Answered step by step

Verified Expert Solution

Question

1 Approved Answer

only need help with the last question b. If Fethe makes the investment today, then it will have the option to renew the franchise fee

only need help with the last question

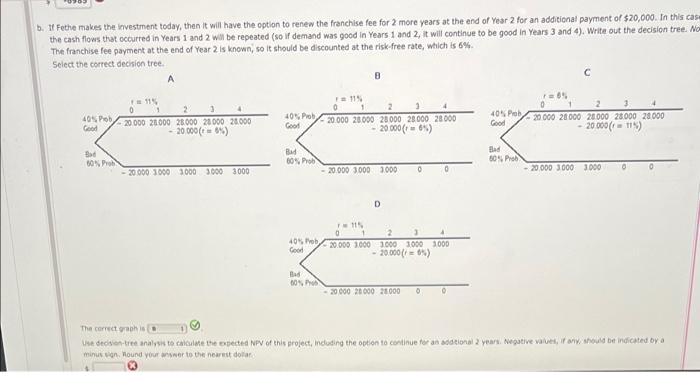

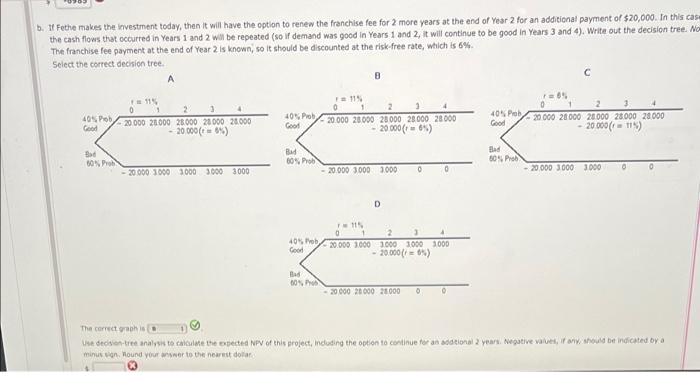

b. If Fethe makes the investment today, then it will have the option to renew the franchise fee for 2 more years at the end of Year 2 for an additional payment of $20,000. In this cas the cash flows that occurred in Years 1 and 2 will be repeated (so if demand was good in Years 1 and 2, it will continue to be good in Years 3 and 4). Write out the decision tree. No The franchise fee payment at the end of Year 2 is known, so it should be discounted at the risk-free rate, which is 6% Select the correct decision tree. B C = 0 11% 0 1 3 405 POD20000 20000 28000 28000 28.000 Good - 20000 (0%) 40% por 30.000 28.000 28000 28000 28000 Good 20.000 (65) 40 Pob Good 20000 28000 28000 28000 28000 20.000 (118) ted B BOP Bad Boob 80P - 20000 3000 3000 3000 3000 20000 3000 3000 0 0 20000 3000 3000 D 40% Pb Good 11 2 . 20.000 3000 3000 3000 3000 - 20.000 () Bad 00 - 20000 20000 2000 The correct is Ustdesentree analysis to all the spected NPV of this project, induding the option to continue for an additional 2 years. Negative valves, it should be indicated by a minus in Hound your or to the nearest doar b. If Fethe makes the investment today, then it will have the option to renew the franchise fee for 2 more years at the end of Year 2 for an additional payment of $20,000. In this cas the cash flows that occurred in Years 1 and 2 will be repeated (so if demand was good in Years 1 and 2, it will continue to be good in Years 3 and 4). Write out the decision tree. No The franchise fee payment at the end of Year 2 is known, so it should be discounted at the risk-free rate, which is 6% Select the correct decision tree. B C = 0 11% 0 1 3 405 POD20000 20000 28000 28000 28.000 Good - 20000 (0%) 40% por 30.000 28.000 28000 28000 28000 Good 20.000 (65) 40 Pob Good 20000 28000 28000 28000 28000 20.000 (118) ted B BOP Bad Boob 80P - 20000 3000 3000 3000 3000 20000 3000 3000 0 0 20000 3000 3000 D 40% Pb Good 11 2 . 20.000 3000 3000 3000 3000 - 20.000 () Bad 00 - 20000 20000 2000 The correct is Ustdesentree analysis to all the spected NPV of this project, induding the option to continue for an additional 2 years. Negative valves, it should be indicated by a minus in Hound your or to the nearest doar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started