Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only Final Answer Plaese Answer it All Or Leave it i need it in half hour plaese q8: Suppose a bank entered into a repurchase

Only Final Answer Plaese

Answer it All Or Leave it i need it in half hour plaese

q8:

Suppose a bank entered into a repurchase agreement under which it agreed to sell Treasury bonds to a correspondent bank at $9999,986 with a promise. o Buy it back at $100,00078 Calculate the return on the repo if it has a maturity date of 4 days (write your answer in percentage and round it to 2 decimal places)

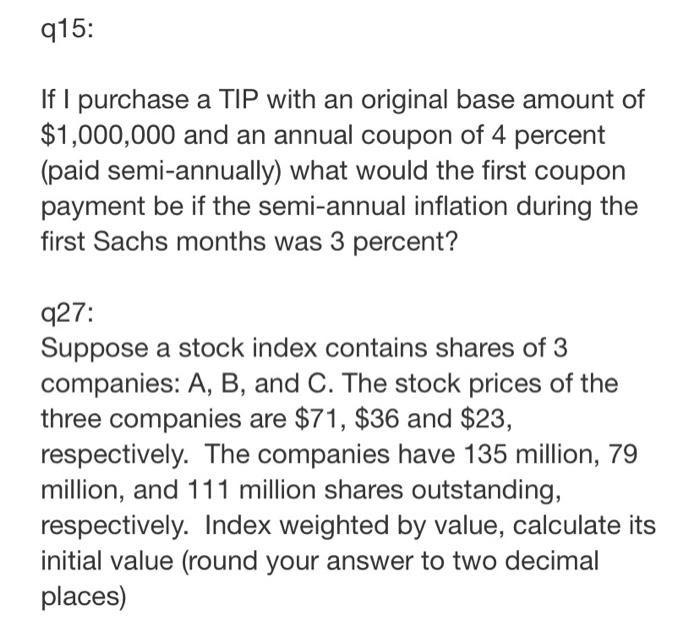

q15:

If I purchase a TIP with an original base amount of $1,000,000 and an annual coupon of 4 percent (paid semi-annually) what would the first coupon payment be if the semi-annual inflation during the first Sachs months was 3 percent?

q27:

Suppose a stock index contains shares of 3 companies: A, B, and C. The stock prices of the three companies are $71, $36 and $23, respectively. The companies have 135 million, 79 million, and 111 million shares outstanding, respectively. Index weighted by value, calculate its initial value (round your answer to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started