Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only need 13-16, the rest is for context. Thank you! 10. Construct the balance sheet of your corporation. (6 points) begin{tabular}{ll} ASSETS & Cash

Only need 13-16, the rest is for context. Thank you!

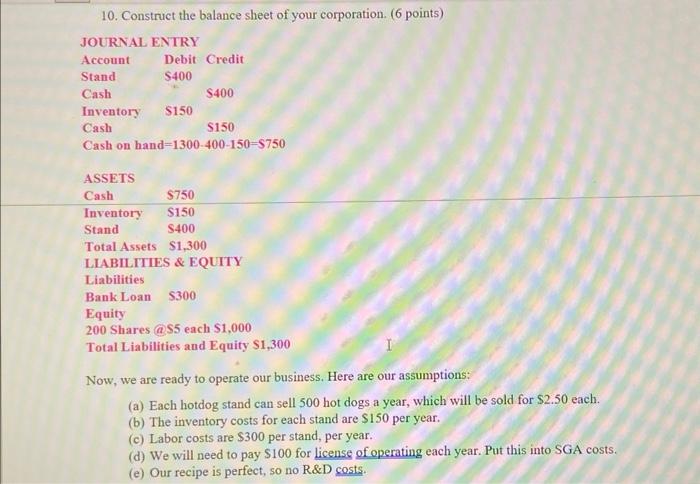

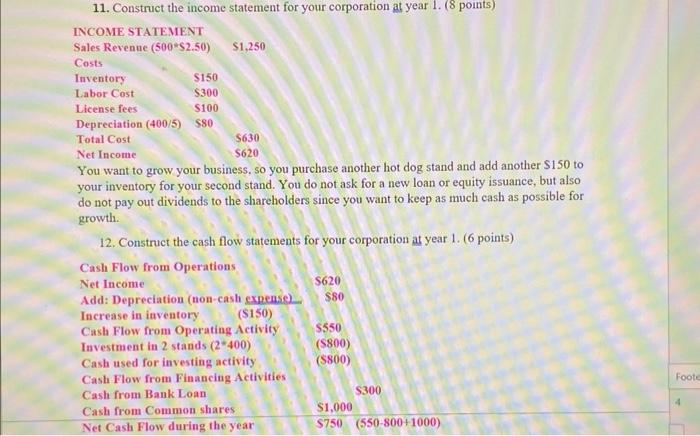

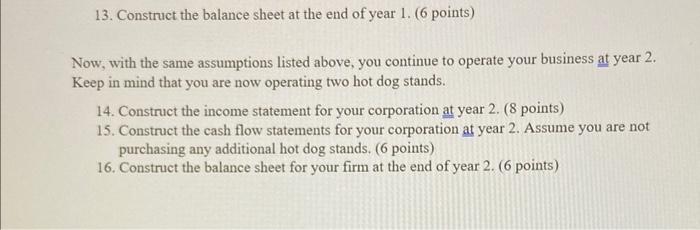

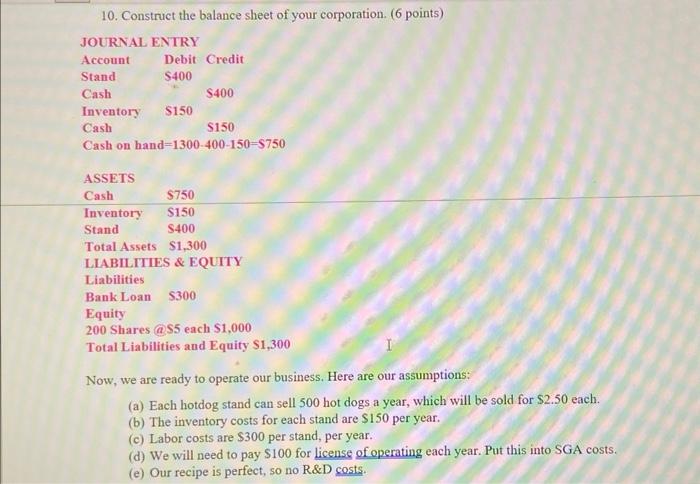

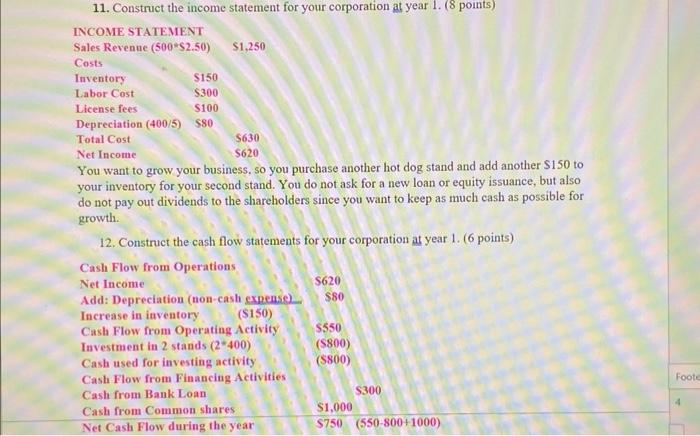

10. Construct the balance sheet of your corporation. (6 points) \begin{tabular}{ll} ASSETS & \\ Cash & $750 \\ \hline Inventory & $150 \\ Stand & $400 \\ Total Assets & $1,300 \\ LLABILITIES \& EQUITY \end{tabular} Liabilities BankLoan $300 Equity 200 Shares@S5 each $1,000 TotalLiabilities and Equity $1,300 Now, we are ready to operate our business. Here are our assumptions: (a) Each hotdog stand can sell 500 hot dogs a year, which will be sold for $2.50 each. (b) The inventory costs for each stand are $150 per year. (c) Labor costs are $300 per stand, per year. (d) We will need to pay $100 for license of operating each year. Put this into SGA costs. (e) Our recipe is perfect, so no R&D costs. 11. Construct the income statement for your corporation at year 1. ( 8 points) You want to grow your business, so you purchase another hot dog stand and add another $150 to your inventory for your second stand. You do not ask for a new loan or equity issuance, but also do not pay out dividends to the shareholders since you want to keep as much cash as possible for growth. 12. Construct the cash flow statements for your corporation at year 1 . (6 points) 13. Construct the balance sheet at the end of year 1 . (6 points) Now, with the same assumptions listed above, you continue to operate your business at year 2 . Keep in mind that you are now operating two hot dog stands. 14. Construct the income statement for your corporation at year 2 . (8 points) 15. Construct the cash flow statements for your corporation at year 2. Assume you are not purchasing any additional hot dog stands. ( 6 points) 16. Construct the balance sheet for your firm at the end of year 2. (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started