Answered step by step

Verified Expert Solution

Question

1 Approved Answer

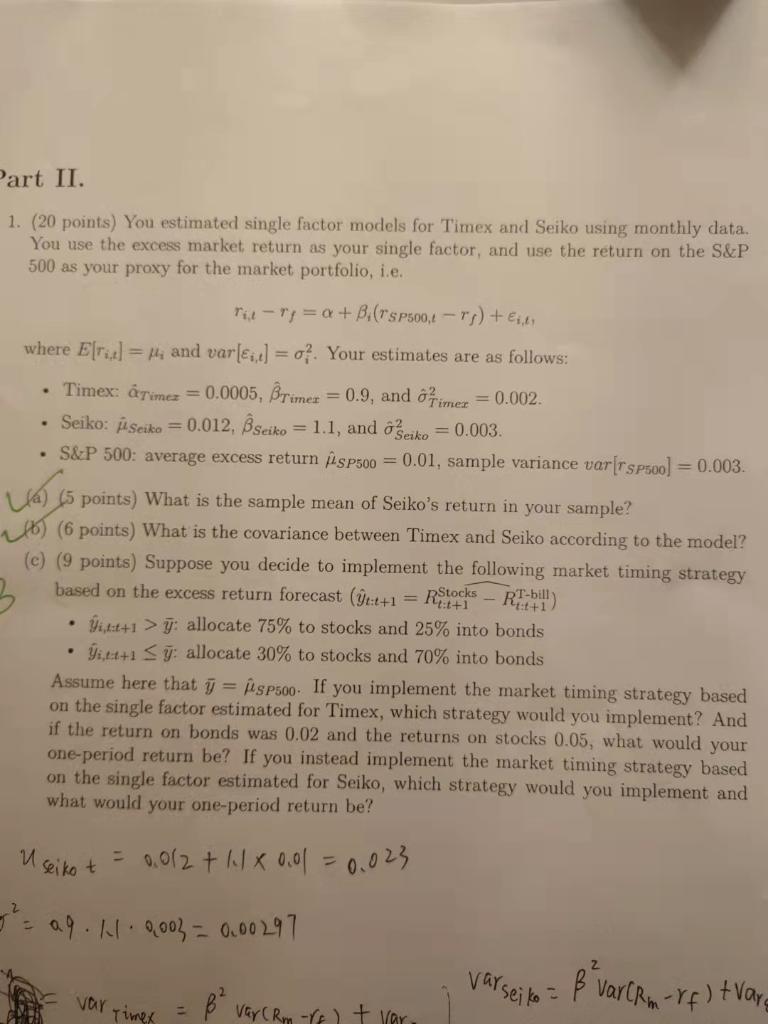

Only explain the question c Part II. 1. (20 points) You estimated single factor models for Timex and Seiko using monthly data. You use the

Only explain the question c

Part II. 1. (20 points) You estimated single factor models for Timex and Seiko using monthly data. You use the excess market return as your single factor, and use the return on the S&P 500 as your proxy for the market portfolio, i.e. rid-ry=a + B.(rs P500,-) + 1.11 where E[ra] = pi and varler,e] =0?. Your estimates are as follows: Timex: &Timez = 0.0005, BTimer = 0.9, and oFimex = 0.002. Seiko: ja Seiko =0.012, BSeiko = 1.1, and eiko = 0.003 S&P 500: average excess return is P500 = 0.01, sample variance var[rspoo) = 0.003. . od 15 points) What is the sample mean of Seiko's return in your sample? 06) (6 points) What is the covariance between Timex and Seiko according to the model? (c) (9 points) Suppose you decide to implement the following market timing strategy based on the excess return forecast (9:+1 = RStocks RE: bill) i,t+1 >y: allocate 75% to stocks and 25% into bonds itati Sy: allocate 30% to stocks and 70% into bonds Assume here that y = ASP500. If you implement the market timing strategy based on the single factor estimated for Timex, which strategy would you implement? And if the return on bonds was 0.02 and the returns on stocks 0.05, what would your one-period return be? If you instead implement the market timing strategy based on the single factor estimated for Seiko, which strategy would you implement and what would your one-period return be? M Seikot = 0.012 t 11 x 0.0l = 0.023 = ag. H. 9003 = 0.00 297 Z varseite = var varCrm -rf) tvare B varCam-re var Timex Part II. 1. (20 points) You estimated single factor models for Timex and Seiko using monthly data. You use the excess market return as your single factor, and use the return on the S&P 500 as your proxy for the market portfolio, i.e. rid-ry=a + B.(rs P500,-) + 1.11 where E[ra] = pi and varler,e] =0?. Your estimates are as follows: Timex: &Timez = 0.0005, BTimer = 0.9, and oFimex = 0.002. Seiko: ja Seiko =0.012, BSeiko = 1.1, and eiko = 0.003 S&P 500: average excess return is P500 = 0.01, sample variance var[rspoo) = 0.003. . od 15 points) What is the sample mean of Seiko's return in your sample? 06) (6 points) What is the covariance between Timex and Seiko according to the model? (c) (9 points) Suppose you decide to implement the following market timing strategy based on the excess return forecast (9:+1 = RStocks RE: bill) i,t+1 >y: allocate 75% to stocks and 25% into bonds itati Sy: allocate 30% to stocks and 70% into bonds Assume here that y = ASP500. If you implement the market timing strategy based on the single factor estimated for Timex, which strategy would you implement? And if the return on bonds was 0.02 and the returns on stocks 0.05, what would your one-period return be? If you instead implement the market timing strategy based on the single factor estimated for Seiko, which strategy would you implement and what would your one-period return be? M Seikot = 0.012 t 11 x 0.0l = 0.023 = ag. H. 9003 = 0.00 297 Z varseite = var varCrm -rf) tvare B varCam-re var TimexStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started