!!!!!ONLY ANSWER USING EXCEL!!!!!!

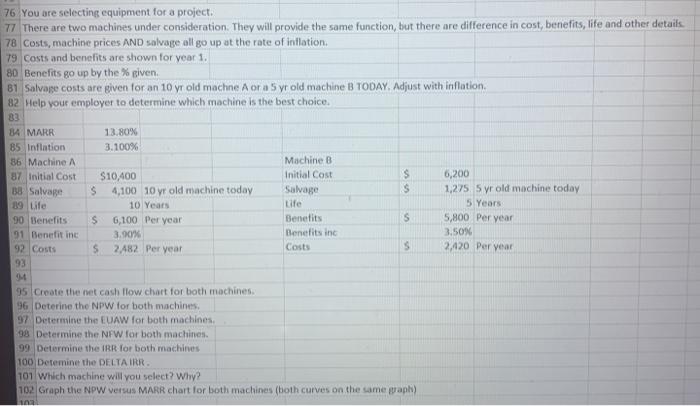

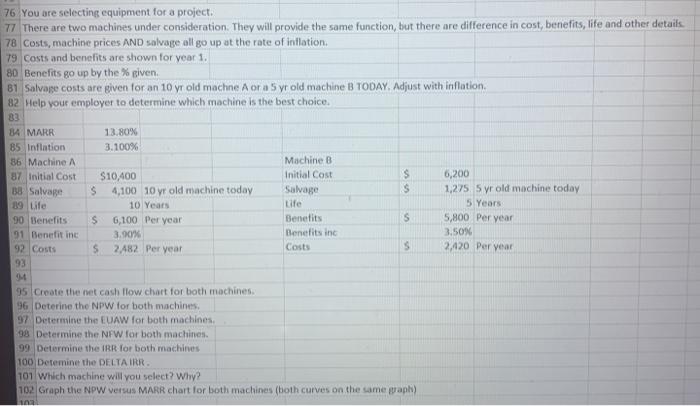

76 You are selecting equipment for a project. 77 There are two machines under consideration. They will provide the same function, but there are difference in cost, benefits, life and other details 78 Costs, machine prices AND salvage all go up at the rate of inflation. 79 Costs and benefits are shown for year 1. 80 Benefits go up by the given 81 Salvage costs are given for an 10 yr old machne A or a 5 yr old machine B TODAY. Adjust with inflation, 82 Help your employer to determine which machine is the best choice. 83 34 MARR 13.80% 85. Inflation 3.100% 86 Machine A Machine B 87 Initial Cost $10,400 Initial Cost $ 6,200 18 Salvage $ 4,100 10yr old machine today Salvage $ 1,275, 5 yr old machine today 19 Life 10 Years Life 5 Years 90 Benefits S 6,100 Per year Benefits S 5,800 Per year 91 Benefit inc 3.90% Benefits ind 3.50% 92 Costs S 2.482 Per year Costs 2,420 Per year 93 M 95 Create the net cash flow chart for both machines. 96 Deterine the NPW for both machines. 97 Determine the EUAW for both machines. 98 Determine the NFW for both machines. 99 Determine the IRR for both machines 100 Detemine the DELTA IRR. 101 Which machine will you select? Why? 102 Graph the NPW versus MARR chart for both machines (both curves on the same graph) 102 76 You are selecting equipment for a project. 77 There are two machines under consideration. They will provide the same function, but there are difference in cost, benefits, life and other details 78 Costs, machine prices AND salvage all go up at the rate of inflation. 79 Costs and benefits are shown for year 1. 80 Benefits go up by the given 81 Salvage costs are given for an 10 yr old machne A or a 5 yr old machine B TODAY. Adjust with inflation, 82 Help your employer to determine which machine is the best choice. 83 34 MARR 13.80% 85. Inflation 3.100% 86 Machine A Machine B 87 Initial Cost $10,400 Initial Cost $ 6,200 18 Salvage $ 4,100 10yr old machine today Salvage $ 1,275, 5 yr old machine today 19 Life 10 Years Life 5 Years 90 Benefits S 6,100 Per year Benefits S 5,800 Per year 91 Benefit inc 3.90% Benefits ind 3.50% 92 Costs S 2.482 Per year Costs 2,420 Per year 93 M 95 Create the net cash flow chart for both machines. 96 Deterine the NPW for both machines. 97 Determine the EUAW for both machines. 98 Determine the NFW for both machines. 99 Determine the IRR for both machines 100 Detemine the DELTA IRR. 101 Which machine will you select? Why? 102 Graph the NPW versus MARR chart for both machines (both curves on the same graph) 102

!!!!!ONLY ANSWER USING EXCEL!!!!!!

!!!!!ONLY ANSWER USING EXCEL!!!!!!