Only Need Help With: J,K,L

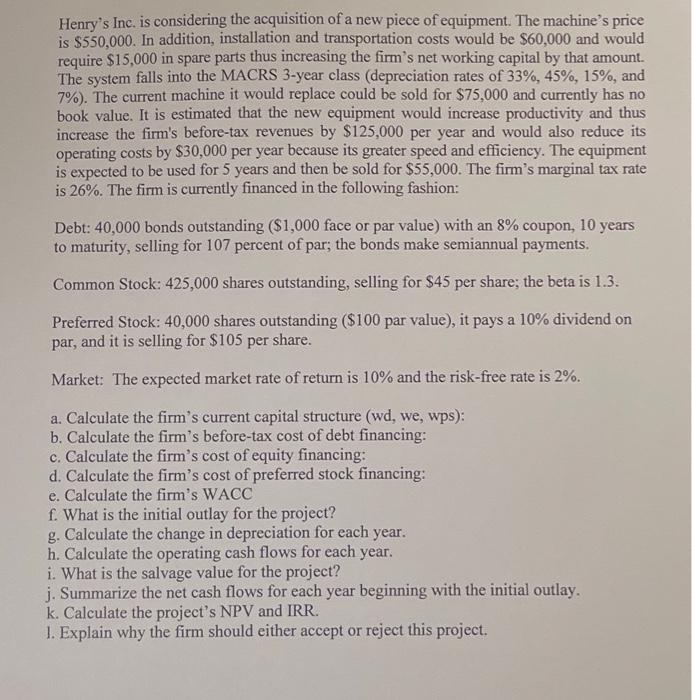

Henry's Inc. is considering the acquisition of a new piece of equipment. The machine's price is $550,000. In addition, installation and transportation costs would be $60,000 and would require $15,000 in spare parts thus increasing the firm's net working capital by that amount. The system falls into the MACRS 3 -year class (depreciation rates of 33%,45%,15%, and 7% ). The current machine it would replace could be sold for $75,000 and currently has no book value. It is estimated that the new equipment would increase productivity and thus increase the firm's before-tax revenues by $125,000 per year and would also reduce its operating costs by $30,000 per year because its greater speed and efficiency. The equipment is expected to be used for 5 years and then be sold for $55,000. The firm's marginal tax rate is 26%. The firm is currently financed in the following fashion: Debt: 40,000 bonds outstanding ( $1,000 face or par value) with an 8% coupon, 10 years to maturity, selling for 107 percent of par; the bonds make semiannual payments. Common Stock: 425,000 shares outstanding, selling for $45 per share; the beta is 1.3. Preferred Stock: 40,000 shares outstanding ( $100 par value), it pays a 10% dividend on par, and it is selling for $105 per share. Market: The expected market rate of return is 10% and the risk-free rate is 2%. a. Calculate the firm's current capital structure (wd, we, wps): b. Calculate the firm's before-tax cost of debt financing: c. Calculate the firm's cost of equity financing: d. Calculate the firm's cost of preferred stock financing: e. Calculate the firm's WACC f. What is the initial outlay for the project? g. Calculate the change in depreciation for each year. h. Calculate the operating cash flows for each year. i. What is the salvage value for the project? j. Summarize the net cash flows for each year beginning with the initial outlay. k. Calculate the project's NPV and IRR. 1. Explain why the firm should either accept or reject this project. Henry's Inc. is considering the acquisition of a new piece of equipment. The machine's price is $550,000. In addition, installation and transportation costs would be $60,000 and would require $15,000 in spare parts thus increasing the firm's net working capital by that amount. The system falls into the MACRS 3 -year class (depreciation rates of 33%,45%,15%, and 7% ). The current machine it would replace could be sold for $75,000 and currently has no book value. It is estimated that the new equipment would increase productivity and thus increase the firm's before-tax revenues by $125,000 per year and would also reduce its operating costs by $30,000 per year because its greater speed and efficiency. The equipment is expected to be used for 5 years and then be sold for $55,000. The firm's marginal tax rate is 26%. The firm is currently financed in the following fashion: Debt: 40,000 bonds outstanding ( $1,000 face or par value) with an 8% coupon, 10 years to maturity, selling for 107 percent of par; the bonds make semiannual payments. Common Stock: 425,000 shares outstanding, selling for $45 per share; the beta is 1.3. Preferred Stock: 40,000 shares outstanding ( $100 par value), it pays a 10% dividend on par, and it is selling for $105 per share. Market: The expected market rate of return is 10% and the risk-free rate is 2%. a. Calculate the firm's current capital structure (wd, we, wps): b. Calculate the firm's before-tax cost of debt financing: c. Calculate the firm's cost of equity financing: d. Calculate the firm's cost of preferred stock financing: e. Calculate the firm's WACC f. What is the initial outlay for the project? g. Calculate the change in depreciation for each year. h. Calculate the operating cash flows for each year. i. What is the salvage value for the project? j. Summarize the net cash flows for each year beginning with the initial outlay. k. Calculate the project's NPV and IRR. 1. Explain why the firm should either accept or reject this project