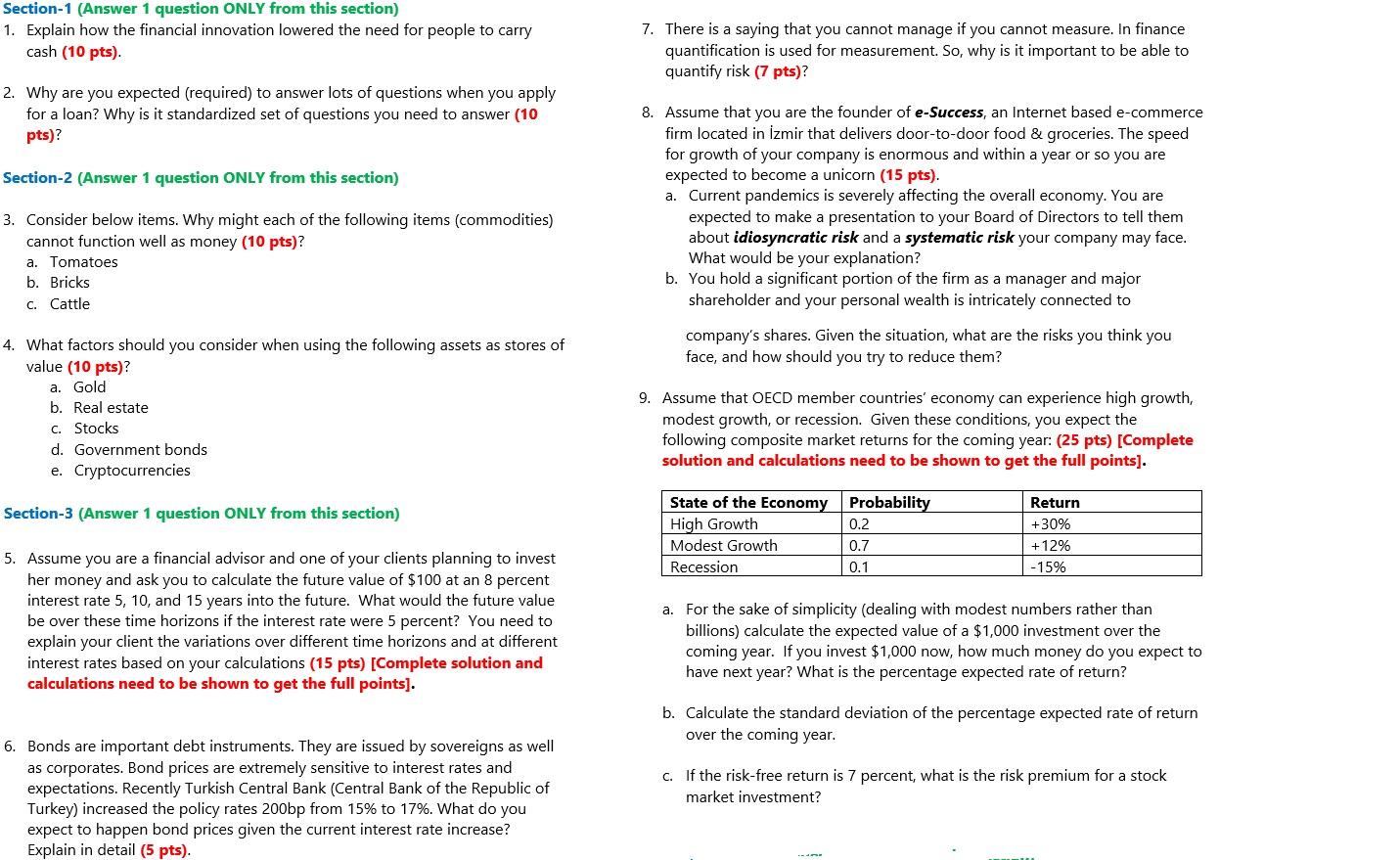

Section-1 (Answer 1 question ONLY from this section) 1. Explain how the financial innovation lowered the need for people to carry cash (10 pts). 7. There is a saying that you cannot manage if you cannot measure. In finance quantification is used for measurement. So, why is it important to be able to quantify risk (7 pts)? 2. Why are you expected (required) to answer lots of questions when you apply for a loan? Why is it standardized set of questions you need to answer (10 pts)? Section-2 (Answer 1 question ONLY from this section) 8. Assume that you are the founder of e-Success, an Internet based e-commerce firm located in Izmir that delivers door-to-door food & groceries. The speed for growth of your company is enormous and within a year or so you are expected to become a unicorn (15 pts). a. Current pandemics is severely affecting the overall economy. You are expected to make a presentation to your Board of Directors to tell them about idiosyncratic risk and a systematic risk your company may face. What would be your explanation? b. You hold a significant portion of the firm as a manager and major shareholder and your personal wealth is intricately connected to 3. Consider below items. Why might each of the following items (commodities) cannot function well as money (10 pts)? a. Tomatoes b. Bricks C. Cattle company's shares. Given the situation, what are the risks you think you face, and how should you try to reduce them? 4. What factors should you consider when using the following assets as stores of value (10 pts)? a. Gold b. Real estate C. Stocks d. Government bonds e. Cryptocurrencies 9. Assume that OECD member countries' economy can experience high growth, modest growth, or recession. Given these conditions, you expect the following composite market returns for the coming year: (25 pts) [Complete solution and calculations need to be shown to get the full points). Section-3 (Answer 1 question ONLY from this section) State of the Economy Probability High Growth 0.2 Modest Growth 0.7 Recession 0.1 Return +30% +12% -15% 5. Assume you are a financial advisor and one of your clients planning to invest her money and ask you to calculate the future value of $100 at an 8 percent interest rate 5, 10, and 15 years into the future. What would the future value be over these time horizons if the interest rate were 5 percent? You need to explain your client the variations over different time horizons and at different interest rates based on your calculations (15 pts) [Complete solution and calculations need to be shown to get the full points). a. For the sake of simplicity (dealing with modest numbers rather than billions) calculate the expected value of a $1,000 investment over the coming year. If you invest $1,000 now, how much money do you expect to have next year? What is the percentage expected rate of return? b. Calculate the standard deviation of the percentage expected rate of return over the coming year. C. 6. Bonds are important debt instruments. They are issued by sovereigns as well as corporates. Bond prices are extremely sensitive to interest rates and expectations. Recently Turkish Central Bank (Central Bank of the Republic of Turkey) increased the policy rates 200bp from 15% to 17%. What do you expect to happen bond prices given the current interest rate increase? Explain in detail (5 pts). If the risk-free return is 7 percent, what is the risk premium for a stock market investment? Section-1 (Answer 1 question ONLY from this section) 1. Explain how the financial innovation lowered the need for people to carry cash (10 pts). 7. There is a saying that you cannot manage if you cannot measure. In finance quantification is used for measurement. So, why is it important to be able to quantify risk (7 pts)? 2. Why are you expected (required) to answer lots of questions when you apply for a loan? Why is it standardized set of questions you need to answer (10 pts)? Section-2 (Answer 1 question ONLY from this section) 8. Assume that you are the founder of e-Success, an Internet based e-commerce firm located in Izmir that delivers door-to-door food & groceries. The speed for growth of your company is enormous and within a year or so you are expected to become a unicorn (15 pts). a. Current pandemics is severely affecting the overall economy. You are expected to make a presentation to your Board of Directors to tell them about idiosyncratic risk and a systematic risk your company may face. What would be your explanation? b. You hold a significant portion of the firm as a manager and major shareholder and your personal wealth is intricately connected to 3. Consider below items. Why might each of the following items (commodities) cannot function well as money (10 pts)? a. Tomatoes b. Bricks C. Cattle company's shares. Given the situation, what are the risks you think you face, and how should you try to reduce them? 4. What factors should you consider when using the following assets as stores of value (10 pts)? a. Gold b. Real estate C. Stocks d. Government bonds e. Cryptocurrencies 9. Assume that OECD member countries' economy can experience high growth, modest growth, or recession. Given these conditions, you expect the following composite market returns for the coming year: (25 pts) [Complete solution and calculations need to be shown to get the full points). Section-3 (Answer 1 question ONLY from this section) State of the Economy Probability High Growth 0.2 Modest Growth 0.7 Recession 0.1 Return +30% +12% -15% 5. Assume you are a financial advisor and one of your clients planning to invest her money and ask you to calculate the future value of $100 at an 8 percent interest rate 5, 10, and 15 years into the future. What would the future value be over these time horizons if the interest rate were 5 percent? You need to explain your client the variations over different time horizons and at different interest rates based on your calculations (15 pts) [Complete solution and calculations need to be shown to get the full points). a. For the sake of simplicity (dealing with modest numbers rather than billions) calculate the expected value of a $1,000 investment over the coming year. If you invest $1,000 now, how much money do you expect to have next year? What is the percentage expected rate of return? b. Calculate the standard deviation of the percentage expected rate of return over the coming year. C. 6. Bonds are important debt instruments. They are issued by sovereigns as well as corporates. Bond prices are extremely sensitive to interest rates and expectations. Recently Turkish Central Bank (Central Bank of the Republic of Turkey) increased the policy rates 200bp from 15% to 17%. What do you expect to happen bond prices given the current interest rate increase? Explain in detail (5 pts). If the risk-free return is 7 percent, what is the risk premium for a stock market investment