Answered step by step

Verified Expert Solution

Question

1 Approved Answer

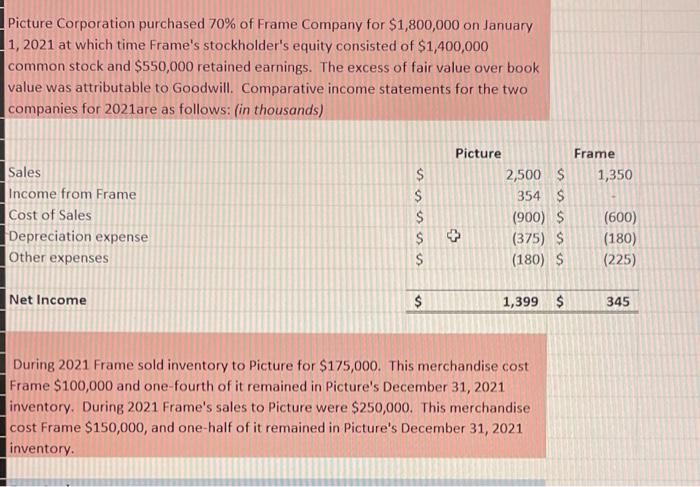

only info given Picture Corporation purchased 70% of Frame Company for $1,800,000 on January 1, 2021 at which time Frame's stockholder's equity consisted of $1,400,000

only info given

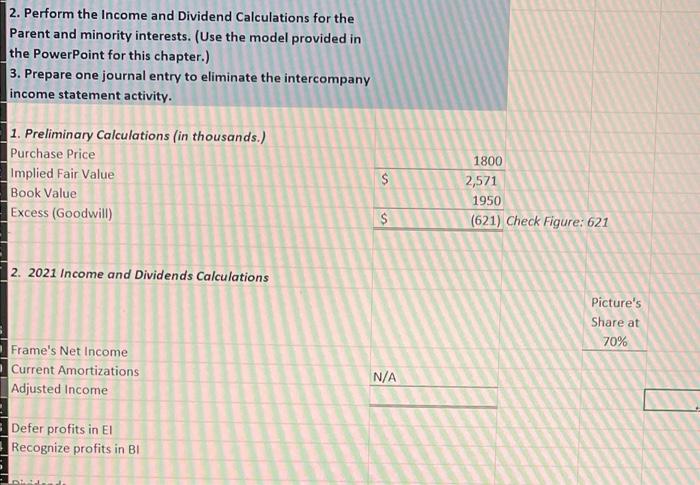

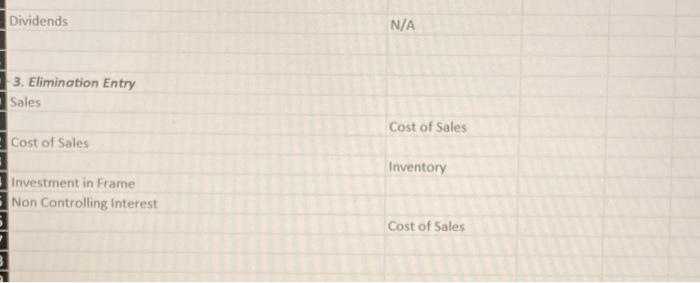

Picture Corporation purchased 70% of Frame Company for $1,800,000 on January 1, 2021 at which time Frame's stockholder's equity consisted of $1,400,000 common stock and $550,000 retained earnings. The excess of fair value over book value was attributable to Goodwill. Comparative income statements for the two companies for 2021are as follows: (in thousands) Frame 1,350 Sales Income from Frame Cost of Sales Depreciation expense Other expenses $ $ S $ $ Picture 2,500 $ 354 S (900) $ + (375) $ (180) S (600) (180) (225) Net Income $ $ 1,399 $ 345 During 2021 Frame sold inventory to Picture for $175,000. This merchandise cost Frame $100,000 and one-fourth of it remained in Picture's December 31, 2021 inventory. During 2021 Frame's sales to Picture were $250,000. This merchandise cost Frame $150,000, and one-half of it remained in Picture's December 31, 2021 inventory 2. Perform the Income and Dividend Calculations for the Parent and minority interests. (Use the model provided in the PowerPoint for this chapter.) 3. Prepare one journal entry to eliminate the intercompany income statement activity. 1. Preliminary Calculations (in thousands.) Purchase Price Implied Fair Value Book Value Excess (Goodwill) S 1800 2,571 1950 (621) Check Figure: 621 $ 2. 2021 Income and Dividends Calculations Picture's Share at 70% Frame's Net Income Current Amortizations Adjusted Income N/A Defer profits in El Recognize profits in BI Dividends N/A 3. Elimination Entry Sales Cost of Sales Cost of Sales Inventory Investment in Frame Non Controlling interest Cost of Sales Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started