Answered step by step

Verified Expert Solution

Question

1 Approved Answer

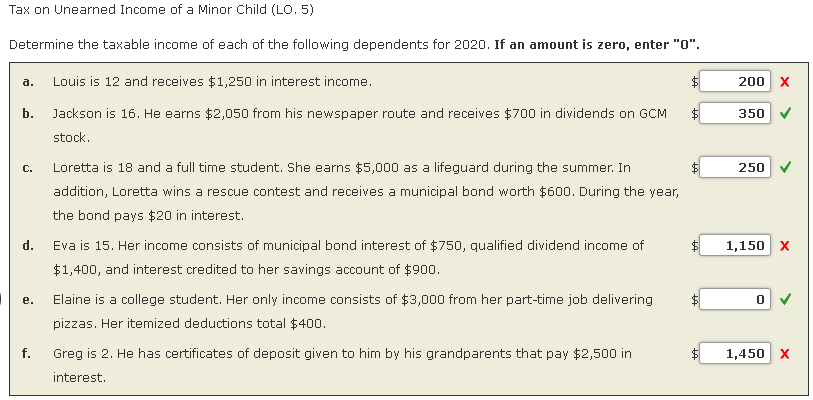

Only need help on A,D, & F Tax on Unearned Income of a Minor Child (LO. 5) Determine the taxable income of each of the

Only need help on A,D, & F

Tax on Unearned Income of a Minor Child (LO. 5) Determine the taxable income of each of the following dependents for 2020. If an amount is zero, enter "O". a. Louis is 12 and receives $1,250 in interest income. 200 x b. 350 Jackson is 16. He earns $2,050 from his newspaper route and receives $700 in dividends on GCM stock C. 250 d. Loretta is 18 and a full time student. She earns $5,000 as a lifeguard during the summer. In addition, Loretta wins a rescue contest and receives a municipal bond worth $600. During the year, the bond pays $20 in interest. Eva is 15. Her income consists of municipal bond interest of $750, qualified dividend income of $1,400, and interest credited to her savings account of $900. Elaine is a college student. Her only income consists of $3,000 from her part-time job delivering pizzas. Her itemized deductions total $400. 1,150 X e. 0 f. 1,450 X Greg is 2. He has certificates of deposit given to him by his grandparents that pay $2,500 in interestStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started