Only need excel data

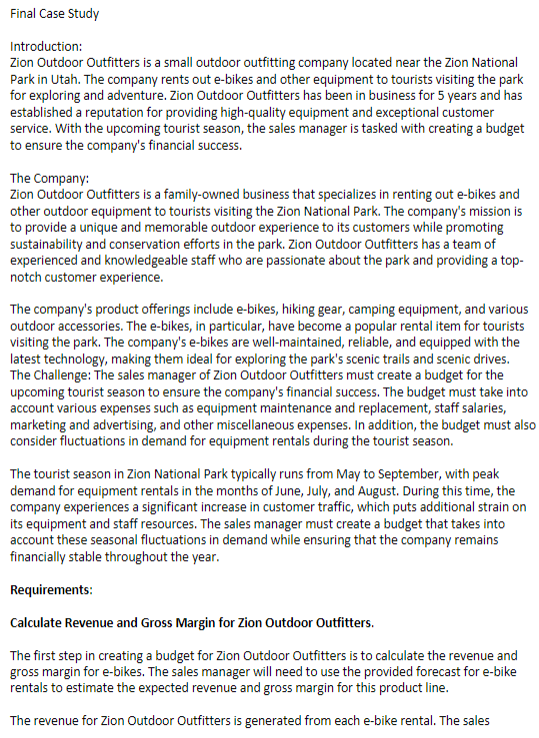

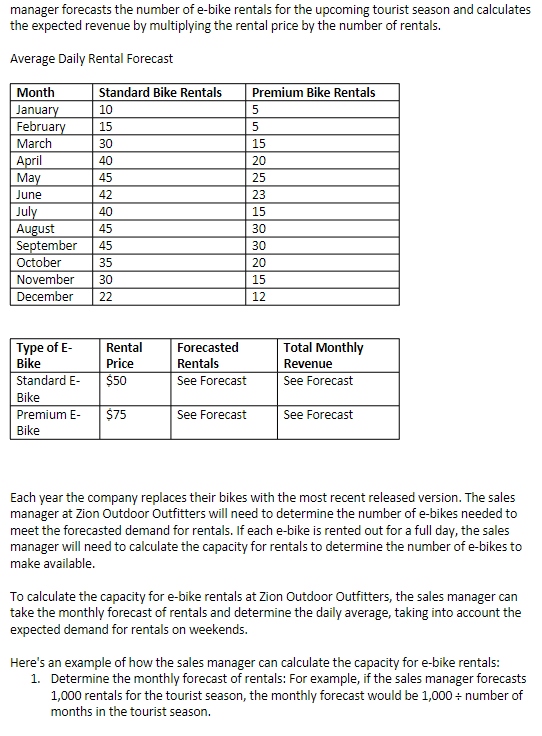

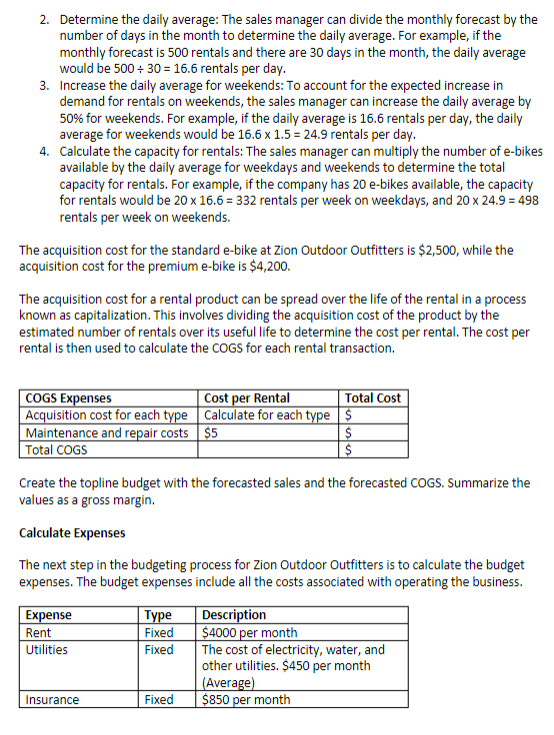

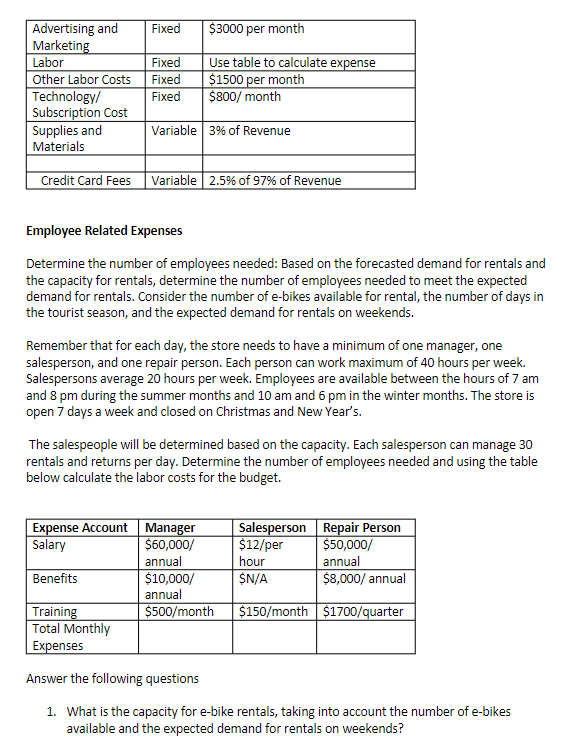

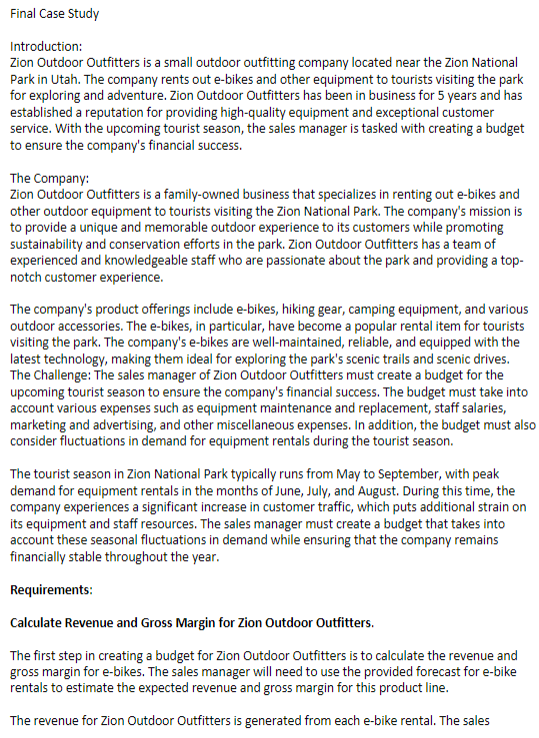

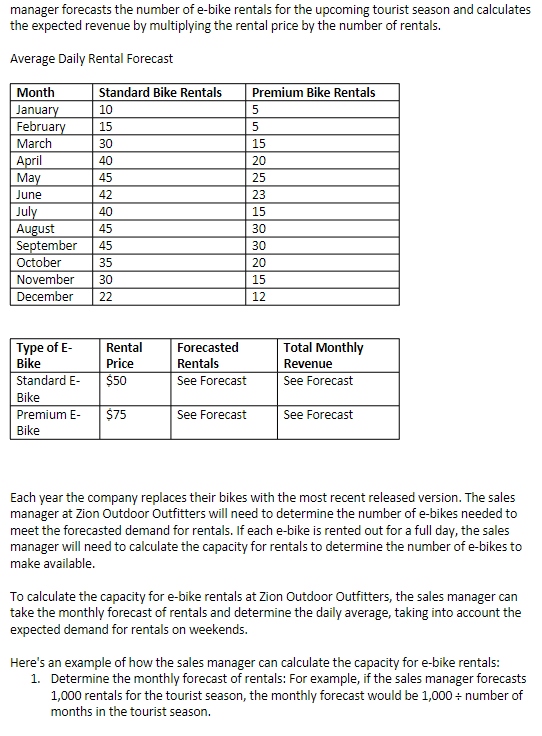

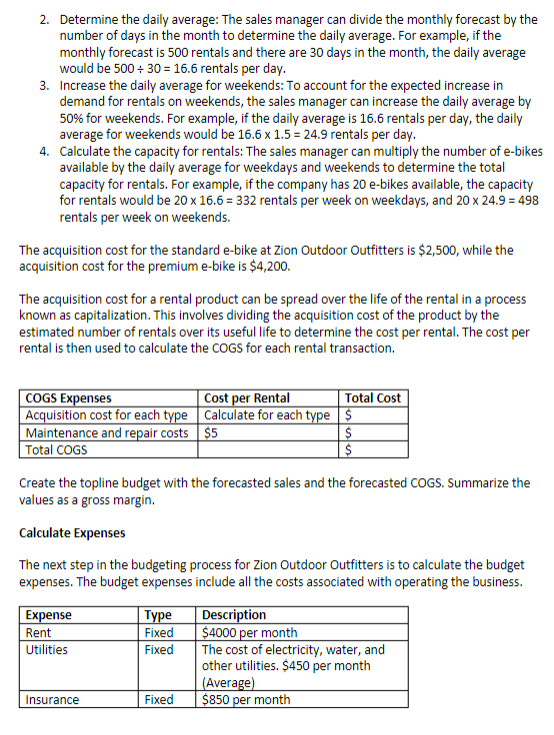

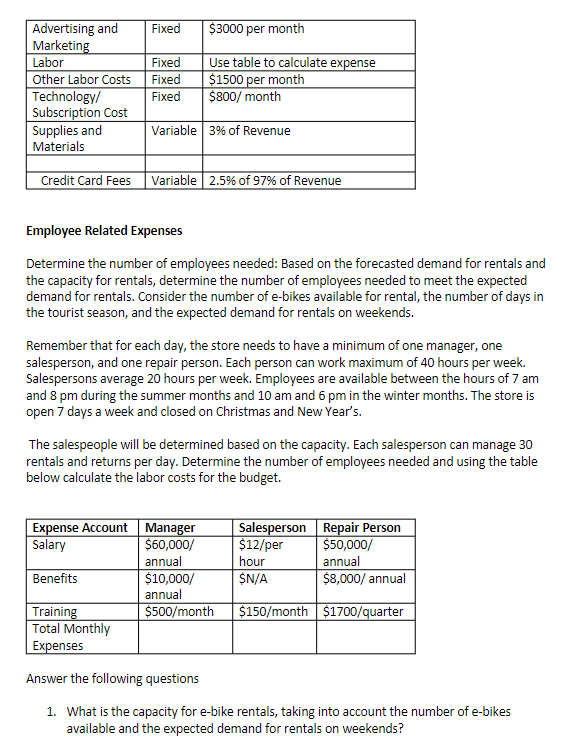

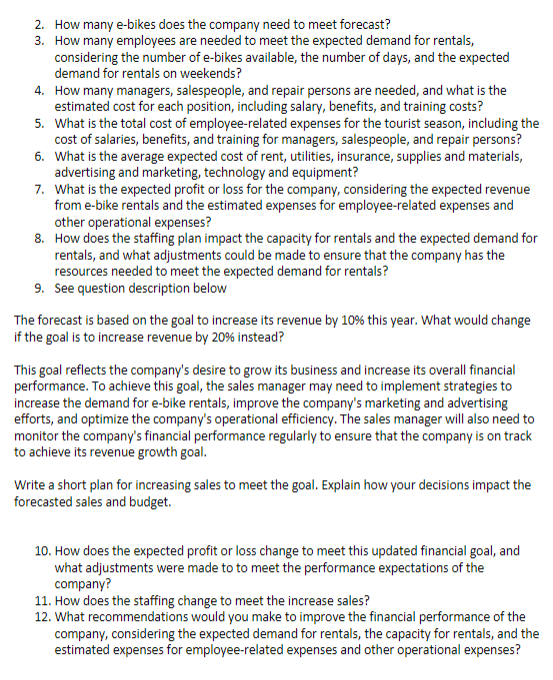

Final Case Study Introduction: Zion Outdoor Outfitters is a small outdoor outfitting company located near the Zion National Park in Utah. The company rents out e-bikes and other equipment to tourists visiting the park for exploring and adventure. Zion Outdoor Outfitters has been in business for 5 years and has established a reputation for providing high-quality equipment and exceptional customer service. With the upcoming tourist season, the sales manager is tasked with creating a budget to ensure the company's financial success. The Company: Zion Outdoor Outfitters is a family-owned business that specializes in renting out e-bikes and other outdoor equipment to tourists visiting the Zion National Park. The company's mission is to provide a unique and memorable outdoor experience to its customers while promoting sustainability and conservation efforts in the park. Zion Outdoor Outfitters has a team of experienced and knowledgeable staff who are passionate about the park and providing a topnotch customer experience. The company's product offerings include e-bikes, hiking gear, camping equipment, and various outdoor accessories. The e-bikes, in particular, have become a popular rental item for tourists visiting the park. The company's e-bikes are well-maintained, reliable, and equipped with the latest technology, making them ideal for exploring the park's scenic trails and scenic drives. The Challenge: The sales manager of Zion Outdoor Outfitters must create a budget for the upcoming tourist season to ensure the company's financial success. The budget must take into account various expenses such as equipment maintenance and replacement, staff salaries, marketing and advertising, and other miscellaneous expenses. In addition, the budget must also consider fluctuations in demand for equipment rentals during the tourist season. The tourist season in Zion National Park typically runs from May to September, with peak demand for equipment rentals in the months of June, July, and August. During this time, the company experiences a significant increase in customer traffic, which puts additional strain on its equipment and staff resources. The sales manager must create a budget that takes into account these seasonal fluctuations in demand while ensuring that the company remains financially stable throughout the year. Requirements: Calculate Revenue and Gross Margin for Zion Outdoor Outfitters. The first step in creating a budget for Zion Outdoor Outfitters is to calculate the revenue and gross margin for e-bikes. The sales manager will need to use the provided forecast for e-bike rentals to estimate the expected revenue and gross margin for this product line. The revenue for Zion Outdoor Outfitters is generated from each e-bike rental. The sales manager forecasts the number of e-bike rentals for the upcoming tourist season and calculates the expected revenue by multiplying the rental price by the number of rentals. Average Daily Rental Forecast Each year the company replaces their bikes with the most recent released version. The sales manager at Zion Outdoor Outfitters will need to determine the number of e-bikes needed to meet the forecasted demand for rentals. If each e-bike is rented out for a full day, the sales manager will need to calculate the capacity for rentals to determine the number of e-bikes to make available. To calculate the capacity for e-bike rentals at Zion Outdoor Outfitters, the sales manager can take the monthly forecast of rentals and determine the daily average, taking into account the expected demand for rentals on weekends. Here's an example of how the sales manager can calculate the capacity for e-bike rentals: 1. Determine the monthly forecast of rentals: For example, if the sales manager forecasts 1,000 rentals for the tourist season, the monthly forecast would be 1,000 number of months in the tourist season. 2. Determine the daily average: The sales manager can divide the monthly forecast by the number of days in the month to determine the daily average. For example, if the monthly forecast is 500 rentals and there are 30 days in the month, the daily average would be 50030=16.6 rentals per day. 3. Increase the daily average for weekends: To account for the expected increase in demand for rentals on weekends, the sales manager can increase the daily average by 50% for weekends. For example, if the daily average is 16.6 rentals per day, the daily average for weekends would be 16.61.5=24.9 rentals per day. 4. Calculate the capacity for rentals: The sales manager can multiply the number of e-bikes available by the daily average for weekdays and weekends to determine the total capacity for rentals. For example, if the company has 20 e-bikes available, the capacity for rentals would be 2016.6=332 rentals per week on weekdays, and 2024.9=498 rentals per week on weekends. The acquisition cost for the standard e-bike at Zion Outdoor Outfitters is $2,500, while the acquisition cost for the premium e-bike is $4,200. The acquisition cost for a rental product can be spread over the life of the rental in a process known as capitalization. This involves dividing the acquisition cost of the product by the estimated number of rentals over its useful life to determine the cost per rental. The cost per rental is then used to calculate the COGS for each rental transaction. Create the topline budget with the forecasted sales and the forecasted COGS. Summarize the values as a gross margin. Calculate Expenses The next step in the budgeting process for Zion Outdoor Outfitters is to calculate the budget expenses. The budget expenses include all the costs associated with operating the business. Employee Related Expenses Determine the number of employees needed: Based on the forecasted demand for rentals and the capacity for rentals, determine the number of employees needed to meet the expected demand for rentals. Consider the number of e-bikes available for rental, the number of days in the tourist season, and the expected demand for rentals on weekends. Remember that for each day, the store needs to have a minimum of one manager, one salesperson, and one repair person. Each person can work maximum of 40 hours per week. Salespersons average 20 hours per week. Employees are available between the hours of 7am and 8 pm during the summer months and 10am and 6pm in the winter months. The store is open 7 days a week and closed on Christmas and New Year's. The salespeople will be determined based on the capacity. Each salesperson can manage 30 rentals and returns per day. Determine the number of employees needed and using the table below calculate the labor costs for the budget. Answer the following questions 1. What is the capacity for e-bike rentals, taking into account the number of e-bikes available and the expected demand for rentals on weekends? 2. How many e-bikes does the company need to meet forecast? 3. How many employees are needed to meet the expected demand for rentals, considering the number of e-bikes available, the number of days, and the expected demand for rentals on weekends? 4. How many managers, salespeople, and repair persons are needed, and what is the estimated cost for each position, including salary, benefits, and training costs? 5. What is the total cost of employee-related expenses for the tourist season, including the cost of salaries, benefits, and training for managers, salespeople, and repair persons? 6. What is the average expected cost of rent, utilities, insurance, supplies and materials, advertising and marketing, technology and equipment? 7. What is the expected profit or loss for the company, considering the expected revenue from e-bike rentals and the estimated expenses for employee-related expenses and other operational expenses? 8. How does the staffing plan impact the capacity for rentals and the expected demand for rentals, and what adjustments could be made to ensure that the company has the resources needed to meet the expected demand for rentals? 9. See question description below The forecast is based on the goal to increase its revenue by 10% this year. What would change if the goal is to increase revenue by 20% instead? This goal reflects the company's desire to grow its business and increase its overall financial performance. To achieve this goal, the sales manager may need to implement strategies to increase the demand for e-bike rentals, improve the company's marketing and advertising efforts, and optimize the company's operational efficiency. The sales manager will also need to monitor the company's financial performance regularly to ensure that the company is on track to achieve its revenue growth goal. Write a short plan for increasing sales to meet the goal. Explain how your decisions impact the forecasted sales and budget. 10. How does the expected profit or loss change to meet this updated financial goal, and what adjustments were made to to meet the performance expectations of the company? 11. How does the staffing change to meet the increase sales? 12. What recommendations would you make to improve the financial performance of the company, considering the expected demand for rentals, the capacity for rentals, and the estimated expenses for employee-related expenses and other operational expenses? Final Case Study Introduction: Zion Outdoor Outfitters is a small outdoor outfitting company located near the Zion National Park in Utah. The company rents out e-bikes and other equipment to tourists visiting the park for exploring and adventure. Zion Outdoor Outfitters has been in business for 5 years and has established a reputation for providing high-quality equipment and exceptional customer service. With the upcoming tourist season, the sales manager is tasked with creating a budget to ensure the company's financial success. The Company: Zion Outdoor Outfitters is a family-owned business that specializes in renting out e-bikes and other outdoor equipment to tourists visiting the Zion National Park. The company's mission is to provide a unique and memorable outdoor experience to its customers while promoting sustainability and conservation efforts in the park. Zion Outdoor Outfitters has a team of experienced and knowledgeable staff who are passionate about the park and providing a topnotch customer experience. The company's product offerings include e-bikes, hiking gear, camping equipment, and various outdoor accessories. The e-bikes, in particular, have become a popular rental item for tourists visiting the park. The company's e-bikes are well-maintained, reliable, and equipped with the latest technology, making them ideal for exploring the park's scenic trails and scenic drives. The Challenge: The sales manager of Zion Outdoor Outfitters must create a budget for the upcoming tourist season to ensure the company's financial success. The budget must take into account various expenses such as equipment maintenance and replacement, staff salaries, marketing and advertising, and other miscellaneous expenses. In addition, the budget must also consider fluctuations in demand for equipment rentals during the tourist season. The tourist season in Zion National Park typically runs from May to September, with peak demand for equipment rentals in the months of June, July, and August. During this time, the company experiences a significant increase in customer traffic, which puts additional strain on its equipment and staff resources. The sales manager must create a budget that takes into account these seasonal fluctuations in demand while ensuring that the company remains financially stable throughout the year. Requirements: Calculate Revenue and Gross Margin for Zion Outdoor Outfitters. The first step in creating a budget for Zion Outdoor Outfitters is to calculate the revenue and gross margin for e-bikes. The sales manager will need to use the provided forecast for e-bike rentals to estimate the expected revenue and gross margin for this product line. The revenue for Zion Outdoor Outfitters is generated from each e-bike rental. The sales manager forecasts the number of e-bike rentals for the upcoming tourist season and calculates the expected revenue by multiplying the rental price by the number of rentals. Average Daily Rental Forecast Each year the company replaces their bikes with the most recent released version. The sales manager at Zion Outdoor Outfitters will need to determine the number of e-bikes needed to meet the forecasted demand for rentals. If each e-bike is rented out for a full day, the sales manager will need to calculate the capacity for rentals to determine the number of e-bikes to make available. To calculate the capacity for e-bike rentals at Zion Outdoor Outfitters, the sales manager can take the monthly forecast of rentals and determine the daily average, taking into account the expected demand for rentals on weekends. Here's an example of how the sales manager can calculate the capacity for e-bike rentals: 1. Determine the monthly forecast of rentals: For example, if the sales manager forecasts 1,000 rentals for the tourist season, the monthly forecast would be 1,000 number of months in the tourist season. 2. Determine the daily average: The sales manager can divide the monthly forecast by the number of days in the month to determine the daily average. For example, if the monthly forecast is 500 rentals and there are 30 days in the month, the daily average would be 50030=16.6 rentals per day. 3. Increase the daily average for weekends: To account for the expected increase in demand for rentals on weekends, the sales manager can increase the daily average by 50% for weekends. For example, if the daily average is 16.6 rentals per day, the daily average for weekends would be 16.61.5=24.9 rentals per day. 4. Calculate the capacity for rentals: The sales manager can multiply the number of e-bikes available by the daily average for weekdays and weekends to determine the total capacity for rentals. For example, if the company has 20 e-bikes available, the capacity for rentals would be 2016.6=332 rentals per week on weekdays, and 2024.9=498 rentals per week on weekends. The acquisition cost for the standard e-bike at Zion Outdoor Outfitters is $2,500, while the acquisition cost for the premium e-bike is $4,200. The acquisition cost for a rental product can be spread over the life of the rental in a process known as capitalization. This involves dividing the acquisition cost of the product by the estimated number of rentals over its useful life to determine the cost per rental. The cost per rental is then used to calculate the COGS for each rental transaction. Create the topline budget with the forecasted sales and the forecasted COGS. Summarize the values as a gross margin. Calculate Expenses The next step in the budgeting process for Zion Outdoor Outfitters is to calculate the budget expenses. The budget expenses include all the costs associated with operating the business. Employee Related Expenses Determine the number of employees needed: Based on the forecasted demand for rentals and the capacity for rentals, determine the number of employees needed to meet the expected demand for rentals. Consider the number of e-bikes available for rental, the number of days in the tourist season, and the expected demand for rentals on weekends. Remember that for each day, the store needs to have a minimum of one manager, one salesperson, and one repair person. Each person can work maximum of 40 hours per week. Salespersons average 20 hours per week. Employees are available between the hours of 7am and 8 pm during the summer months and 10am and 6pm in the winter months. The store is open 7 days a week and closed on Christmas and New Year's. The salespeople will be determined based on the capacity. Each salesperson can manage 30 rentals and returns per day. Determine the number of employees needed and using the table below calculate the labor costs for the budget. Answer the following questions 1. What is the capacity for e-bike rentals, taking into account the number of e-bikes available and the expected demand for rentals on weekends? 2. How many e-bikes does the company need to meet forecast? 3. How many employees are needed to meet the expected demand for rentals, considering the number of e-bikes available, the number of days, and the expected demand for rentals on weekends? 4. How many managers, salespeople, and repair persons are needed, and what is the estimated cost for each position, including salary, benefits, and training costs? 5. What is the total cost of employee-related expenses for the tourist season, including the cost of salaries, benefits, and training for managers, salespeople, and repair persons? 6. What is the average expected cost of rent, utilities, insurance, supplies and materials, advertising and marketing, technology and equipment? 7. What is the expected profit or loss for the company, considering the expected revenue from e-bike rentals and the estimated expenses for employee-related expenses and other operational expenses? 8. How does the staffing plan impact the capacity for rentals and the expected demand for rentals, and what adjustments could be made to ensure that the company has the resources needed to meet the expected demand for rentals? 9. See question description below The forecast is based on the goal to increase its revenue by 10% this year. What would change if the goal is to increase revenue by 20% instead? This goal reflects the company's desire to grow its business and increase its overall financial performance. To achieve this goal, the sales manager may need to implement strategies to increase the demand for e-bike rentals, improve the company's marketing and advertising efforts, and optimize the company's operational efficiency. The sales manager will also need to monitor the company's financial performance regularly to ensure that the company is on track to achieve its revenue growth goal. Write a short plan for increasing sales to meet the goal. Explain how your decisions impact the forecasted sales and budget. 10. How does the expected profit or loss change to meet this updated financial goal, and what adjustments were made to to meet the performance expectations of the company? 11. How does the staffing change to meet the increase sales? 12. What recommendations would you make to improve the financial performance of the company, considering the expected demand for rentals, the capacity for rentals, and the estimated expenses for employee-related expenses and other operational expenses