Answered step by step

Verified Expert Solution

Question

1 Approved Answer

only need part 4 of 4 answered. First 3 parts are provided for reference. STEP: 1 of 4 Assume that you plan to take a

only need part 4 of 4 answered. First 3 parts are provided for reference.

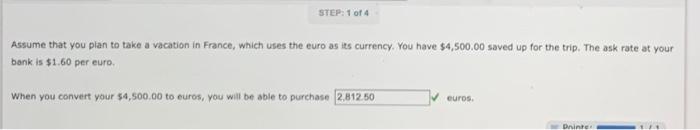

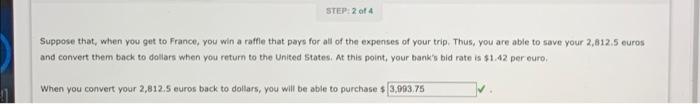

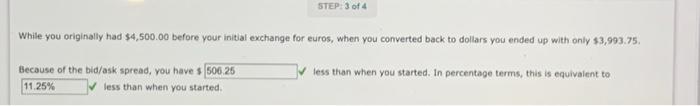

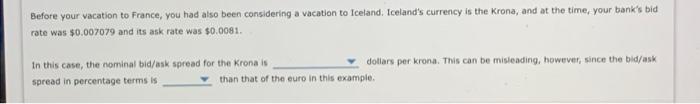

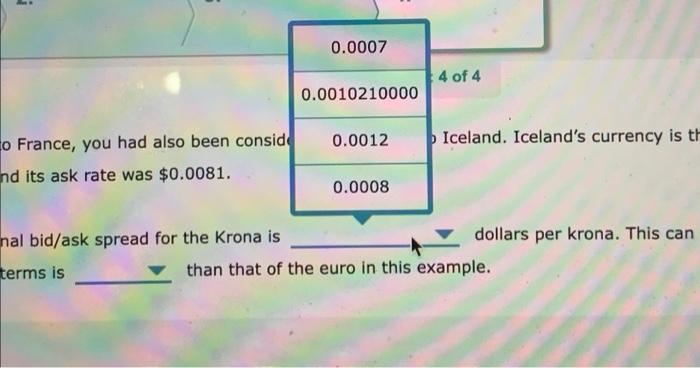

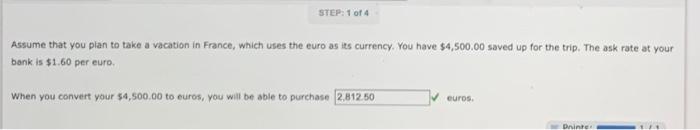

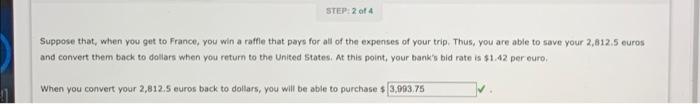

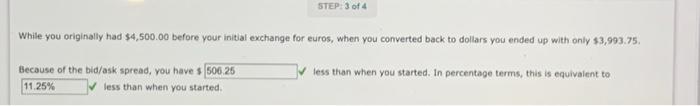

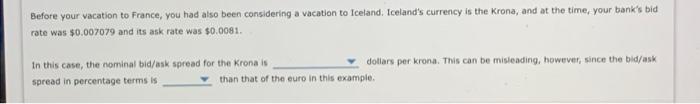

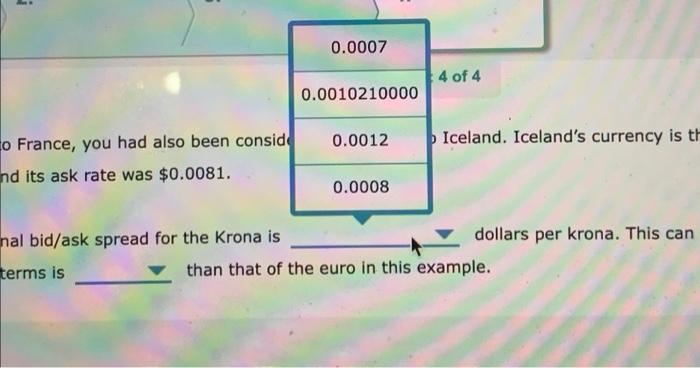

STEP: 1 of 4 Assume that you plan to take a vacation in France, which uses the euro as its currency. You have 54,500.00 saved up for the trip. The ask rate at your bank is $1.60 per euro when you convert your $4,500,00 to euros, you will be able to purchase 2,812.50 euros. Drinter STEP: 2 of 4 Suppose that when you get to France, you win a raffle that pays for all of the expenses of your trip. Thus, you are able to save your 2,612.5 euros and convert them back to dollars when you return to the United States. At this point, your bank's bid rate is $1.42 per curo When you convert your 2,812.5 euros back to dollars, you will be able to purchases 3,093,75 STEP 3 of 4 While you originally had $4,500.00 before your initial exchange for euros, when you converted back to dollars you ended up with only $3,903.75 Because of the bid/ask spread, you have $ 506.25 11.25% less than when you started. less than when you started. In percentage terms, this is equivalent to Before your vacation to France, you had also been considering a vacation to Iceland, Iceland's currency is the Krona, and at the time, your bank's bid rate was $0.007079 and its ask rate was $0.0081. In this case, the nominal bid/ask spread for the Krona is dollars per krona. This can be misleading, however, since the bid/ask spread in percentage terms is than that of the euro in this example ! 0.0007 4 of 4 0.0010210000 0.0012 Iceland, Iceland's currency is th to France, you had also been conside nd its ask rate was $0.0081. 0.0008 nal bid/ask spread for the Krona is dollars per krona. This can terms is than that of the euro in this example

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started