Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only need help with part 4. a&b please. Thanks. > Side-by-Side prints custom training material for corporations. The business was There were two jobs in

Only need help with part 4. a&b please. Thanks.

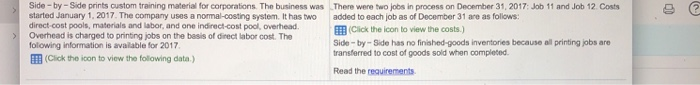

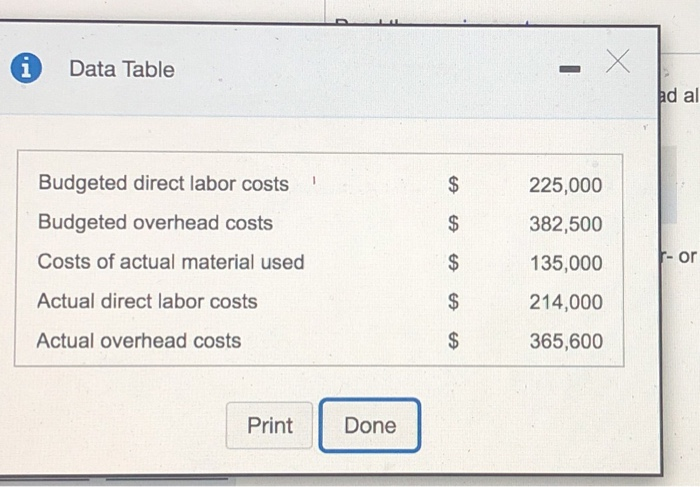

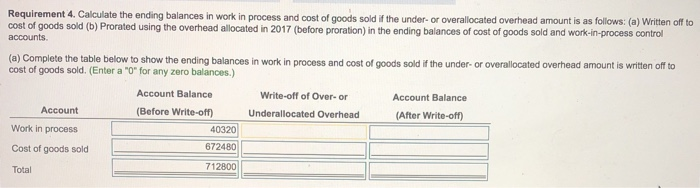

> Side-by-Side prints custom training material for corporations. The business was There were two jobs in process on December 31, 2017: Job 11 and Job 12. Costs started January 1, 2017. The company uses a normal-costing system. It has two added to each job as of December 31 are as follows: direct-cost pools, materials and labor, and one indirect-cost pool, overhead. Click the icon to view the costs.) Overhead is charged to printing jobs on the basis of direct labor cost. The folowing information is available for 2017 Side-by-Side has no finished-goods inventories because all printing jobs are transferred to cost of goods sold when completed (Click the icon to view the folowing data) Read the requirements i Data Table - X ad al $ 225,000 Budgeted direct labor costs Budgeted overhead costs $ 382,500 Costs of actual material used $ 135,000 - or Actual direct labor costs $ 214,000 Actual overhead costs $ 365,600 Print Done tio heac th i - X Data Table le $ Direct materials Direct labor ng Job 11 $ 4,090 $ 5,200 der- efol Job 12 $ 5,720 $ 6,100 6 Print Done Requirement 4. Calculate the ending balances in work in process and cost of goods sold if the under-or overallocated overhead amount is as follows: (a) Written off to cost of goods sold (b) Prorated using the overhead allocated in 2017 (before proration) in the ending balances of cost of goods sold and work-in-process control accounts (a) Complete the table below to show the ending balances in work in process and cost of goods sold if the under-or overallocated overhead amount is written off to cost of goods sold. (Enter a "O" for any zero balances.) Account Balance Write-off of Over-or Account Balance Account (Before Write-off) Underallocated Overhead (After Write-off) Work in process 40320 Cost of goods sold Total 712800 672480 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started