Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only need A, B and C. already got D ill give a thumbs up asap if the work is correct Pie Corporation acquired 65 percent

Only need A, B and C. already got D ill give a thumbs up asap if the work is correct

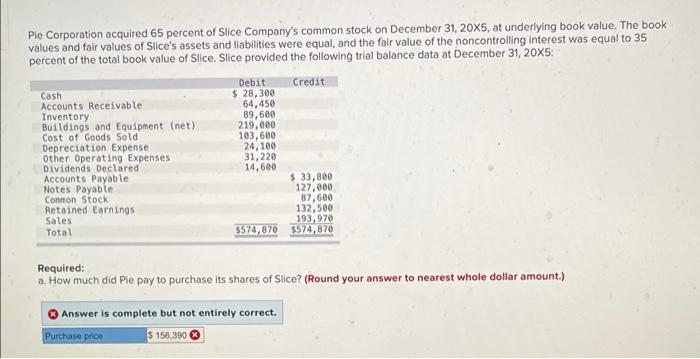

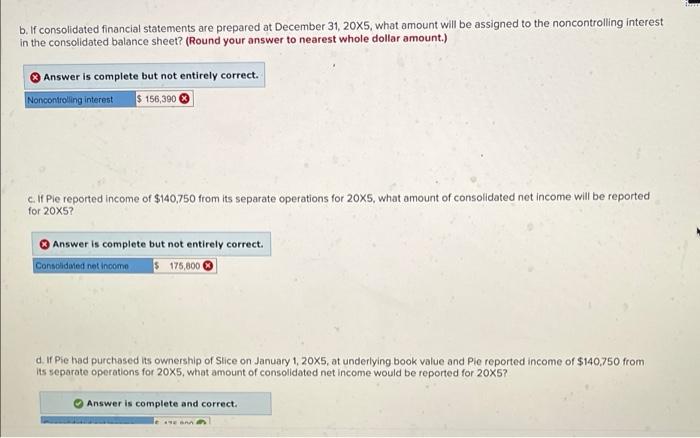

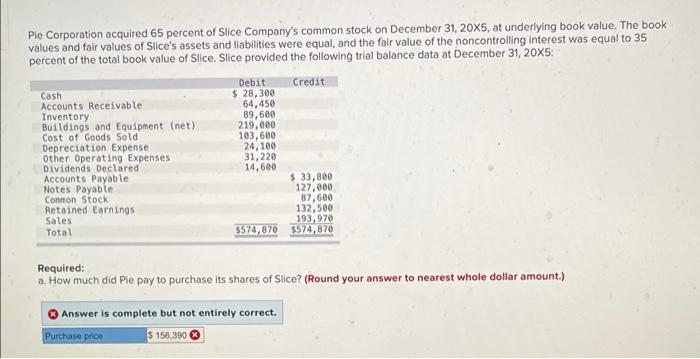

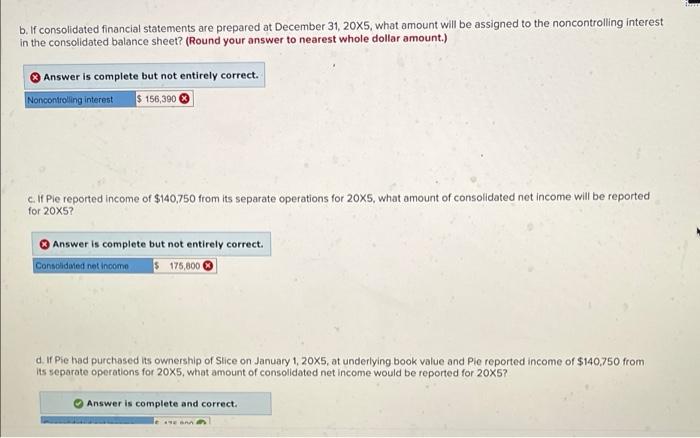

Pie Corporation acquired 65 percent of Slice Company's common stock on December 31, 20X5, at underlying book value. The book values and fair values of Slice's assets and liabilities were equal, and the fair value of the noncontrolling interest was equal to 35 percent of the total book value of Sice. Slice provided the following trial balance data at December 31, 20x5: Credit Cash Accounts Receivable Inventory Buildings and Equipment (net) Cost of Goods Sold Depreciation Expense Other Operating Expenses Dividends Declared Accounts Payable Notes Payable Connon Stock Retained Earnings Sales Total Debit $ 28,300 64,450 89,600 219,000 103,600 24,100 31,220 14,600 $ 33,800 127,000 87,600 132,500 193,970 $574,870 $574,870 Required: a. How much did Pie pay to purchase its shares of Slice? (Round your answer to nearest whole dollar amount.) Answer is complete but not entirely correct. Purchase price 156,390 b. If consolidated financial statements are prepared at December 31, 20X5, what amount will be assigned to the noncontrolling interest in the consolidated balance sheet? (Round your answer to nearest whole dollar amount.) Answer is complete but not entirely correct. Noncontrolling interest S156,300 c. If Ple reported income of $140,750 from its separate operations for 20X5, what amount of consolidated net income will be reported for 20X5? Answer is complete but not entirely correct. Consolidated net income $ 176,000 d. If Pie had purchased its ownership of Slice on January 1, 2005, at underlying book value and Pia reported income of $140,750 from its separate operations for 20X5, what amount of consolidated net income would be reported for 20X5? Answer is complete and correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started