Answered step by step

Verified Expert Solution

Question

1 Approved Answer

only need last four blanks Suppose that currently the inflation rate is 2 percent and there is no cyclical unemployment. So, the Taylor rule suggests

only need last four blanks

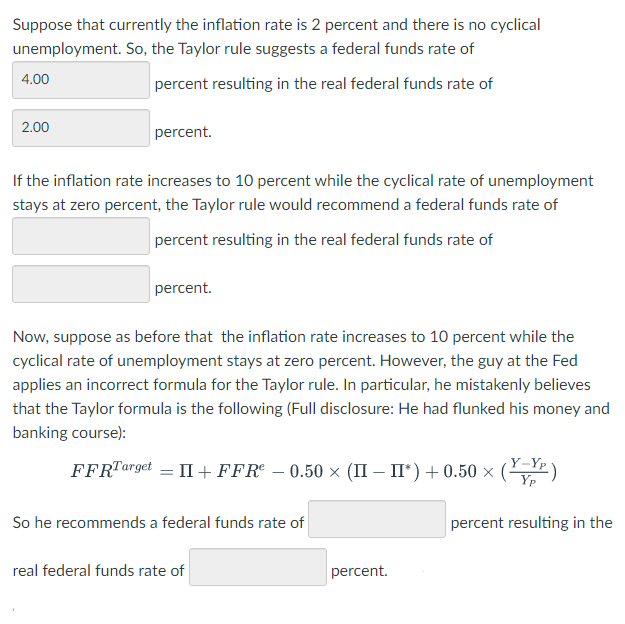

Suppose that currently the inflation rate is 2 percent and there is no cyclical unemployment. So, the Taylor rule suggests a federal funds rate of 4.00 percent resulting in the real federal funds rate of 2.00 percent. If the inflation rate increases to 10 percent while the cyclical rate of unemployment stays at zero percent, the Taylor rule would recommend a federal funds rate of percent resulting in the real federal funds rate of percent. Now, suppose as before that the inflation rate increases to 10 percent while the cyclical rate of unemployment stays at zero percent. However, the guy at the Fed applies an incorrect formula for the Taylor rule. In particular, he mistakenly believes that the Taylor formula is the following (Full disclosure: He had flunked his money and banking course): FFRTarget = II + FFR - 0.50 (II - II*) +0.50 (Y) So he recommends a federal funds rate of percent resulting in the real federal funds rate of percent. Suppose that currently the inflation rate is 2 percent and there is no cyclical unemployment. So, the Taylor rule suggests a federal funds rate of 4.00 percent resulting in the real federal funds rate of 2.00 percent. If the inflation rate increases to 10 percent while the cyclical rate of unemployment stays at zero percent, the Taylor rule would recommend a federal funds rate of percent resulting in the real federal funds rate of percent. Now, suppose as before that the inflation rate increases to 10 percent while the cyclical rate of unemployment stays at zero percent. However, the guy at the Fed applies an incorrect formula for the Taylor rule. In particular, he mistakenly believes that the Taylor formula is the following (Full disclosure: He had flunked his money and banking course): FFRTarget = II + FFR - 0.50 (II - II*) +0.50 (Y) So he recommends a federal funds rate of percent resulting in the real federal funds rate of percentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started