Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only need to 4. 5. 6. Our code is 813 and Study period is from 2 Jan 2017 to 31 Dec 2017. Thank you. Please

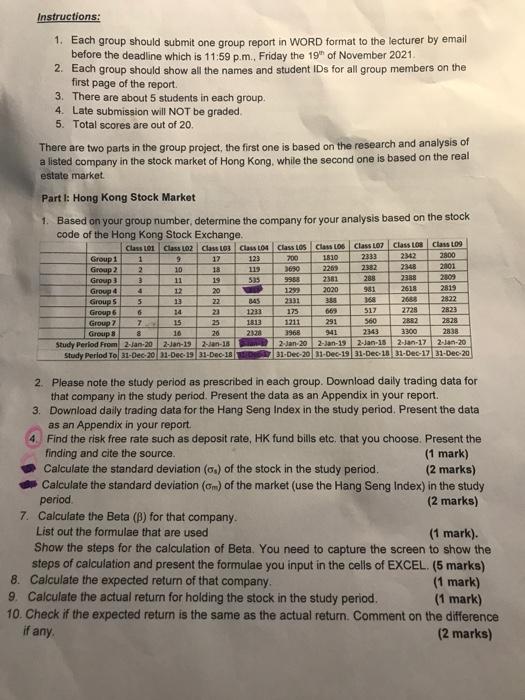

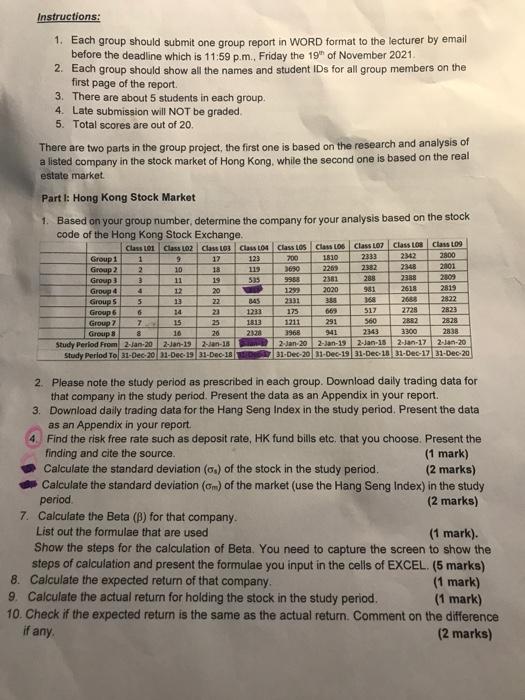

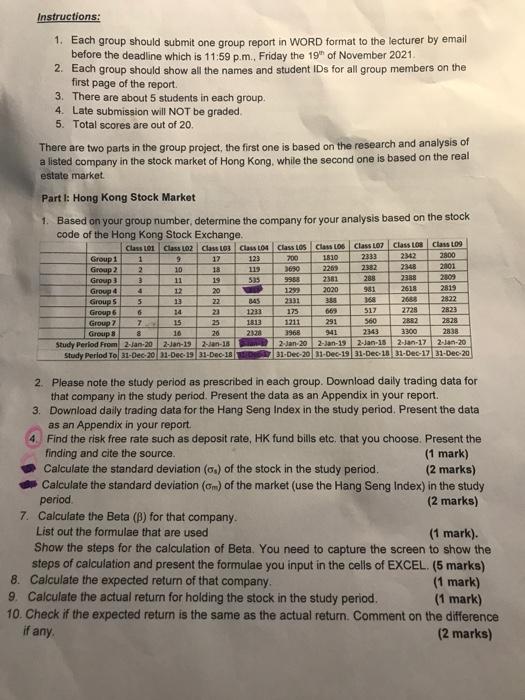

Only need to 4. 5. 6. Our code is 813 and Study period is from 2 Jan 2017 to 31 Dec 2017. Thank you.  Please view the stock market of the Hong Kong Exchange. and search the stock code of the 813to have more information. Thank you. Instructions: 1. Each group should submit one group report in WORD format to the lecturer by email before the deadline which is 11:59 p.m. Friday the 19" of November 2021 2. Each group should show all the names and student IDs for all group members on the first page of the report. 3. There are about 5 students in each group. 4. Late submission will NOT be graded 5. Total scores are out of 20. There are two parts in the group project, the first one is based on the research and analysis of a listed company in the stock market of Hong Kong, while the second one is based on the real estate market Part : Hong Kong Stock Market 1. Based on your group number, determine the company for your analysis based on the stock code of the Hong Kong Stock Exchange. Class 101 Class 02 Claus Log Claus LOL Class Los Class LOS Class 107 Class B Class Log Group 1 1 9 12 123 200 1810 233) 2312 2800 Group 2 2 10 18 119 3690 2269 2382 2340 2001 Group 3 11 19 535 9958 2381 288 2388 2009 Group 4 12 20 1299 2020 981 2618 2319 Group 5 5 13 22 845 2331 338 168 2688 2822 Group 6 6 23 1233 175 669 517 2728 2823 Group 7 15 1813 1211 291 560 2882 2828 Groups 8 10 26 2128 3968 941 2343 3300 2838 Study Perlod From 2-Jan-20 2-Jan-192-Jan-18 2-Jan-202-Jan-19 2-Jan-18 2-Jan-172-Jan-20 Study Perlod To 31-Dec-20 21-Dec-19 31-Dec-18 31-Dec-20 31-Dec-19 31-Dec 18 31-Dec-17 31-Dec-20 2. Please note the study period as prescribed in each group. Download daily trading data for that company in the study period. Present the data as an Appendix in your report. 3. Download daily trading data for the Hang Seng Index in the study period. Present the data as an Appendix in your report. 4. Find the risk free rate such as deposit rate, HK fund bills etc. that you choose. Present the finding and cite the source (1 mark) Calculate the standard deviation (.) of the stock in the study period. (2 marks) Calculate the standard deviation (m) of the market (use the Hang Seng Index) in the study period (2 marks) 7. Calculate the Beta (B) for that company. List out the formulae that are used (1 mark). Show the steps for the calculation of Beta. You need to capture the screen to show the steps of calculation and present the formulae you input in the cells of EXCEL. (5 marks) 8. Calculate the expected return of that company (1 mark) 9. Calculate the actual return for holding the stock in the study period. (1 mark) 10. Check if the expected return is the same as the actual return. Comment on the difference (2 marks) if any Instructions: 1. Each group should submit one group report in WORD format to the lecturer by email before the deadline which is 11:59 p.m. Friday the 19" of November 2021 2. Each group should show all the names and student IDs for all group members on the first page of the report. 3. There are about 5 students in each group. 4. Late submission will NOT be graded 5. Total scores are out of 20. There are two parts in the group project, the first one is based on the research and analysis of a listed company in the stock market of Hong Kong, while the second one is based on the real estate market Part : Hong Kong Stock Market 1. Based on your group number, determine the company for your analysis based on the stock code of the Hong Kong Stock Exchange. Class 101 Class 02 Claus Log Claus LOL Class Los Class LOS Class 107 Class B Class Log Group 1 1 9 12 123 200 1810 233) 2312 2800 Group 2 2 10 18 119 3690 2269 2382 2340 2001 Group 3 11 19 535 9958 2381 288 2388 2009 Group 4 12 20 1299 2020 981 2618 2319 Group 5 5 13 22 845 2331 338 168 2688 2822 Group 6 6 23 1233 175 669 517 2728 2823 Group 7 15 1813 1211 291 560 2882 2828 Groups 8 10 26 2128 3968 941 2343 3300 2838 Study Perlod From 2-Jan-20 2-Jan-192-Jan-18 2-Jan-202-Jan-19 2-Jan-18 2-Jan-172-Jan-20 Study Perlod To 31-Dec-20 21-Dec-19 31-Dec-18 31-Dec-20 31-Dec-19 31-Dec 18 31-Dec-17 31-Dec-20 2. Please note the study period as prescribed in each group. Download daily trading data for that company in the study period. Present the data as an Appendix in your report. 3. Download daily trading data for the Hang Seng Index in the study period. Present the data as an Appendix in your report. 4. Find the risk free rate such as deposit rate, HK fund bills etc. that you choose. Present the finding and cite the source (1 mark) Calculate the standard deviation (.) of the stock in the study period. (2 marks) Calculate the standard deviation (m) of the market (use the Hang Seng Index) in the study period (2 marks) 7. Calculate the Beta (B) for that company. List out the formulae that are used (1 mark). Show the steps for the calculation of Beta. You need to capture the screen to show the steps of calculation and present the formulae you input in the cells of EXCEL. (5 marks) 8. Calculate the expected return of that company (1 mark) 9. Calculate the actual return for holding the stock in the study period. (1 mark) 10. Check if the expected return is the same as the actual return. Comment on the difference (2 marks) if any

Please view the stock market of the Hong Kong Exchange. and search the stock code of the 813to have more information. Thank you. Instructions: 1. Each group should submit one group report in WORD format to the lecturer by email before the deadline which is 11:59 p.m. Friday the 19" of November 2021 2. Each group should show all the names and student IDs for all group members on the first page of the report. 3. There are about 5 students in each group. 4. Late submission will NOT be graded 5. Total scores are out of 20. There are two parts in the group project, the first one is based on the research and analysis of a listed company in the stock market of Hong Kong, while the second one is based on the real estate market Part : Hong Kong Stock Market 1. Based on your group number, determine the company for your analysis based on the stock code of the Hong Kong Stock Exchange. Class 101 Class 02 Claus Log Claus LOL Class Los Class LOS Class 107 Class B Class Log Group 1 1 9 12 123 200 1810 233) 2312 2800 Group 2 2 10 18 119 3690 2269 2382 2340 2001 Group 3 11 19 535 9958 2381 288 2388 2009 Group 4 12 20 1299 2020 981 2618 2319 Group 5 5 13 22 845 2331 338 168 2688 2822 Group 6 6 23 1233 175 669 517 2728 2823 Group 7 15 1813 1211 291 560 2882 2828 Groups 8 10 26 2128 3968 941 2343 3300 2838 Study Perlod From 2-Jan-20 2-Jan-192-Jan-18 2-Jan-202-Jan-19 2-Jan-18 2-Jan-172-Jan-20 Study Perlod To 31-Dec-20 21-Dec-19 31-Dec-18 31-Dec-20 31-Dec-19 31-Dec 18 31-Dec-17 31-Dec-20 2. Please note the study period as prescribed in each group. Download daily trading data for that company in the study period. Present the data as an Appendix in your report. 3. Download daily trading data for the Hang Seng Index in the study period. Present the data as an Appendix in your report. 4. Find the risk free rate such as deposit rate, HK fund bills etc. that you choose. Present the finding and cite the source (1 mark) Calculate the standard deviation (.) of the stock in the study period. (2 marks) Calculate the standard deviation (m) of the market (use the Hang Seng Index) in the study period (2 marks) 7. Calculate the Beta (B) for that company. List out the formulae that are used (1 mark). Show the steps for the calculation of Beta. You need to capture the screen to show the steps of calculation and present the formulae you input in the cells of EXCEL. (5 marks) 8. Calculate the expected return of that company (1 mark) 9. Calculate the actual return for holding the stock in the study period. (1 mark) 10. Check if the expected return is the same as the actual return. Comment on the difference (2 marks) if any Instructions: 1. Each group should submit one group report in WORD format to the lecturer by email before the deadline which is 11:59 p.m. Friday the 19" of November 2021 2. Each group should show all the names and student IDs for all group members on the first page of the report. 3. There are about 5 students in each group. 4. Late submission will NOT be graded 5. Total scores are out of 20. There are two parts in the group project, the first one is based on the research and analysis of a listed company in the stock market of Hong Kong, while the second one is based on the real estate market Part : Hong Kong Stock Market 1. Based on your group number, determine the company for your analysis based on the stock code of the Hong Kong Stock Exchange. Class 101 Class 02 Claus Log Claus LOL Class Los Class LOS Class 107 Class B Class Log Group 1 1 9 12 123 200 1810 233) 2312 2800 Group 2 2 10 18 119 3690 2269 2382 2340 2001 Group 3 11 19 535 9958 2381 288 2388 2009 Group 4 12 20 1299 2020 981 2618 2319 Group 5 5 13 22 845 2331 338 168 2688 2822 Group 6 6 23 1233 175 669 517 2728 2823 Group 7 15 1813 1211 291 560 2882 2828 Groups 8 10 26 2128 3968 941 2343 3300 2838 Study Perlod From 2-Jan-20 2-Jan-192-Jan-18 2-Jan-202-Jan-19 2-Jan-18 2-Jan-172-Jan-20 Study Perlod To 31-Dec-20 21-Dec-19 31-Dec-18 31-Dec-20 31-Dec-19 31-Dec 18 31-Dec-17 31-Dec-20 2. Please note the study period as prescribed in each group. Download daily trading data for that company in the study period. Present the data as an Appendix in your report. 3. Download daily trading data for the Hang Seng Index in the study period. Present the data as an Appendix in your report. 4. Find the risk free rate such as deposit rate, HK fund bills etc. that you choose. Present the finding and cite the source (1 mark) Calculate the standard deviation (.) of the stock in the study period. (2 marks) Calculate the standard deviation (m) of the market (use the Hang Seng Index) in the study period (2 marks) 7. Calculate the Beta (B) for that company. List out the formulae that are used (1 mark). Show the steps for the calculation of Beta. You need to capture the screen to show the steps of calculation and present the formulae you input in the cells of EXCEL. (5 marks) 8. Calculate the expected return of that company (1 mark) 9. Calculate the actual return for holding the stock in the study period. (1 mark) 10. Check if the expected return is the same as the actual return. Comment on the difference (2 marks) if any

Only need to 4. 5. 6. Our code is 813 and Study period is from 2 Jan 2017 to 31 Dec 2017. Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started