Only need the answers for i,iv,v,vi,vii

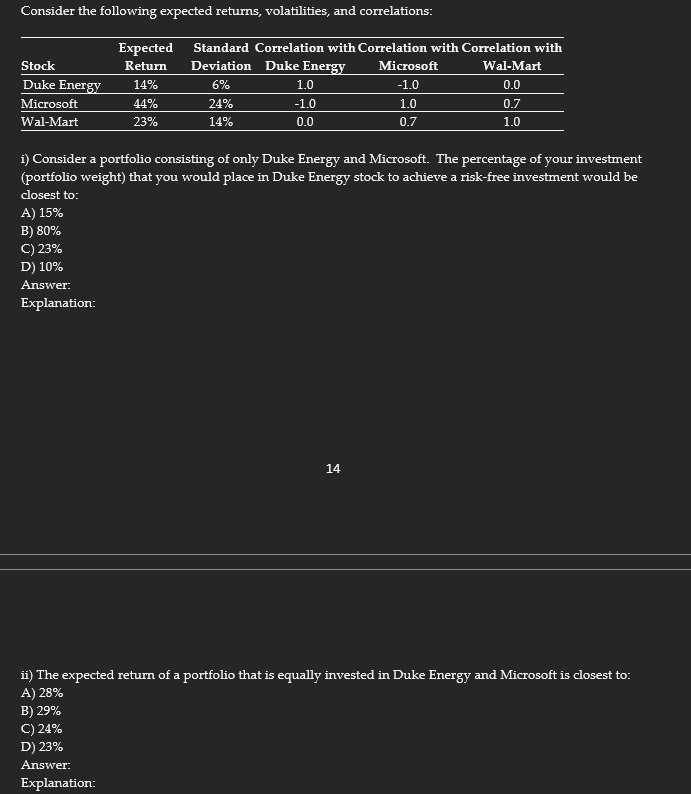

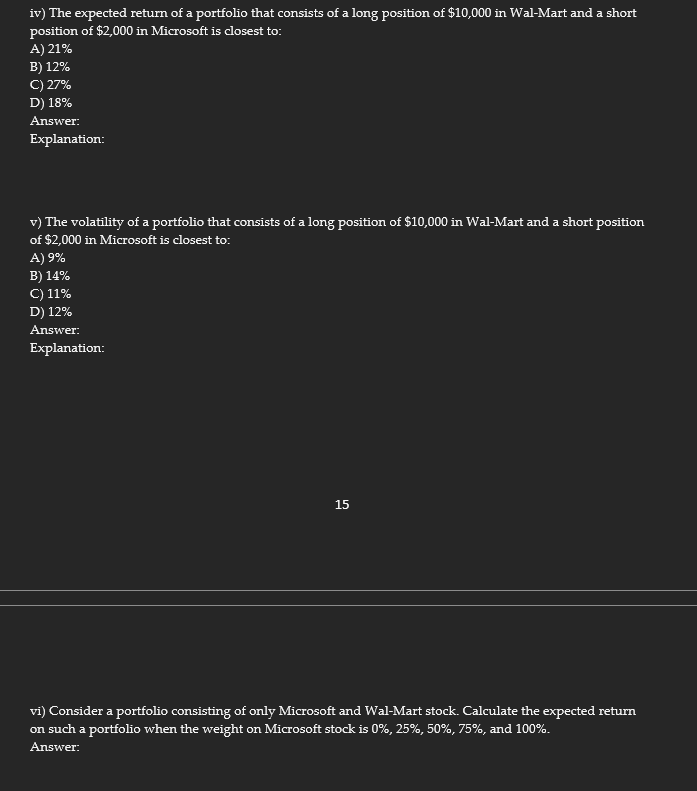

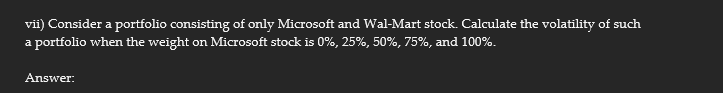

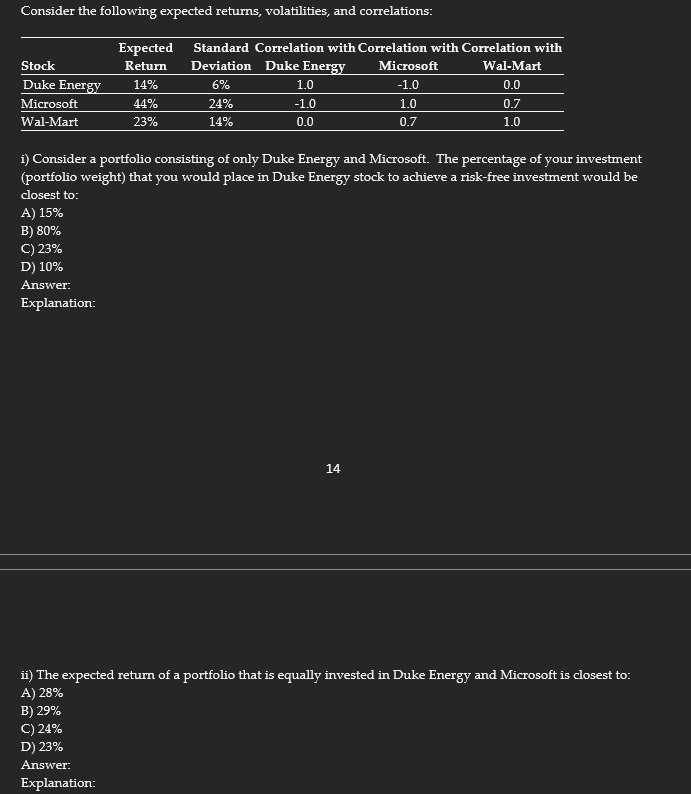

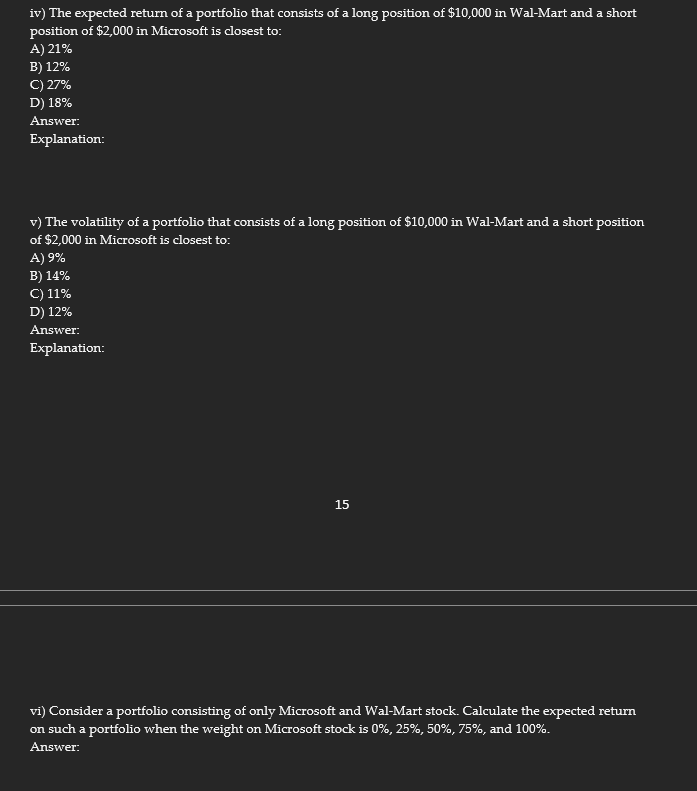

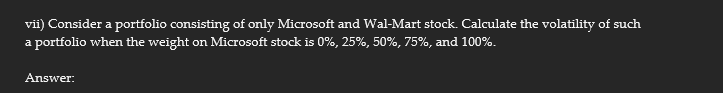

Consider the following expected returns, volatilities, and correlations: i) Consider a portfolio consisting of only Duke Energy and Microsoft. The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to: A) 15% B) 80% C) 23% D) 10% Answer: Explanation: 14 ii) The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to: A) 28% B) 29% C) 24% D) 23% Answer: Explanation: iv) The expected return of a portfolio that consists of a long position of $10,000 in Wal-Mart and a short position of $2,000 in Microsoft is closest to: A) 21% B) 12% C) 27% D) 18% Answer: Explanation: v) The volatility of a portfolio that consists of a long position of $10,000 in Wal-Mart and a short position of $2,000 in Microsoft is closest to: A) 9% B) 14% C) 11% D) 12% Answer: Explanation: 15 vi) Consider a portfolio consisting of only Microsoft and Wal-Mart stock. Calculate the expected return on such a portfolio when the weight on Microsoft stock is 0%,25%,50%,75%, and 100%. Answer: vii) Consider a portfolio consisting of only Microsoft and Wal-Mart stock. Calculate the volatility of such a portfolio when the weight on Microsoft stock is 0%,25%,50%,75%, and 100%. Answer: Consider the following expected returns, volatilities, and correlations: i) Consider a portfolio consisting of only Duke Energy and Microsoft. The percentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment would be closest to: A) 15% B) 80% C) 23% D) 10% Answer: Explanation: 14 ii) The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to: A) 28% B) 29% C) 24% D) 23% Answer: Explanation: iv) The expected return of a portfolio that consists of a long position of $10,000 in Wal-Mart and a short position of $2,000 in Microsoft is closest to: A) 21% B) 12% C) 27% D) 18% Answer: Explanation: v) The volatility of a portfolio that consists of a long position of $10,000 in Wal-Mart and a short position of $2,000 in Microsoft is closest to: A) 9% B) 14% C) 11% D) 12% Answer: Explanation: 15 vi) Consider a portfolio consisting of only Microsoft and Wal-Mart stock. Calculate the expected return on such a portfolio when the weight on Microsoft stock is 0%,25%,50%,75%, and 100%. Answer: vii) Consider a portfolio consisting of only Microsoft and Wal-Mart stock. Calculate the volatility of such a portfolio when the weight on Microsoft stock is 0%,25%,50%,75%, and 100%