Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ONLY NEED ASSISTANCE WITH THE LAST PROBLEM. THE FIRST TWO ARE SUPPORTING DOCUMENTS Bob Adkins has recently been approached by his cousin, Ed Lamar, with

ONLY NEED ASSISTANCE WITH THE LAST PROBLEM. THE FIRST TWO ARE SUPPORTING DOCUMENTS

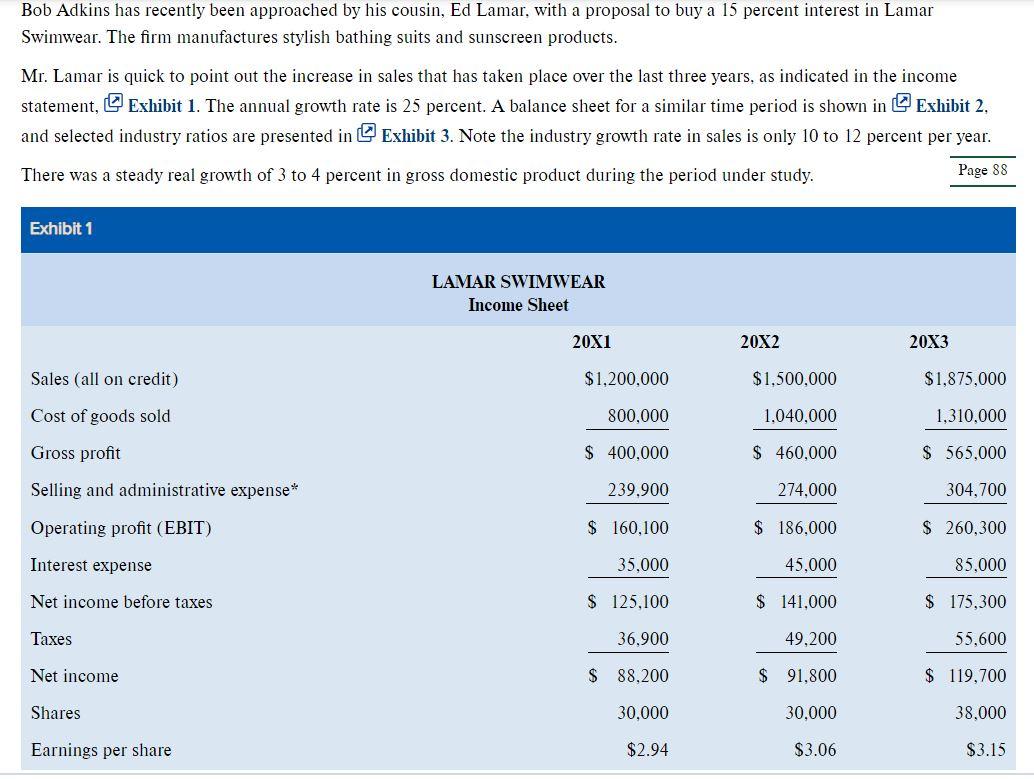

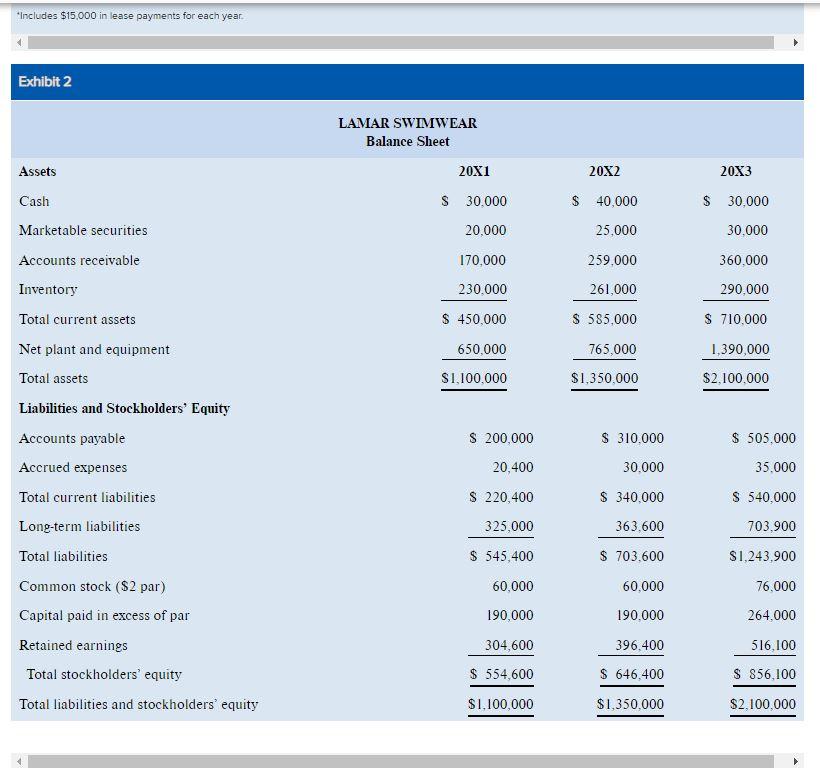

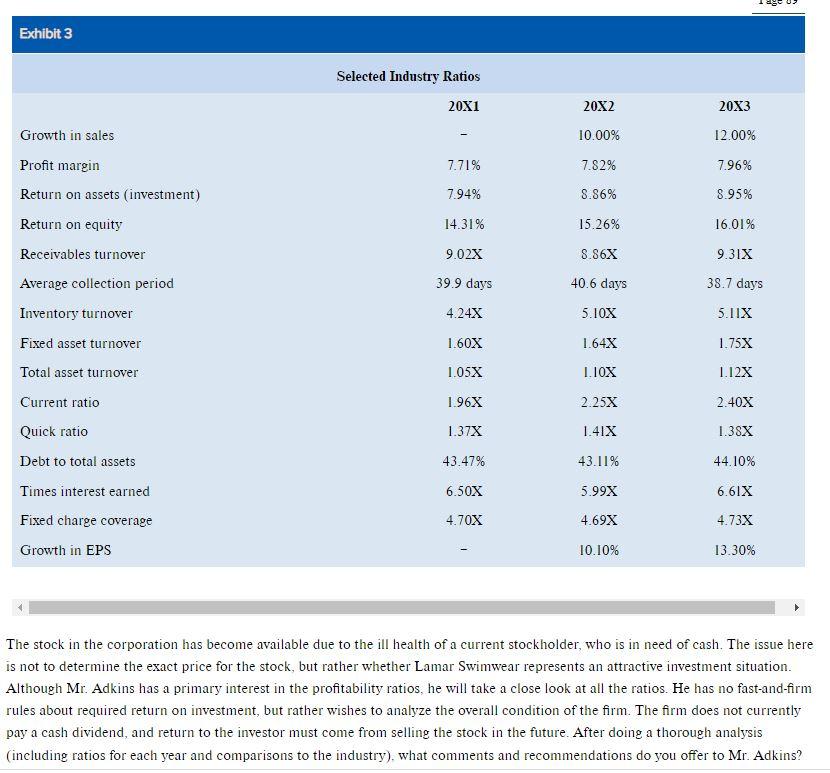

Bob Adkins has recently been approached by his cousin, Ed Lamar, with a proposal to buy a 15 percent interest in Lamar Swimwear. The firm manufactures stylish bathing suits and sunscreen products. Mr. Lamar is quick to point out the increase in sales that has taken place over the last three years, as indicated in the income statement, Exhibit 1. The annual growth rate is 25 percent. A balance sheet for a similar time period is shown in Exhibit 2, and selected industry ratios are presented in Exhibit 3. Note the industry growth rate in sales is only 10 to 12 percent per year. There was a steady real growth of 3 to 4 percent in gross domestic product during the period under study. "Includes $15.000 in lease Davments for each vear. The stock in the corporation has become available due to the ill health of a current stockholder, who is in need of cash. The issue here is not to determine the exact price for the stock, but rather whether Lamar Swimwear represents an attractive investment situation. Although Mr. Adkins has a primary interest in the profitability ratios, he will take a close look at all the ratios. He has no fast-and-firm rules about required return on investment, but rather wishes to analyze the overall condition of the firm. The firm does not currently pay a cash dividend, and return to the investor must come from selling the stock in the future. After doing a thorough analysis (including ratios for each year and comparisons to the industry), what comments and recommendations do you offer to Mr. Adkins? Bob Adkins has recently been approached by his cousin, Ed Lamar, with a proposal to buy a 15 percent interest in Lamar Swimwear. The firm manufactures stylish bathing suits and sunscreen products. Mr. Lamar is quick to point out the increase in sales that has taken place over the last three years, as indicated in the income statement, Exhibit 1. The annual growth rate is 25 percent. A balance sheet for a similar time period is shown in Exhibit 2, and selected industry ratios are presented in Exhibit 3. Note the industry growth rate in sales is only 10 to 12 percent per year. There was a steady real growth of 3 to 4 percent in gross domestic product during the period under study. "Includes $15.000 in lease Davments for each vear. The stock in the corporation has become available due to the ill health of a current stockholder, who is in need of cash. The issue here is not to determine the exact price for the stock, but rather whether Lamar Swimwear represents an attractive investment situation. Although Mr. Adkins has a primary interest in the profitability ratios, he will take a close look at all the ratios. He has no fast-and-firm rules about required return on investment, but rather wishes to analyze the overall condition of the firm. The firm does not currently pay a cash dividend, and return to the investor must come from selling the stock in the future. After doing a thorough analysis (including ratios for each year and comparisons to the industry), what comments and recommendations do you offer to Mr. AdkinsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started