Answered step by step

Verified Expert Solution

Question

1 Approved Answer

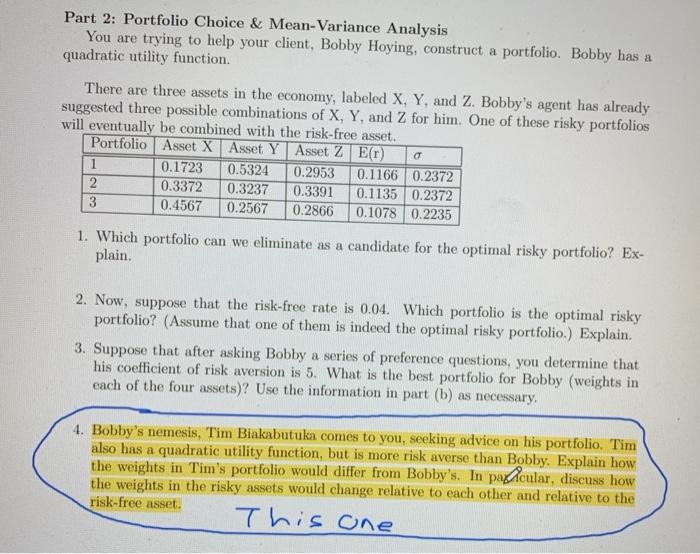

Only need number 4 which is highlighted and circled, please. Part 2: Portfolio Choice & Mean-Variance Analysis You are trying to help your client, Bobby

Only need number 4 which is highlighted and circled, please.

Part 2: Portfolio Choice & Mean-Variance Analysis You are trying to help your client, Bobby Hoying, construct a portfolio. Bobby has a quadratic utility function. There are three assets in the economy, labeled X, Y, and Z. Bobby's agent has already suggested three possible combinations of X, Y, and Z for him. One of these risky portfolios will eventually be combined with the risk-free asset. Portfolio Asset X Asset Y Asset Z E(r) 0.1723 0.5324 0.2953 0.1166 0.2372 2 0.3372 0.3237 0.3391 0.1135 0.2372 0.4567 0.2567 0.2866 0.1078 0.2235 0 1 3 1. Which portfolio can we eliminate as a candidate for the optimal risky portfolio? Ex- plain. 2. Now, suppose that the risk-free rate is 0.04. Which portfolio is the optimal risky portfolio? (Assume that one of them is indeed the optimal risky portfolio.) Explain. 3. Suppose that after asking Bobby a series of preference questions, you determine that his coefficient of risk aversion is 5. What is the best portfolio for Bobby (weights in each of the four assets)? Use the information in part (b) as necessary 4. Bobby's nemesis, Tim Biakabutuka comes to you, seeking advice on his portfolio. Tim also has a quadratic utility function, but is more risk averse than Bobby. Explain how the weights in Tim's portfolio would differ from Bobby's. In parcular, discuss how the weights in the risky assets would change relative to each other and relative to the risk-free asset. This one Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started