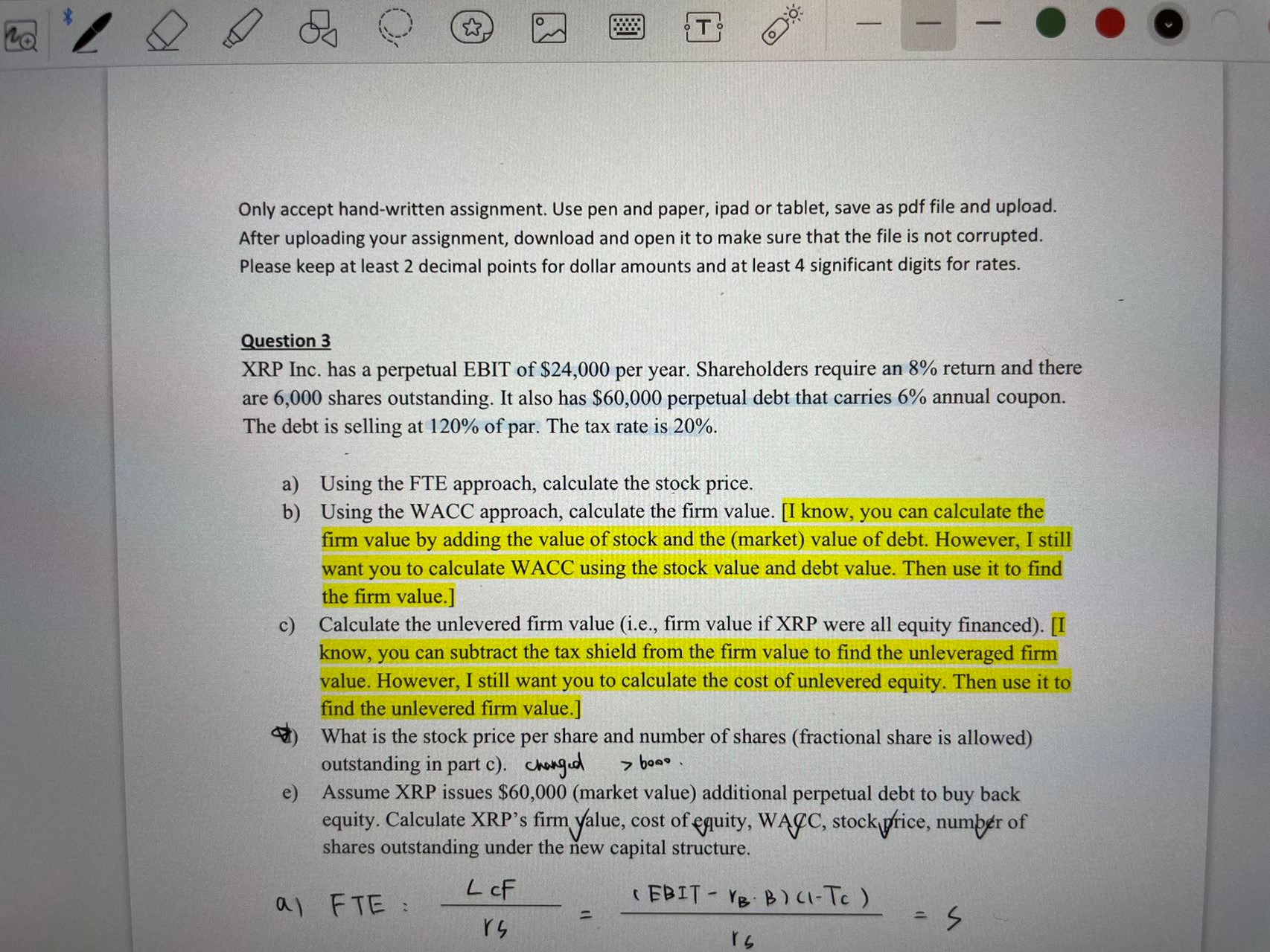

Only accept hand-written assignment. Use pen and paper, ipad or tablet, save as pdf file and upload. After uploading your assignment, download and open it to make sure that the file is not corrupted. Please keep at least 2 decimal points for dollar amounts and at least 4 significant digits for rates. Question 3 XRP Inc. has a perpetual EBIT of $24,000 per year. Shareholders require an 8% return and there are 6,000 shares outstanding. It also has $60,000 perpetual debt that carries 6% annual coupon. The debt is selling at 120% of par. The tax rate is 20%. a) Using the FTE approach, calculate the stock price. b) Using the WACC approach, calculate the firm value. [I know, you can calculate the firm value by adding the value of stock and the (market) value of debt. However, I still want you to calculate WACC using the stock value and debt value. Then use it to find the firm value.] c) Calculate the unlevered firm value (i.e., firm value if XRP were all equity financed). [I know, you can subtract the tax shield from the firm value to find the unleveraged firm value. However, I still want you to calculate the cost of unlevered equity. Then use it to find the unlevered firm value.] What is the stock price per share and number of shares (fractional share is allowed) outstanding in part c). changed > boso. e) Assume XRP issues $60,000 (market value) additional perpetual debt to buy back equity. Calculate XRP's firm yalue, cost of equity, WAYC, stock price, numper of shares outstanding under the new capital structure. a) FTE:rSLCF=rS(EBITrBB)(1TC)=S

Only accept hand-written assignment. Use pen and paper, ipad or tablet, save as pdf file and upload. After uploading your assignment, download and open it to make sure that the file is not corrupted. Please keep at least 2 decimal points for dollar amounts and at least 4 significant digits for rates. Question 3 XRP Inc. has a perpetual EBIT of $24,000 per year. Shareholders require an 8% return and there are 6,000 shares outstanding. It also has $60,000 perpetual debt that carries 6% annual coupon. The debt is selling at 120% of par. The tax rate is 20%. a) Using the FTE approach, calculate the stock price. b) Using the WACC approach, calculate the firm value. [I know, you can calculate the firm value by adding the value of stock and the (market) value of debt. However, I still want you to calculate WACC using the stock value and debt value. Then use it to find the firm value.] c) Calculate the unlevered firm value (i.e., firm value if XRP were all equity financed). [I know, you can subtract the tax shield from the firm value to find the unleveraged firm value. However, I still want you to calculate the cost of unlevered equity. Then use it to find the unlevered firm value.] What is the stock price per share and number of shares (fractional share is allowed) outstanding in part c). changed > boso. e) Assume XRP issues $60,000 (market value) additional perpetual debt to buy back equity. Calculate XRP's firm yalue, cost of equity, WAYC, stock price, numper of shares outstanding under the new capital structure. a) FTE:rSLCF=rS(EBITrBB)(1TC)=S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started