Answered step by step

Verified Expert Solution

Question

1 Approved Answer

only need number 9 answered For Problems 6-11, assume you buy a home and borrow $150,000 at 4.96% for 30 years. You pay a total

only need number 9 answered

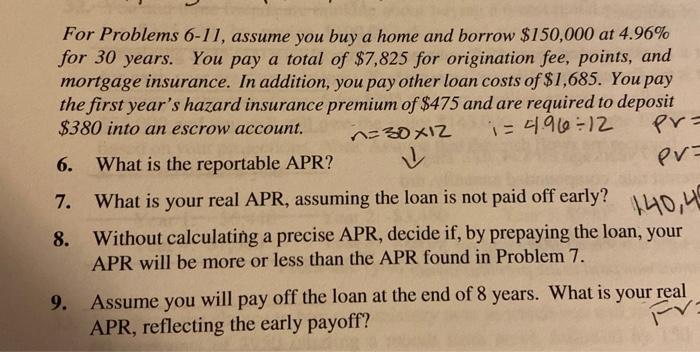

For Problems 6-11, assume you buy a home and borrow $150,000 at 4.96% for 30 years. You pay a total of $7,825 for origination fee, points, and mortgage insurance. In addition, you pay other loan costs of $1,685. You pay the first year's hazard insurance premium of $475 and are required to deposit $380 into an escrow account. n ^=30x12 i=4.96-12 pr= 6. What is the reportable APR? pv 7. What is your real APR, assuming the loan is not paid off early? 8. Without calculating a precise APR, decide if, by prepaying the loan, your APR will be more or less than the APR found in Problem 7. 9. Assume you will pay off the loan at the end of 8 years. What is your real APR, reflecting the early payoff? Fr. 140,41 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started