Answered step by step

Verified Expert Solution

Question

1 Approved Answer

only for one year 2019 In this project, you will assess the financial health of a publicly-traded merchandising* business and, using financial analysis tools in

only for one year 2019

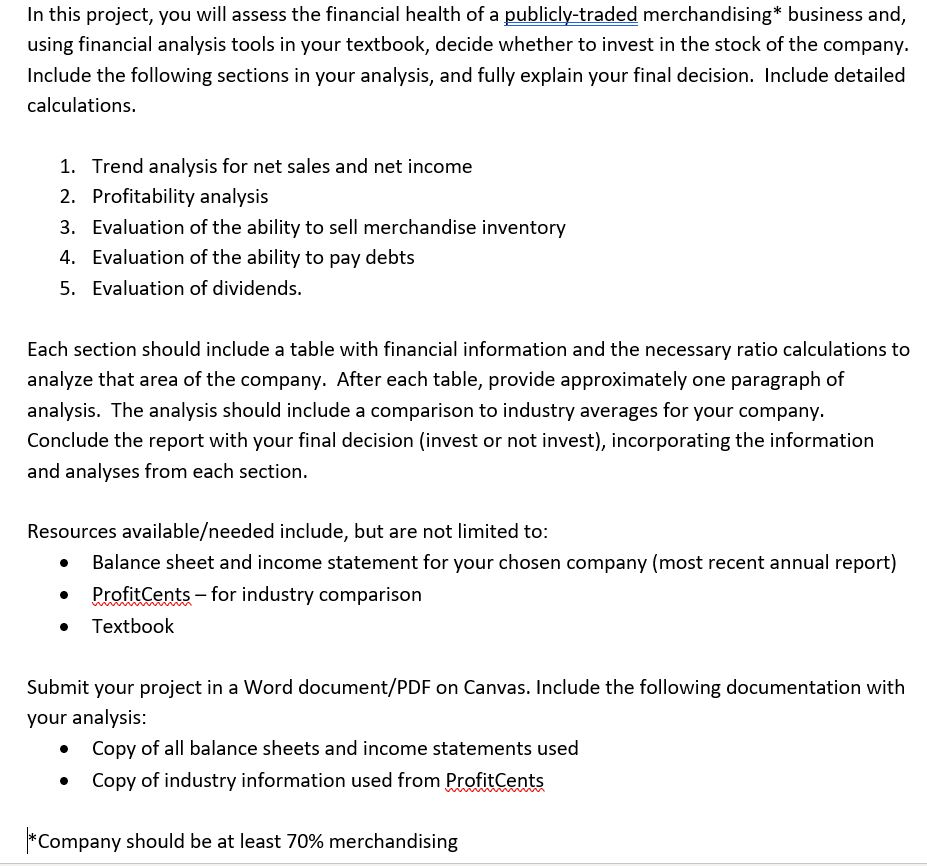

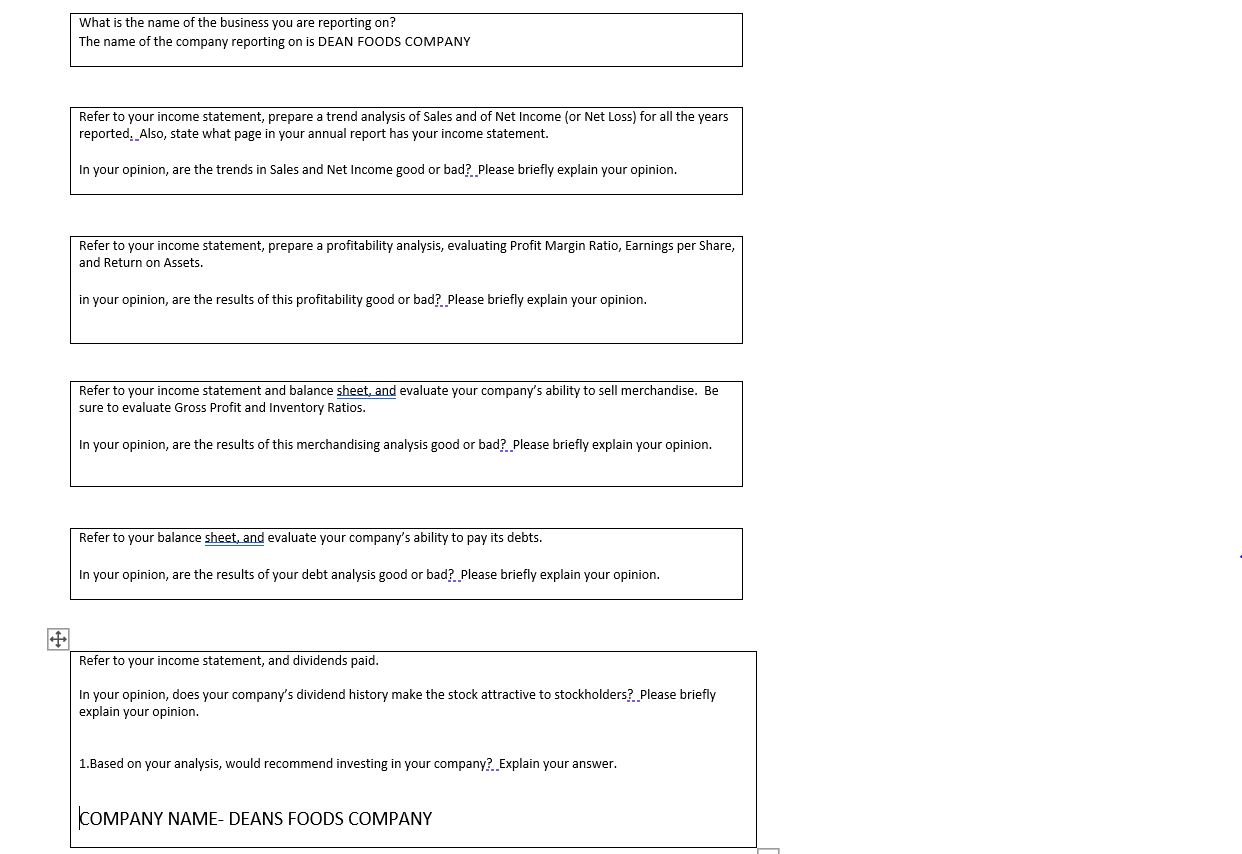

In this project, you will assess the financial health of a publicly-traded merchandising* business and, using financial analysis tools in your textbook, decide whether to invest in the stock of the company, Include the following sections in your analysis, and fully explain your final decision. Include detailed calculations. 1. Trend analysis for net sales and net income 2. Profitability analysis 3. Evaluation of the ability to sell merchandise inventory 4. Evaluation of the ability to pay debts 5. Evaluation of dividends. Each section should include a table with financial information and the necessary ratio calculations to analyze that area of the company. After each table, provide approximately one paragraph of analysis. The analysis should include a comparison to industry averages for your company. Conclude the report with your final decision (invest or not invest), incorporating the information and analyses from each section. Resources availableeeded include, but are not limited to: Balance sheet and income statement for your chosen company (most recent annual report) ProfitCents - for industry comparison Textbook Submit your project in a Word document/PDF on Canvas. Include the following documentation with your analysis: Copy of all balance sheets and income statements used Copy of industry information used from ProfitCents * Company should be at least 70% merchandising What is the name of the business you are reporting on? The name of the company reporting on is DEAN FOODS COMPANY Refer to your income statement, prepare a trend analysis of Sales and of Net Income (or Net Loss) for all the years reported. Also, state what page in your annual report has your income statement. In your opinion, are the trends in Sales and Net Income good or bad? Please briefly explain your opinion. Refer to your income statement, prepare a profitability analysis, evaluating Profit Margin Ratio, Earnings per Share, and Return on Assets. in your opinion, are the results of this profitability good or bad? Please briefly explain your opinion. Refer to your income statement and balance sheet, and evaluate your company's ability to sell merchandise. Be sure to evaluate Gross Profit and Inventory Ratios. In your opinion, are the results of this merchandising analysis good or bad? Please briefly explain your opinion. Refer to your balance sheet, and evaluate your company's ability to pay its debts. In your opinion, are the results of your debt analysis good or bad? Please briefly explain your opinion. Refer to your income statement, and dividends paid. In your opinion, does your company's dividend history make the stock attractive to stockholders? Please briefly explain your opinion. 1.Based on your analysis, would recommend investing in your company? Explain your answer. COMPANY NAME-DEANS FOODS COMPANY In this project, you will assess the financial health of a publicly-traded merchandising* business and, using financial analysis tools in your textbook, decide whether to invest in the stock of the company, Include the following sections in your analysis, and fully explain your final decision. Include detailed calculations. 1. Trend analysis for net sales and net income 2. Profitability analysis 3. Evaluation of the ability to sell merchandise inventory 4. Evaluation of the ability to pay debts 5. Evaluation of dividends. Each section should include a table with financial information and the necessary ratio calculations to analyze that area of the company. After each table, provide approximately one paragraph of analysis. The analysis should include a comparison to industry averages for your company. Conclude the report with your final decision (invest or not invest), incorporating the information and analyses from each section. Resources availableeeded include, but are not limited to: Balance sheet and income statement for your chosen company (most recent annual report) ProfitCents - for industry comparison Textbook Submit your project in a Word document/PDF on Canvas. Include the following documentation with your analysis: Copy of all balance sheets and income statements used Copy of industry information used from ProfitCents * Company should be at least 70% merchandising What is the name of the business you are reporting on? The name of the company reporting on is DEAN FOODS COMPANY Refer to your income statement, prepare a trend analysis of Sales and of Net Income (or Net Loss) for all the years reported. Also, state what page in your annual report has your income statement. In your opinion, are the trends in Sales and Net Income good or bad? Please briefly explain your opinion. Refer to your income statement, prepare a profitability analysis, evaluating Profit Margin Ratio, Earnings per Share, and Return on Assets. in your opinion, are the results of this profitability good or bad? Please briefly explain your opinion. Refer to your income statement and balance sheet, and evaluate your company's ability to sell merchandise. Be sure to evaluate Gross Profit and Inventory Ratios. In your opinion, are the results of this merchandising analysis good or bad? Please briefly explain your opinion. Refer to your balance sheet, and evaluate your company's ability to pay its debts. In your opinion, are the results of your debt analysis good or bad? Please briefly explain your opinion. Refer to your income statement, and dividends paid. In your opinion, does your company's dividend history make the stock attractive to stockholders? Please briefly explain your opinion. 1.Based on your analysis, would recommend investing in your company? Explain your answer. COMPANY NAME-DEANS FOODS COMPANY Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started