Answered step by step

Verified Expert Solution

Question

1 Approved Answer

only is Note 1 and 2 from the first picture to answer question A from the last picture Questions, Exercises. Problems, and Cases 493 7.16

only is Note 1 and 2 from the first picture to answer question A from the last picture

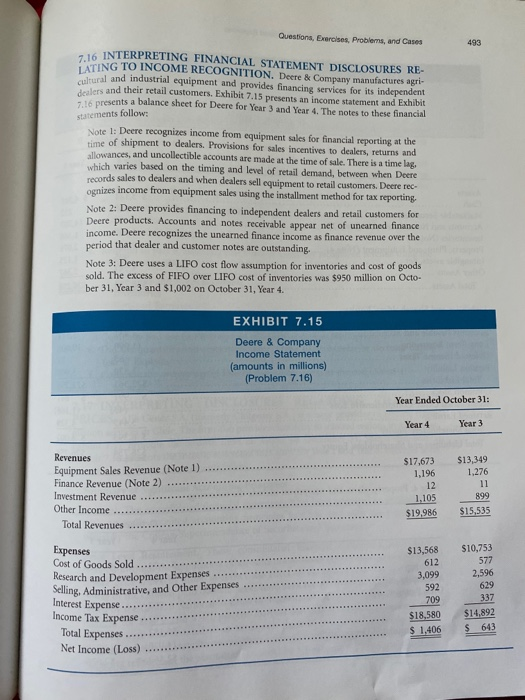

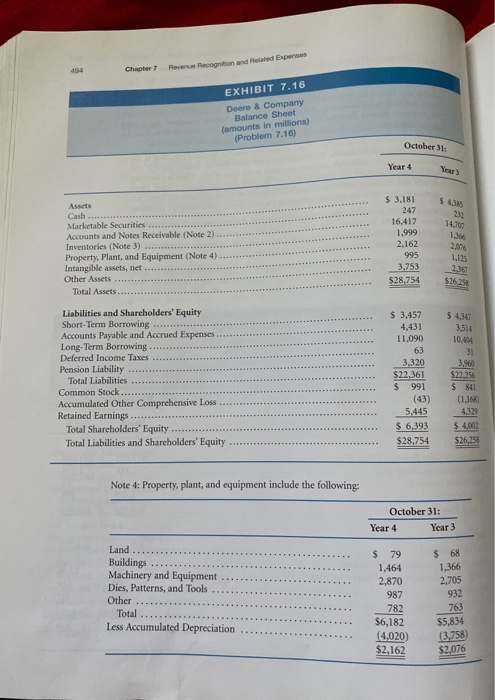

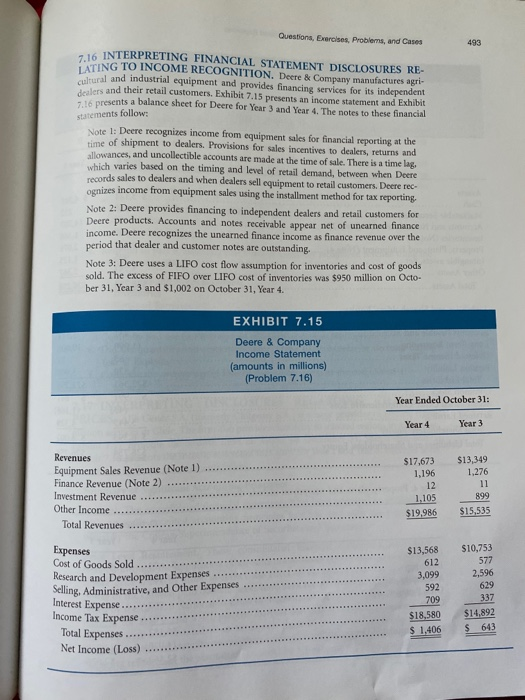

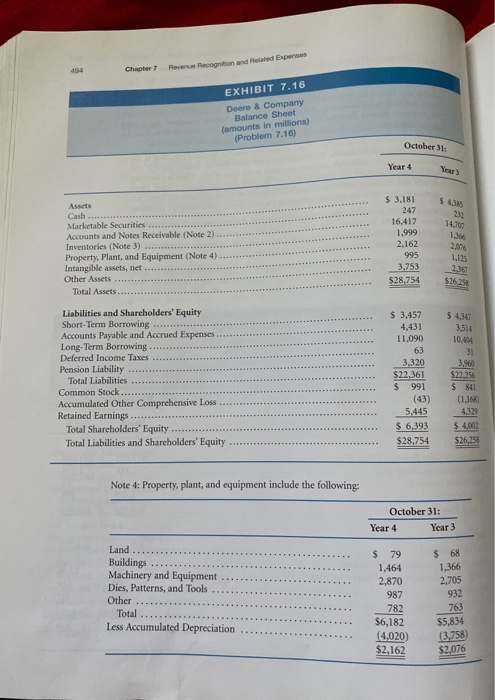

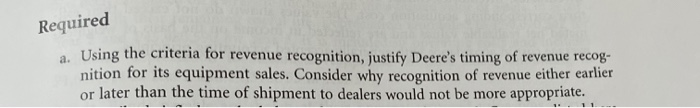

Questions, Exercises. Problems, and Cases 493 7.16 INTERPRETING FINANCIAL STATEMENT DISCLOSURES RE- 1 ATING TO INCOME RECOGNITION. Deere & Company manufactures agri cultural and industrial equipment and provides financing services for its independent dealers and their retail customers. Exhibit 7.15 presents an income statement and Exhibit 7.16 presents a balance sheet for Deere for Year 3 and Year 4. The notes to these financial statements follow: Note 1: Deere recognizes income from equipment sales for financial reporting at the time of shipment to dealers. Provisions for sales incentives to dealers, returns and allowances, and uncollectible accounts are made at the time of sale. There is a time lag, which varies based on the timing and level of retail demand, between when Deere records sales to dealers and when dealers sell equipment to retail customers. Deere rec- ognizes income from equipment sales using the installment method for tax reporting, Note 2: Deere provides financing to independent dealers and retail customers for Deere products. Accounts and notes receivable appear net of unearned finance income. Deere recognizes the unearned finance income as finance revenue over the period that dealer and customer notes are outstanding. Note 3: Deere uses a LIFO cost flow assumption for inventories and cost of goods sold. The excess of FIFO over LIFO cost of inventories was $950 million on Octo- ber 31, Year 3 and $1,002 on October 31, Year 4. EXHIBIT 7.15 Deere & Company Income Statement (amounts in millions) (Problem 7.16) Year Ended October 31: Year 4 Year 3 Revenues Equipment Sales Revenue (Note 1) Finance Revenue (Note 2) Investment Revenue Other Income Total Revenues $17.673 1.196 12 1,105 $19.986 $13,349 1,276 11 899 $15,535 Expenses Cost of Goods Sold Research and Development Expenses Selling. Administrative, and Other Expenses Interest Expense.. Income Tax Expense Total Expenses Net Income (Loss) $13,568 612 3,099 592 709 $18,580 $ 1.406 $10,753 577 2.596 629 337 $14.892 $ 643 494 Chapter 7 Revenue Recognition and Related Expenses EXHIBIT 7.16 Deere & Company Balance Sheet (amounts in millions) (Problem 7.16) October 31: Year 4 Year $ 4.3 232 14.00 Assets Cash Marketable Securities Accounts and Notes Receivable (Note 2) Inventories (Note 3) .... Property, plant, and Equipment (Note 4) Intangible assets, net Other Assets Total Assets $ 3.181 247 16,417 1,999 2,162 995 3,753 $28.754 2.076 1.115 2.367 $26.95 $ 4,347 3,514 10,404 3,960 Liabilities and Shareholders' Equity Short-Term Borrowing Accounts Payable and Accrued Expenses Long-Term Borrowing Deferred Income Taxes Pension Liability Total Liabilities Common Stock Accumulated Other Comprehensive Loss Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity $ 3.457 4,431 11,090 63 3,320 $22,361 $ 991 (43) 5,445 $ 6,393 $28,754 $22.256 $ 841 (1.168) 4,329 $ 4.002 $26,258 Note 4: Property, plant, and equipment include the following: October 31: Year 4 Year 3 Land Buildings Machinery and Equipment Dies, Patterns, and Tools Other Total Less Accumulated Depreciation $ 79 1,464 2,870 987 782 $6,182 (4,020) $2,162 $ 68 1,366 2,705 932 763 $5,834 3.758 $2,076 Required a. Using the criteria for revenue recognition, justify Deere's timing of revenue recog- nition for its equipment sales. Consider why recognition of revenue either earlier or later than the time of shipment to dealers would not be more appropriate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started