Question

ONLY NEED HELP WITH PART 4. Natalie Lawson spent much of her youth playing sports. She passed many hours on the soccer field and in

ONLY NEED HELP WITH PART 4.

Natalie Lawson spent much of her youth playing sports. She passed many hours on the soccer field and in the dance studio. As Natalie grew older, her passion for healthy living continued as she started practising yoga. Now, at the start of her second year in college, Natalie is investigating various possibilities for starting her own business as part of the requirements of the Entrepreneurship program she is taking. A long-time friend insists that Natalie has to somehow include healthy living in her business plan and, after a series of brainstorming sessions, Natalie settles on the idea of operating a smoothie business. She will start on a part-time basis. She will make the product at home, bottle it, and take it to the yoga studio where she exercises because they have agreed to purchase it on a regular basis. Now that she has started thinking about it, the possibilities seem endless. During the summer, she will concentrate on fresh fruit and vegetable smoothies. The first difficult decision is coming up with the perfect name for her business. In the end, she settles on Healthy Smoothies and then moves on to more important issues.

During the month of April 2017, the following activities take place:

| Apr. | 12 |

Natalie cashes her Canada Savings Bonds and receives $980, which she deposits in her personal bank account. |

|

| 13 |

She opens a bank account under the name Healthy Smoothies and transfers $900 from her personal account to the new account. |

|

| 15 |

Natalie realizes that her initial cash investment is not enough. Her mother lends her $3,000 cash, for which Natalie signs a one-year, 3% note payable in the name of the business. Natalie deposits the money in the business bank account. |

|

| 18 |

Natalie pays $325 to advertise in the April 20 issue of her community newspaper. Natalie hopes that this ad will generate revenue during the months of May and June. |

|

| 20 |

She buys supplies, such as protein powder, cups, straws, and fresh fruit and vegetables, for $198 cash. |

|

| 22 |

Natalie starts to investigate juicing machines for her business. She selects an excellent top-of-the-line juicer that costs $825. She pays for it using her own personal account. |

|

| 23 |

Natalie prepares her first batch of smoothies to bring to the yoga studio. At the end of the first day, Natalie leaves an invoice for $300 with the studio owner. The owner says the invoice will be paid sometime in May. |

|

| 24 |

A $98 invoice is received for the use of Natalie's cell phone. The cell phone is used exclusively for the Sant Smoothies business. The invoice is for services provided in April and is due on April 30. |

|

| 28 | The yoga studio where Natalie sold her first smoothies orders smoothies for the next month. Natalie is thrilled! She receives $125 in advance as a down payment. |

PART 1: APRIL MONTH (33 marks available)

Requirement 1: Natalie has hired you to be her bookkeeper. Prepare the required journal entries for the above events. Explanations are not required and round to the nearest dollar. (17 marks)

Requirement 2: Post the entries to the general ledger using the t-account format. (9 marks)

Requirement 3: Prepare the unadjusted trial balance as of July 31, 2013. (7 marks)

PART 2: APRIL MONTH END (36 marks)

It is the end of April and Natalie has been in touch with her mother. Her mother is curious to know if Natalie has been profitable and if Natalie requires another loan to help finance her business. Natalie too would like to know if she has been profitable during her first month of operation. Natalie realizes that, in order to determine Sant Smoothies' income, she must first make adjustments. Natalie puts together the following additional information:

1. Account reveals that $105 of supplies remain at the end of April.

2. Natalie was invited to deliver smoothies to a summer barbecue at her local community centre. At the end of the day, she left an invoice for $175 with the facility manager. Natalie had not had time to record this invoice in her accounting records.

3. Because there were so many guests expected to attend the barbecue in item 2, she asked a friend to help with making the smoothies and promised to pay her $12 an hour. The payment to her friend was made on May 4, 2017, for four hours of work.

4. Natalie estimates that all of her equipment will have a useful life of three years or 36 months. (Assume Natalie decides to record a full month's worth of depreciation, regardless of when the equipment was acquired by the business.)

5. Recall that Natalie's mother is charging 3% interest on the note payable extended on April 15. The loan plus interest is to be repaid in 12 months. (Calculate interest to the nearest month.)

Requirement 4: Prepare the necessary adjusting journal entries. (10 marks)

Requirement 5: Post the adjusting journal entries. (15.5 marks)

Requirement 6: Prepare the adjusted trial balance. (10.5 marks)

PART 3: FINANCIAL STATEMENTS (19 marks)

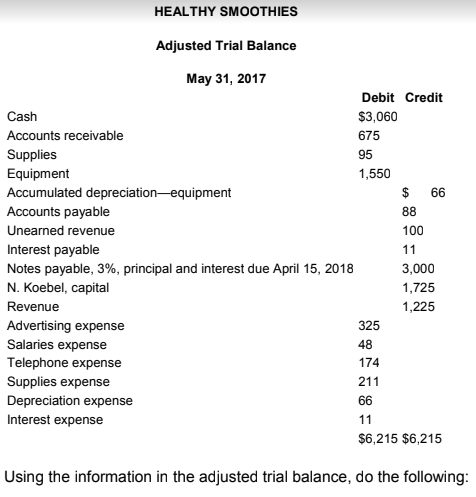

Natalie had a very busy May. At the end of the month, Natalie journalized and posted her adjusting entries, and prepared the following adjusted trial balance at May 31, 2017:

Requirement 7: Prepare an income statement for the two months ending May 31, 2017. (5 marks)

Requirement 8: Prepare the Statement of Owners Equity for the two months ended May 31, 2017,(3 marks)

Requirement 9: Prepare a Classified Balance Sheet at May 31, 2017. (8 marks)

Requirement 10:Calculate Healthy Smoothies'

current ratio and acid-test ratio. (2 marks)

Comment on Healthy Smoothies liquidity. (1 marks)

PART 4: CLOSING (12 marks)

Requirement 11: Natalie has decided that her year-end will be May 31, 2017. Prepare closing entries. (5.5 marks)

Requirement 12: Prepare a post-closing trial balance. (6.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started