only need c d and e

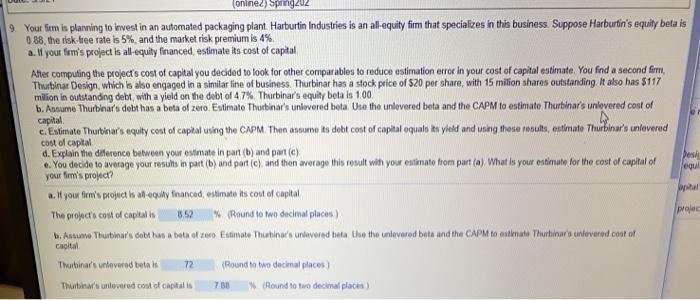

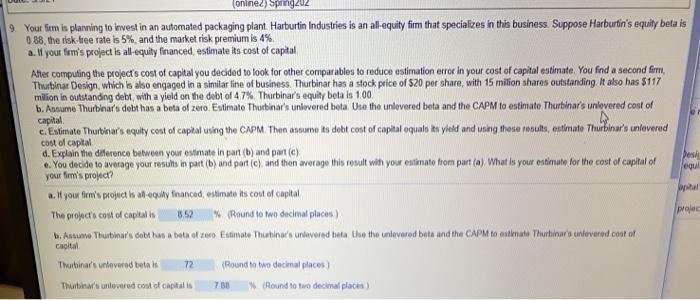

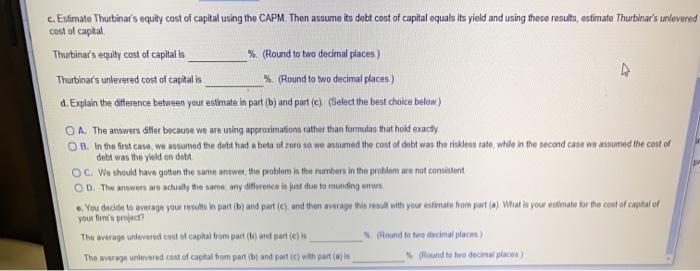

(onine2) Sping 02 9. Your firm is planning to invest in an automated packaging plant. Harburtin Industries is an all equity firm that specializes in this business Suppose Harburtin's equity beta is 088 the risk-free rate is 5% and the market risk premium is 4% a. If you fom's project is all-equity financed estimate its cost of capital After computing the project's cost of capital you decided to look for other comparables to reduce estimation error in your cost of capital estimate. You find a second form, Thurtina Design, which is also engaged in a similar line of business. Thurbinar has a stock price of $20 por share with 15 milion shares outstanding. It also has $117 milion in outstanding debt, with a yield on the debt of 47% Thurbinar's equity bota is 100 b. Anime Thurbinars debt has a beta of 2000. Estimate Thurbinars unlevered bota Uue the unlovered beta and the CAPM to estimate Thurbinars unlevered cost of capital c. Estimate Thurber's equity cont of capital using the CAPM Then astumes debt cost of capital equals es yield and using these results, outimate Thurbinar's unleverud cost of capital d. Explain the diference between your estimate in pan (b) and part(e) Desic e. You decide te werage your results in part (b) und parte), and then averago this result with your estimate from part(a) What is your estimate for the cost of capital of your firm's project? wital a. you firm's project is an equity financed estimate its cout of capital The project's cost of capital h 852 Round to two decimal places) polec b. An Thurbinas Gotthon a beta of zen Estima Thuhina's undavered beta. Use the unlovered bota and the CAPM to steal Thurbinar's untevered cost of capital Thurbinar's unlevernd betais 72 Roond to two decimal places Thurina's unlevered cost of capitalis 7.31 (Pound to two decimal places egul c. Estimate Thurbinat's equity cost of capital using the CAPM. Then assume its debt cost of capital equals its yield and using these results, estimate Thurbinar's unlovered cont of capital Thaibinar's equity cost of capital is % (Round to two decimal places) Thurbinars unlevered cost of capital is % (Round to two decimal places) d. Explain the difference between your estimate in part (b) and part (c) (Select the best choice below) O A. The answers differ because we are using approximations rather than formules that hold exactly OB. In the first case, we awwmed the debt had a bets of zero so we assumed the cont of debt was the likes to while in the second case we assumed the cost of debt was the yield on debt OC. We should have gotten the same answer the problem in the numbers in the problem are not comitent OD. The answers are actually the same, any difference is just don to rounding oron. You decide to everage your resume sport and part(e) and then average this result with your estimate from port (a). What is your ordenate for the cost of capital of your firm's projec? The werage unlevered cost of capital from part() and part(e) Round town decimal places) The average cost of capital from part (band participar als (Round to two deomal places)