Answered step by step

Verified Expert Solution

Question

1 Approved Answer

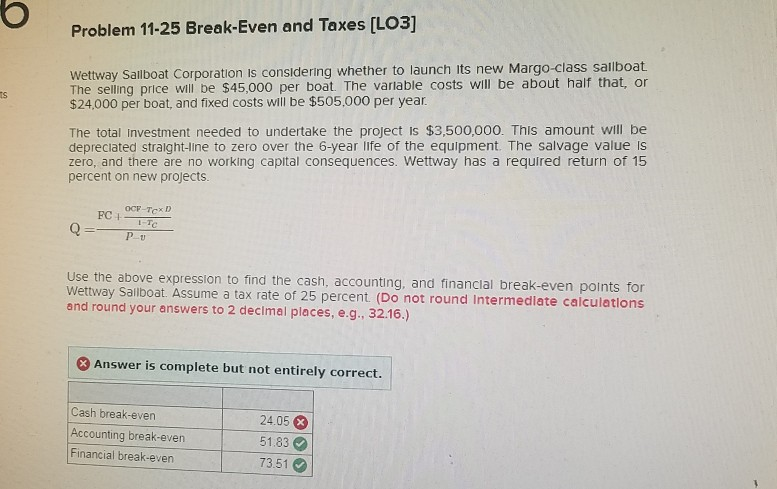

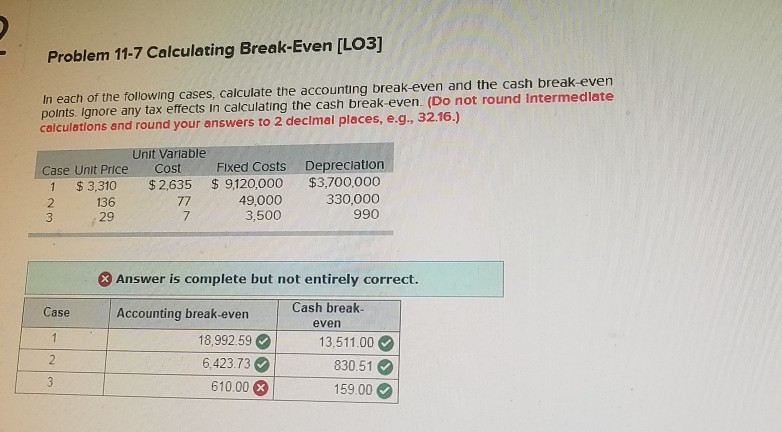

only need the answers where it is wrong! thank you Problem 11-25 Break-Even and Taxes (LO3] Wettway Sailboat Corporation is considering whether to launch its

only need the answers where it is wrong! thank you

Problem 11-25 Break-Even and Taxes (LO3] Wettway Sailboat Corporation is considering whether to launch its new Margo-class sailboat The selling price will be $45,000 per boat. The variable costs will be about half that, or $24,000 per boat, and fixed costs will be $505,000 per year. The total Investment needed to undertake the project is $3,500,000. This amount will be depreciated straight-line to zero over the 6-year life of the equipment. The salvage value is zero, and there are no working capital consequences. Wettway has a required return of 15 percent on new projects. OCF-Tex FC +- Q=- T-TC PU Use the above expression to find the cash, accounting, and financial break-even points for Wettway Sailboat. Assume a tax rate of 25 percent. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Cash break-even Accounting break-even Financial break-even 24.05 X 51.83 73.51 Problem 11-7 Calculating Break-Even [LO3] In each of the following cases, calculate the accounting break-even and the cash break-even points. Ignore any tax effects in calculating the cash break-even. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Unit Variable Case Unit Price Cost 1 $3,310 $ 2,635 136 29 7 Fixed Costs $ 9,120,000 77 Depreciation $3,700,000 330,000 990 3,500 & Answer is complete but not entirely correct. Case Accounting break-even 18,992.59 6,423.73 610.00 & Cash break- even 13,511.00 830.51 159.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started