Question: Only do starting from which of the following will require I attached the first set of questions to guide and make the question complete. 10.

Only do starting from "which of the following will require" I attached the first set of questions to guide and make the question complete.

Only do starting from "which of the following will require" I attached the first set of questions to guide and make the question complete.

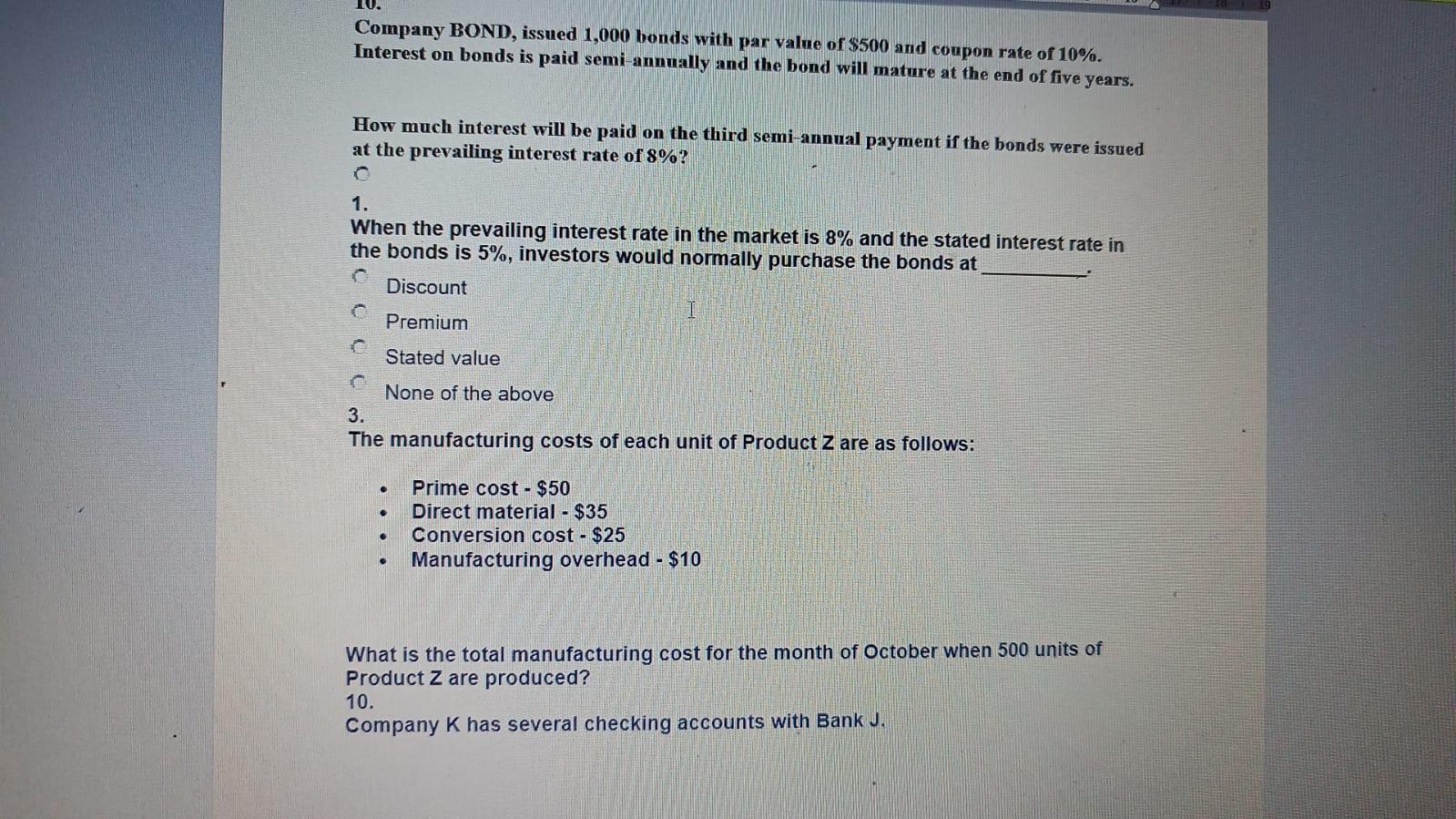

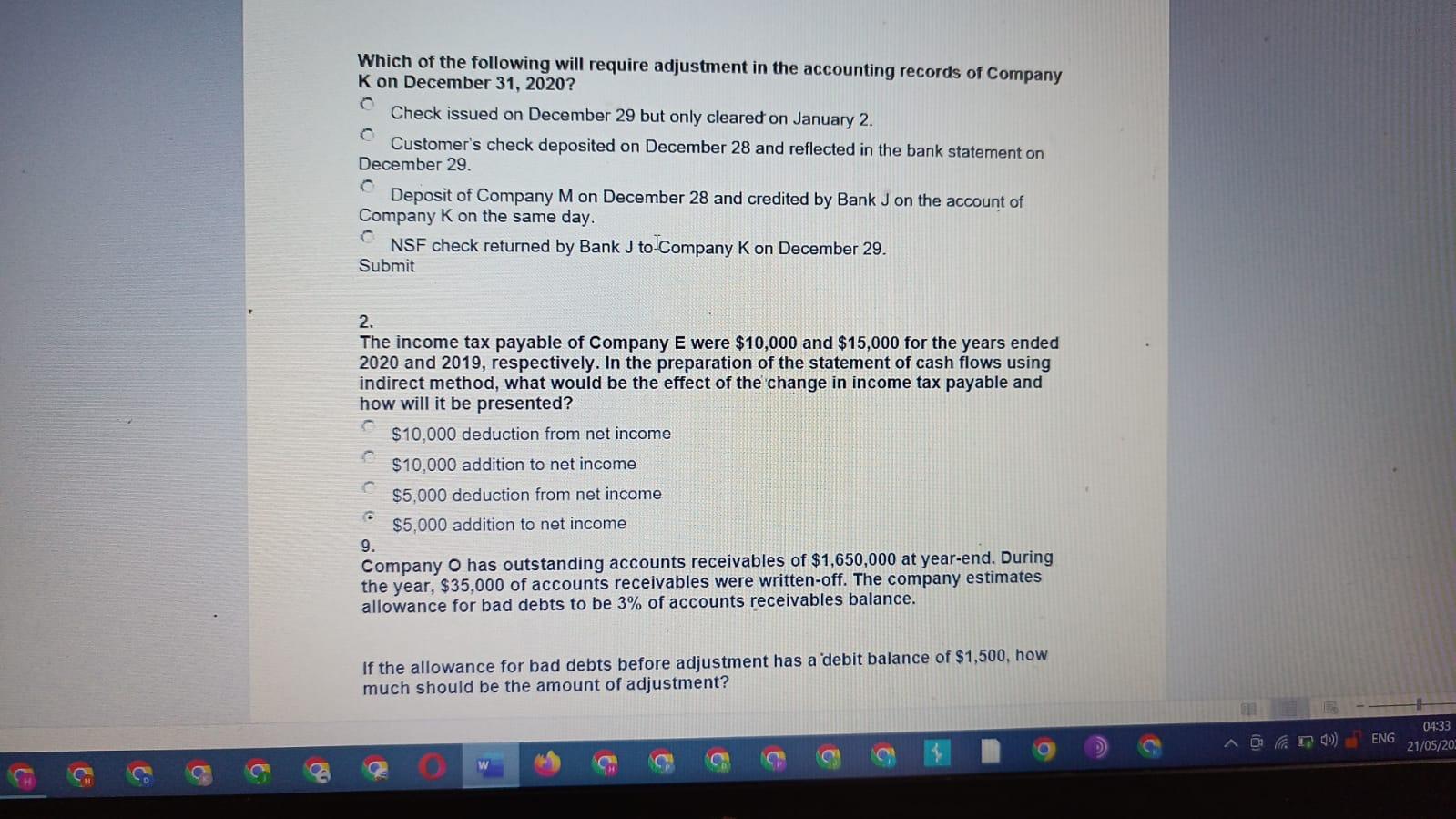

10. Company BOND, issued 1,000 bonds with par value of $500 and coupon rate of 10%. Interest on bonds is paid semi-annually and the bond will mature at the end of five years. How much interest will be paid on the third semi-annual payment if the bonds were issued at the prevailing interest rate of 8%? 1. When the prevailing interest rate in the market is 8% and the stated interest rate in the bonds is 5%, investors would normally purchase the bonds at C Discount C I Premium Stated value None of the above 3. The manufacturing costs of each unit of Product Z are as follows: Prime cost - $50 . Direct material - $35 Conversion cost - $25 Manufacturing overhead - $10 What is the total manufacturing cost for the month of October when 500 units of Product Z are produced? 10. Company K has several checking accounts with Bank J. Which of the following will require adjustment in the accounting records of Company K on December 31, 2020? 0 Check issued on December 29 but only cleared on January 2. O Customer's check deposited on December 28 and reflected in the bank statement on December 29. 0 Deposit of Company M on December 28 and credited by Bank J on the account of Company K on the same day. NSF check returned by Bank J to Company K on December 29. Submit 2. The income tax payable of Company E were $10,000 and $15,000 for the years ended 2020 and 2019, respectively. In the preparation of the statement of cash flows using indirect method, what would be the effect of the change in income tax payable and how will it be presented? $10,000 deduction from net income $10,000 addition to net income C $5,000 deduction from net income $5,000 addition to net income 9. Company O has outstanding accounts receivables of $1,650,000 at year-end. During the year, $35,000 of accounts receivables were written-off. The company estimates allowance for bad debts to be 3% of accounts receivables balance. If the allowance for bad debts before adjustment has a debit balance of $1,500, how much should be the amount of adjustment? C ENG 04:33 21/05/202

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts