Answered step by step

Verified Expert Solution

Question

1 Approved Answer

only need question C Q1. (25 cash reserves required b the lending-borrowing transactions are taking place and the funds lern returned to the banking system

only need question C

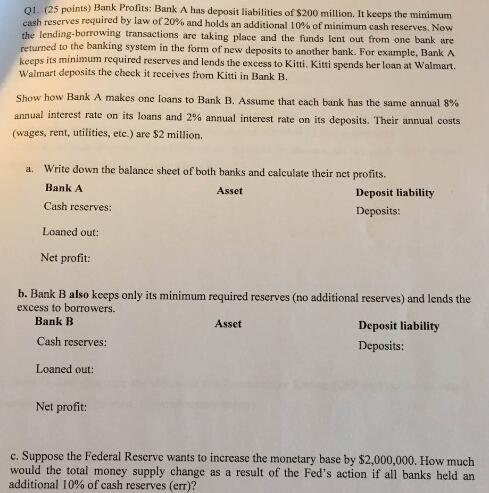

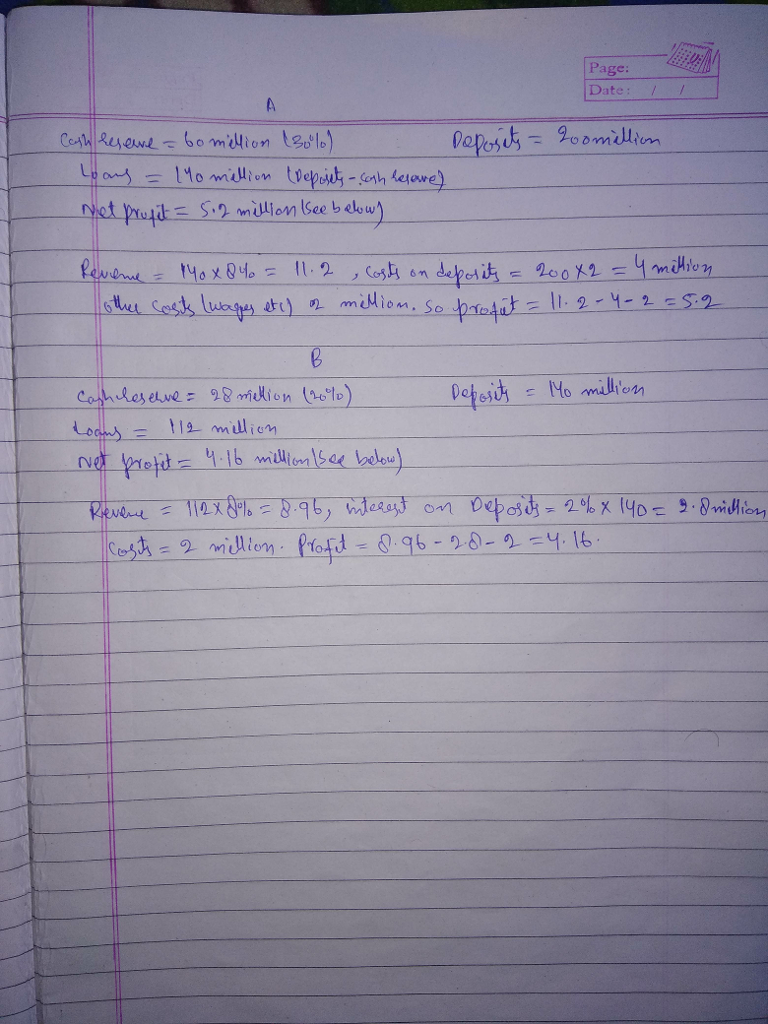

Q1. (25 cash reserves required b the lending-borrowing transactions are taking place and the funds lern returned to the banking system in the form of new deposits to another keeps its minimum required reserves and lends the excess to Kitti. Kitti spends her loan at Walmart. Walmart deposits the check it receives from Kitti in Bank B points) Bank Profits: Bank A has deposit liabilities of $200 million. It keeps the minimum y law of20% and holds an additional 10% of minimum cash reserves. Now t out from one bank are bank. For example, Bank A Show how Bank A makes one loans to Bank B. Assume that each bank has the same annual 8% annual interest rate on its loans and 2% annual interest rate on its deposits. Their annual costs (wages, rent, utilities, etc.) are $2 million. Write down the balance sheet of both banks and calculate their net profits. Bank A Cash reserves: a. Asset Deposit liability Deposits: Loaned out: Net profit: b. Bank B also keeps only its minimum required reserves (no additional reserves) and lends the excess to borrowers. Bank B Cash reserves: Loaned out: Asset Deposit liability Deposits: Net profit: c. Suppose the Federal Reserve wants to increase the monetary base by $2,000,000. How much would the total money supply change as a result of the Fed's action if all banks held an additional 10% of cash reserves (er)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started