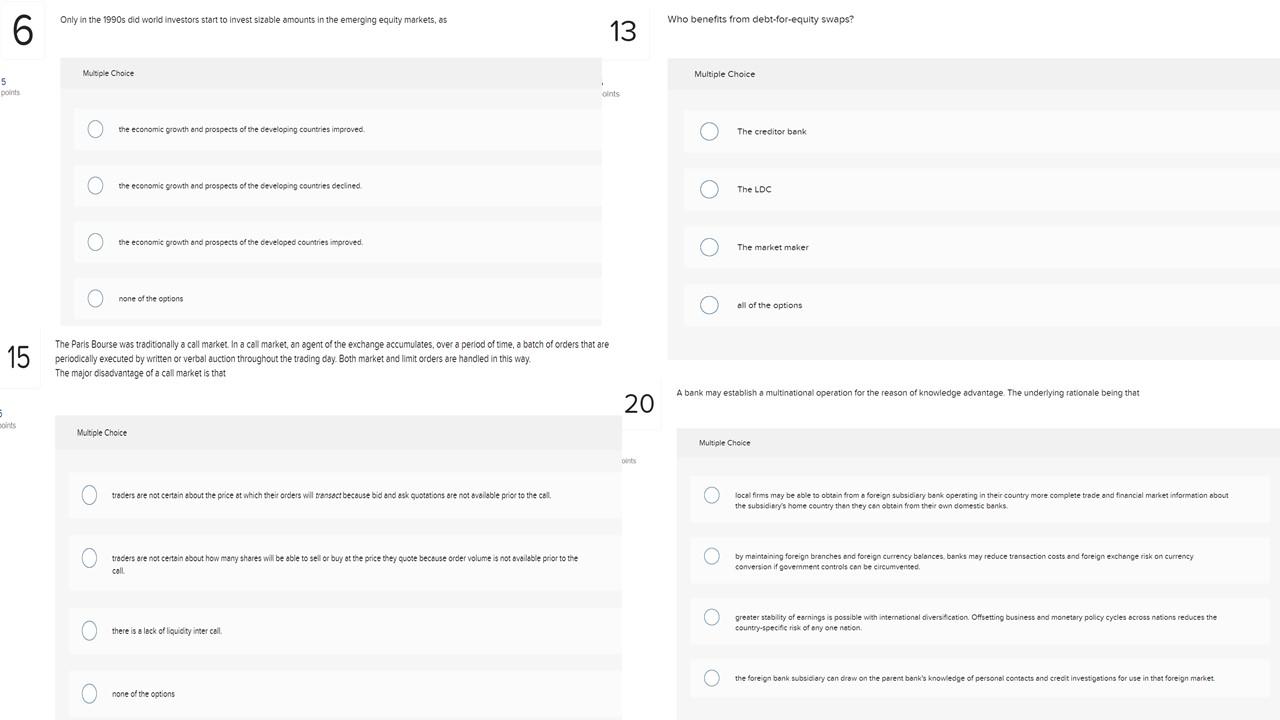

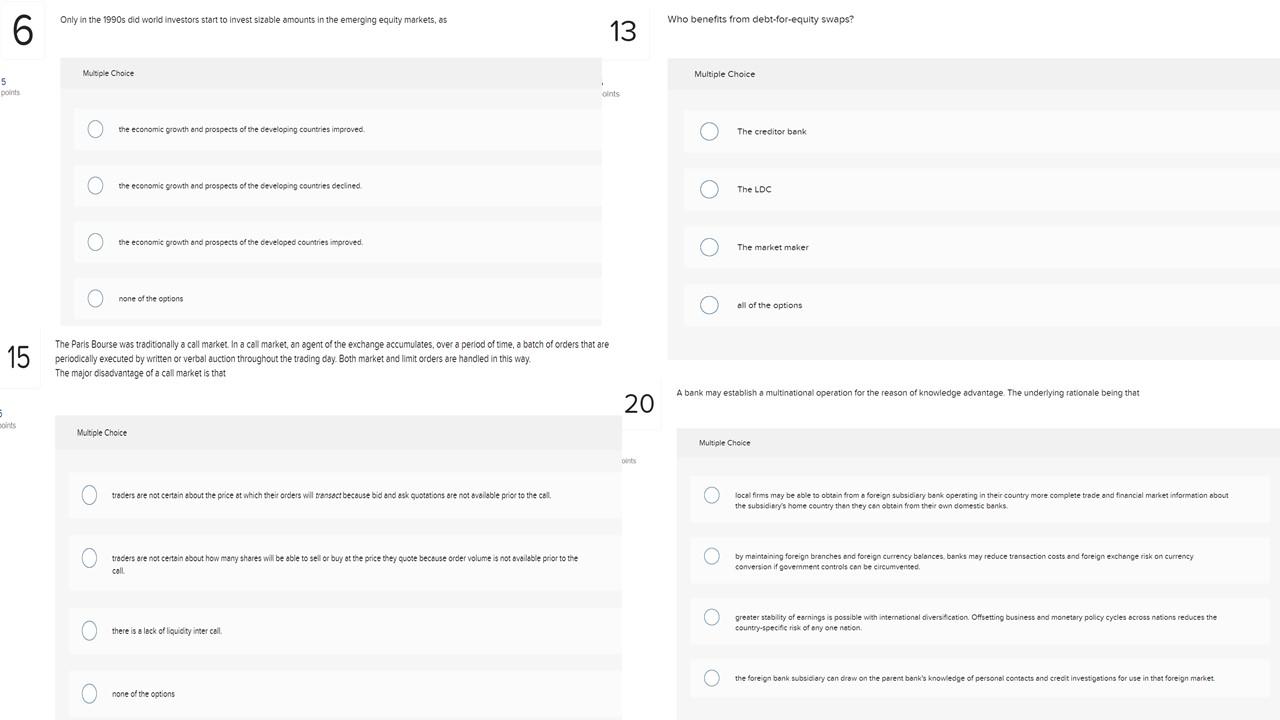

Only in the 1990s did world investors start to invest sizable amounts in the emerging equity markets, as Who benefits from debt-for-equity swaps? 6 13 Multiple Choice Multiple Choice 5 points oints the economic growth and prospects of the developing countries improved The creditor bank the economic growth and prospects of the developing countries declined The LDC the economic growth and prospects of the developed countries improved The market maker none of the options all of the options The Paris Bourse was traditionally a call market. In a call market, an agent of the exchange accumulates, over a period of time, a batch of orders that are 15 periodically evectured by writen or verbal auction throughout the reading day. Both market and imt orders are handied in this way. The major disadvantage of a call market is that A bank may establish a multinational operation for the reason of knowledge advantage. The underlying rationale being that 20 5 points Multiple Choice Multiple Choice traders are not certain about the price at which their orders will transact because bid and ask quotations are not available prior to the call local firms may be able to obtain from a foreign subsidiary bank operating in their country more complete trade and financial market information about the subsidiary's home country then they can obtain from their own domestic banks O O O traders are not certain about how many shares will be able to sell or buy at the price they quote because order volume is not available prior to the call y maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion of government controls can be circumvented Othere is a lack of liquidity inter call greater stability of earnings is possible with international diversification Offsetting business and monetary policy cycles cross nations reduces the country-specific risk of any one nation the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts and credit investigations for use in the foreign market none of the options