Only need one small part answered. rest of the work is done. Please help ASAP.

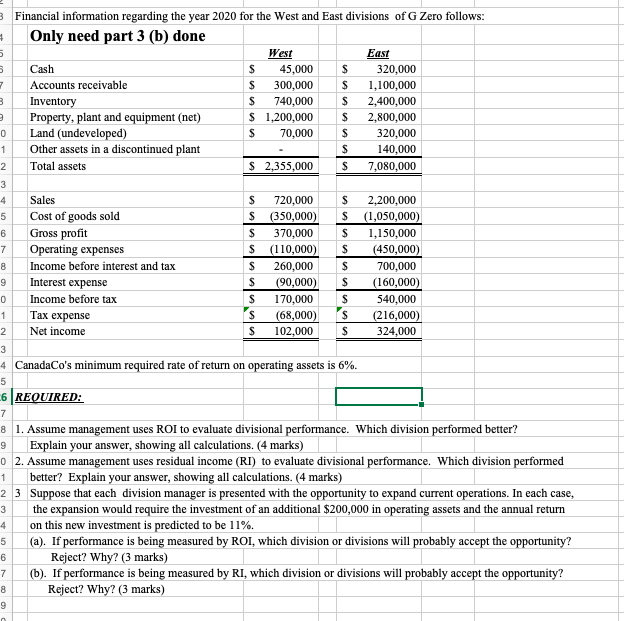

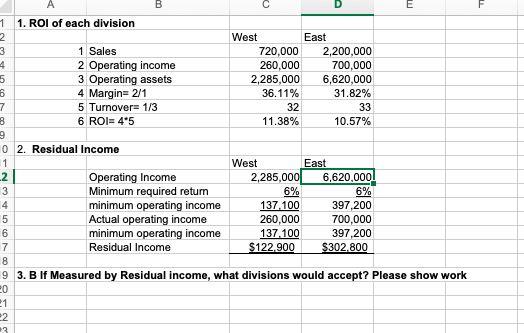

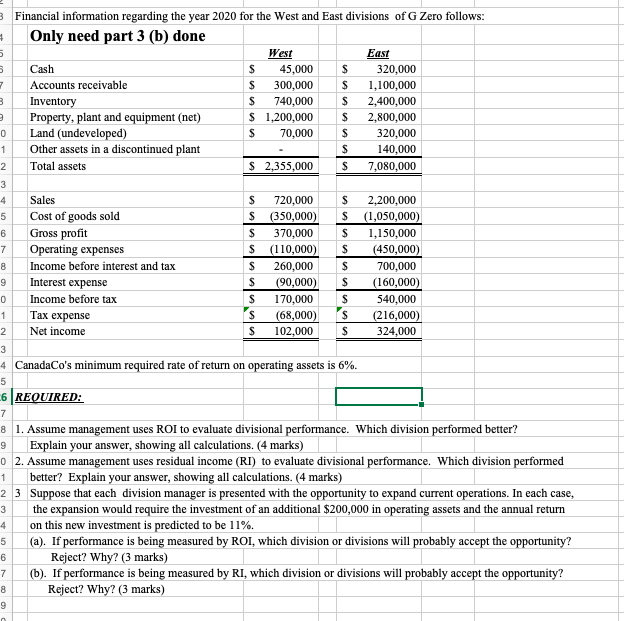

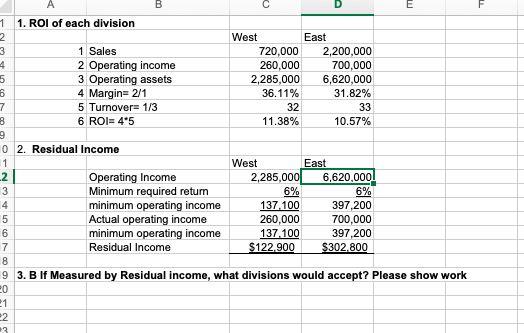

3 Financial information regarding the year 2020 for the West and East divisions of G Zero follows: Only need part 3 (b) done West East Cash 45,000 $ 320,000 Accounts receivable 300,000 $ 1,100,000 Inventory $ 740,000 $ 2,400,000 Property, plant and equipment (net) $ 1,200,000 $ 2,800,000 Land (undeveloped) $ 70.000 $ 320,000 Other assets in a discontinued plant $ 140,000 Total assets $ 2,355,000 $ 7,080.000 2 Sales Cost of goods sold Gross profit Operating expenses Income before interest and tax Interest expense Income before tax Tax expense Net income $ $ $ $ $ S $ $ $ 720,000 (350,000) 370,000 (110,000) 260,000 (90,000) 170,000 (68,000) 102,000 $ $ $ $ $ $ $ $ $ 2,200,000 (1,050,000) 1,150,000 (450,000) 700,000 (160,000) 540,000 (216,000) 324,000 2 N 4 CanadaCo's minimum required rate of return on operating assets is 6%. 6 REQUIRED: 8 1. Assume management uses ROI to evaluate divisional performance. Which division performed better? 9 Explain your answer, showing all calculations. (4 marks) 0 2. Assume management uses residual income (RI) to evaluate divisional performance. Which division performed 1 better? Explain your answer, showing all calculations. (4 marks) 2 3 Suppose that each division manager is presented with the opportunity to expand current operations. In each case, the expansion would require the investment of an additional $200,000 in operating assets and the annual return on this new investment is predicted to be 11%. 5 (a). If performance is being measured by ROI, which division or divisions will probably accept the opportunity? Reject? Why? (3 marks) 7 (b). If performance is being measured by RI, which division or divisions will probably accept the opportunity? Reject? Why? (3 marks) 000 B C D F F 1. ROI of each division TYY 1 Sales 2 Operating income 3 Operating assets 4 Margin= 2/1 5 Turnover= 1/3 6 ROI= 45 West East 720,000 2,200,000 260.000 700.000 2,285,000 6,620,000 36.11% 31.82% 32 33 11.38% 10.57% 10 2. Residual Income SEO OWN Operating Income Minimum required return minimum operating income Actual operating income minimum operating income Residual Income West East 2,285,000 6,620.0001 6% 137.100 397,200 260,000 700,000 137.100 397,200 $122.900 $302.800 3. B If Measured by Residual income, what divisions would accept? Please show work