Answered step by step

Verified Expert Solution

Question

1 Approved Answer

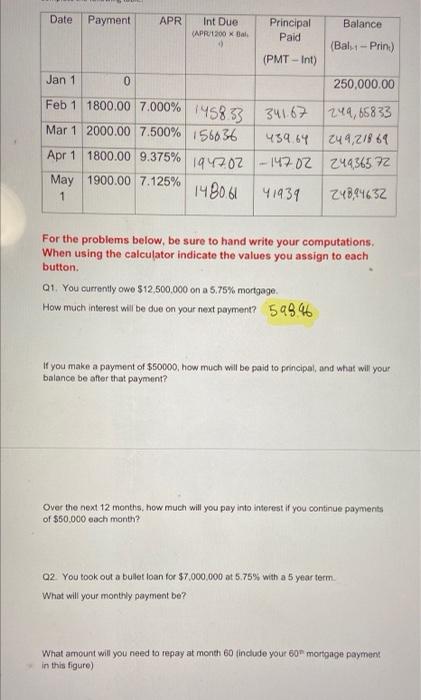

ONLY NEED Question TWO ANSWERED Complete the following table: Date Payment APR Balance Int Due (APR/1200 x Bal 1) Principal Paid (Balt-1 - Print) (PMT

ONLY NEED Question TWO ANSWERED

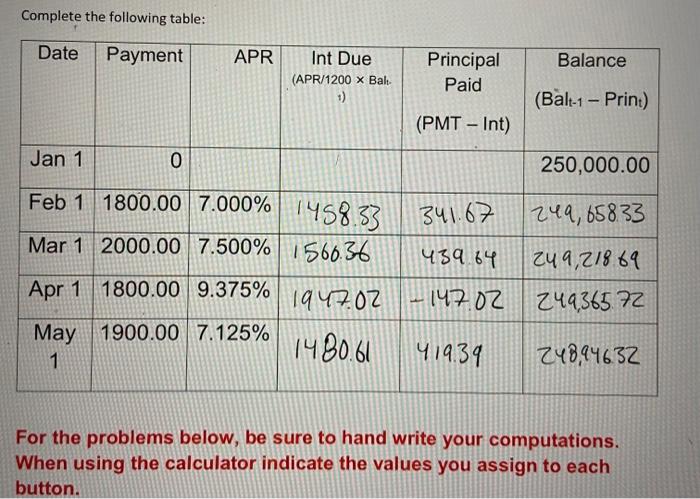

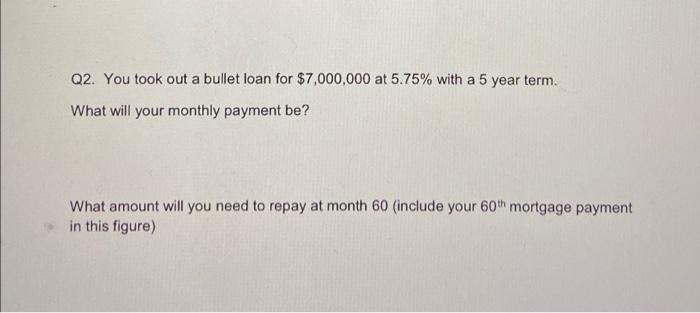

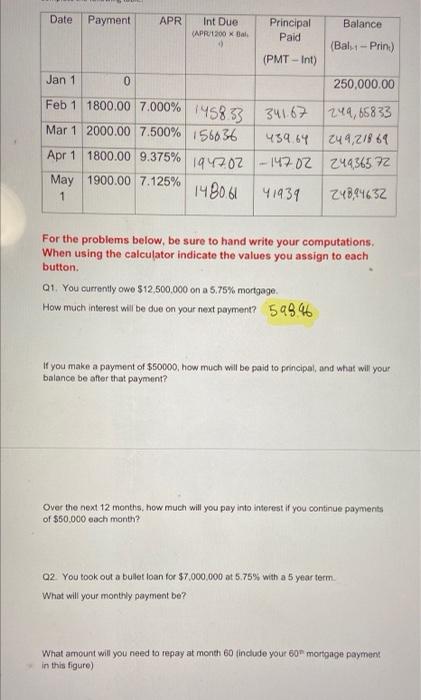

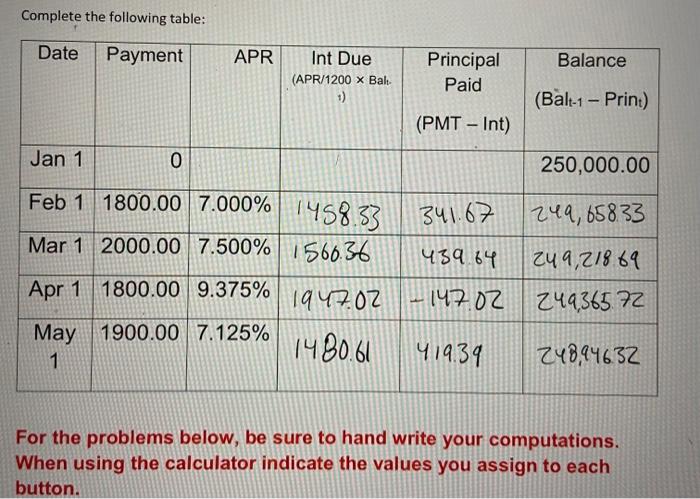

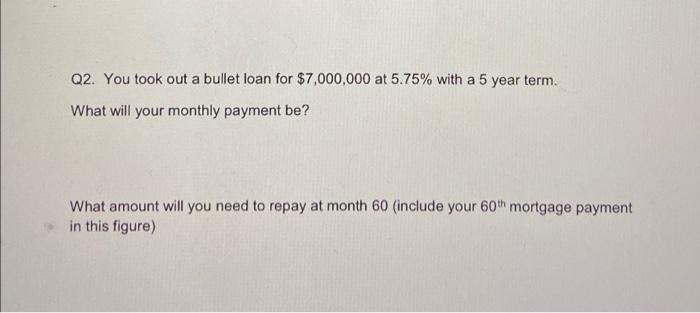

Complete the following table: Date Payment APR Balance Int Due (APR/1200 x Bal 1) Principal Paid (Balt-1 - Print) (PMT - Int) Jan 1 0 250,000.00 Feb 1 1800.00 7.000% 1458.33 Mar 1 2000.00 7.500% 1560.36 341.67 249, 658.33 439.64 249,21869 Apr 1 1800.00 9.375% 1947.02 14702 249,36572 May 1900.00 7.125% 1 1480.61 419.39 248,946.32 For the problems below, be sure to hand write your computations. When using the calculator indicate the values you assign to each button. Q2. You took out a bullet loan for $7,000,000 at 5.75% with a 5 year term. What will your monthly payment be? What amount will you need to repay at month 60 (include your 60th mortgage payment in this figure) Int Due (APR 1200 X Bali Date Payment APR Principal Balance Paid (Bal+ - Prin) (PMT - Int) Jan 1 0 250,000.00 Feb 1 1800.00 7.000% 14583 34167 249, 65833 Mar 1 2000.00 7.500% 156636 439.64 249,2/8 69 Apr 1 1800.00 9.375% 1947.02 -14702 249,36572 May 1900.00 7.125% 1480.61 1 41939 248,94632 For the problems below, be sure to hand write your computations, When using the calculator indicate the values you assign to each button, Q1. You currently owe $12.500.000 on a 5.75% mortgage. How much interest will be due on your next payment? 59846 If you make a payment of $50000, how much will be paid to principal, and what will your balance be after that payment? Over the next 12 months, how much will you pay into interest if you continue payments of $50.000 each month? 02. You took out a bulet loan for $7.000.000 at 5.75% with a 5 year term What will your monthly payment be? What amount will you need to repay at month 60 include your 60 mortgage payment in this figure)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started