only need requirement 3 4 5 6

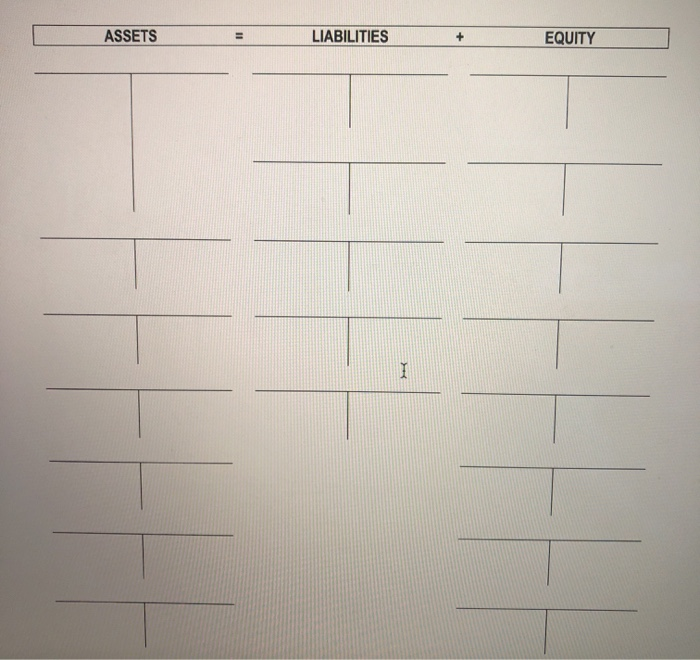

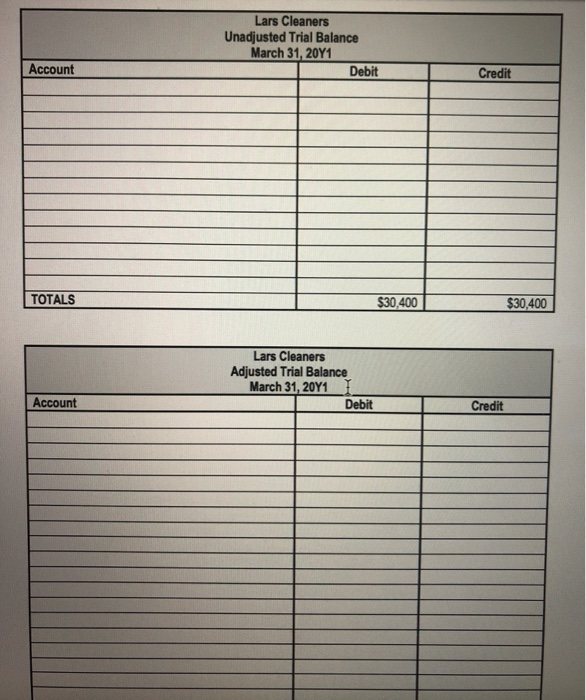

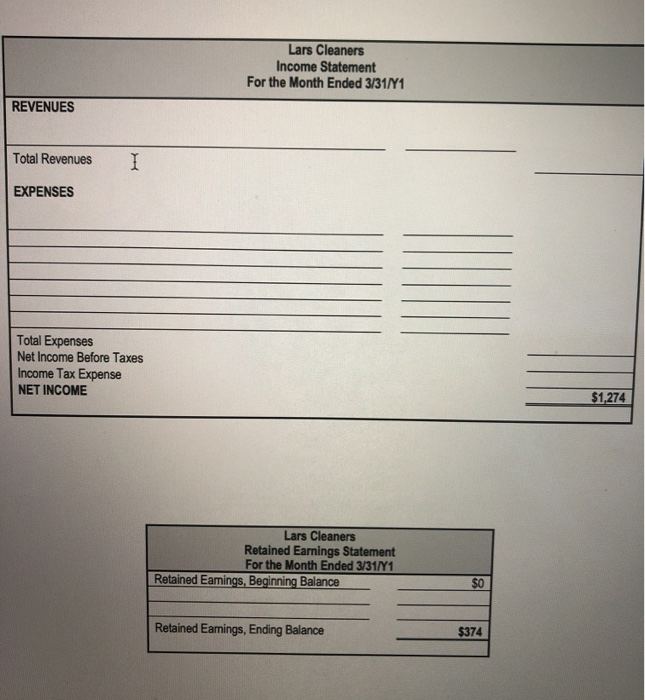

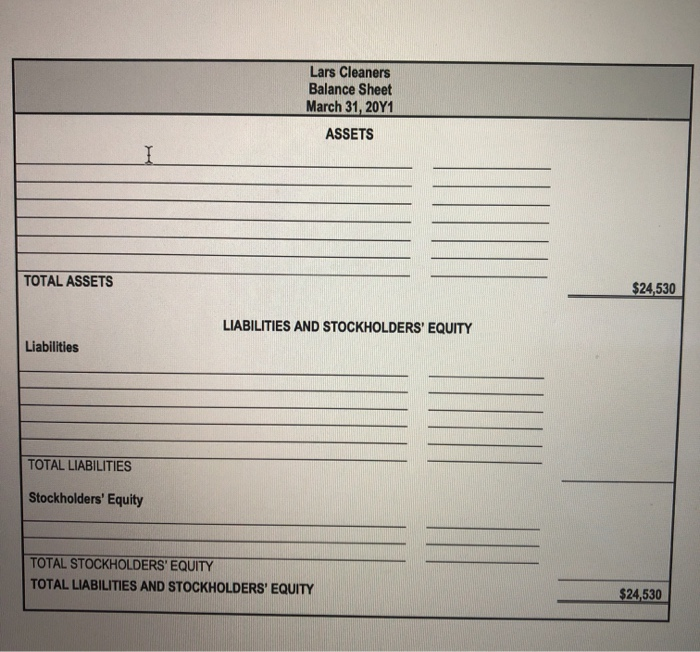

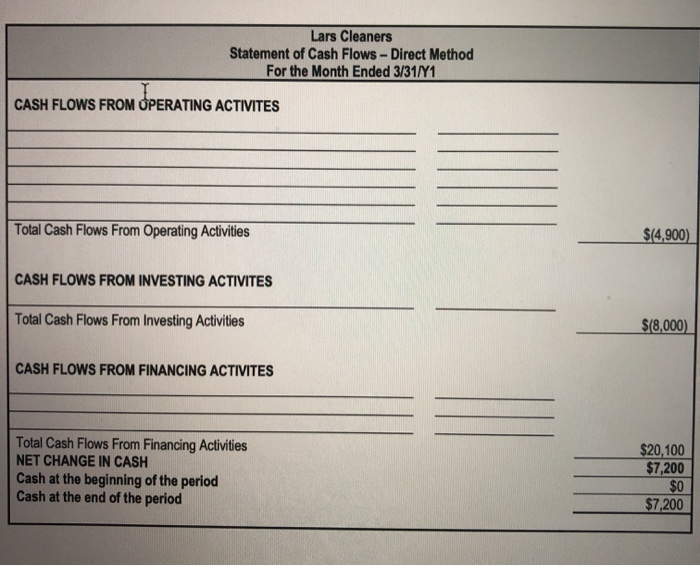

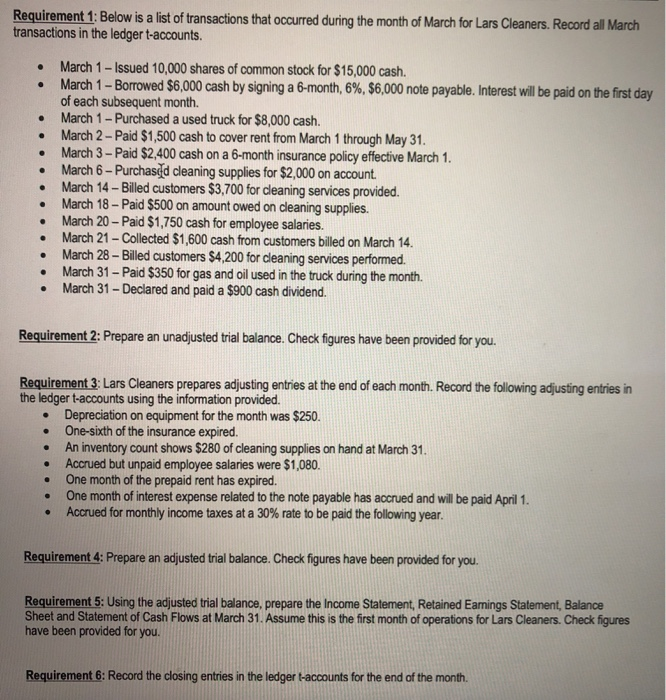

. . . Requirement 1: Below is a list of transactions that occurred during the month of March for Lars Cleaners. Record all March transactions in the ledger t-accounts. March 1 - Issued 10,000 shares of common stock for $15,000 cash. March 1 - Borrowed $6,000 cash by signing a 6-month, 6%, $6,000 note payable. Interest will be paid on the first day of each subsequent month. March 1 - Purchased a used truck for $8,000 cash. March 2 - Paid $1,500 cash to cover rent from March 1 through May 31. March 3 - Paid $2,400 cash on a 6-month insurance policy effective March 1. March 6 - Purchased cleaning supplies for $2,000 on account. March 14 - Billed customers $3,700 for cleaning services provided. March 18 - Paid $500 on amount owed on cleaning supplies. March 20 - Paid $1,750 cash for employee salaries. March 21 - Collected $1,600 cash from customers billed on March 14. March 28 - Billed customers $4,200 for cleaning services performed. March 31 - Paid $350 for gas and oil used in the truck during the month. March 31 - Declared and paid a $900 cash dividend. . . . . . . . Requirement 2: Prepare an unadjusted trial balance. Check figures have been provided for you. . Requirement 3: Lars Cleaners prepares adjusting entries at the end of each month. Record the following adjusting entries in the ledger t-accounts using the information provided. Depreciation on equipment for the month was $250. One-sixth of the insurance expired. An inventory count shows $280 of cleaning supplies on hand at March 31. Accrued but unpaid employee salaries were $1,080. One month of the prepaid rent has expired. One month of interest expense related to the note payable has accrued and will be paid April 1. Accrued for monthly income taxes at a 30% rate to be paid the following year. . . Requirement 4: Prepare an adjusted trial balance. Check figures have been provided for you. Requirement 5: Using the adjusted trial balance, prepare the Income Statement, Retained Eamings Statement, Balance Sheet and Statement of Cash Flows at March 31. Assume this is the first month of operations for Lars Cleaners. Check figures have been provided for you. Requirement 6: Record the closing entries in the ledger t-accounts for the end of the month. ASSETS LIABILITIES EQUITY I Lars Cleaners Unadjusted Trial Balance March 31, 20Y1 Debit Account Credit TOTALS $30,400 $30,400 Lars Cleaners Adjusted Trial Balance March 31, 20Y1 Debit Account Credit Lars Cleaners Income Statement For the Month Ended 3/31/41 REVENUES Total Revenues I EXPENSES Total Expenses Net Income Before Taxes Income Tax Expense NET INCOME $1,274 Lars Cleaners Retained Earnings Statement For the Month Ended 3/31/41 Retained Eamings, Beginning Balance $0 Retained Earnings, Ending Balance $374 Lars Cleaners Balance Sheet March 31, 20Y1 ASSETS 1 TOTAL ASSETS $24,530 LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities TOTAL LIABILITIES Stockholders' Equity TOTAL STOCKHOLDERS' EQUITY TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $24,530 Lars Cleaners Statement of Cash Flows - Direct Method For the Month Ended 3/31/41 CASH FLOWS FROM OPERATING ACTIVITES Total Cash Flows From Operating Activities $14,900) CASH FLOWS FROM INVESTING ACTIVITES Total Cash Flows From Investing Activities $(8,000) CASH FLOWS FROM FINANCING ACTIVITES Total Cash Flows From Financing Activities NET CHANGE IN CASH Cash at the beginning of the period Cash at the end of the period $20,100 $7,200 $0 $7,200