Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only parts 3/4 Intro Taquito is a U.S. fast food chain which imports supplies from Mexico. The company will need 1,000,000 Mexican pesos (MXN) in

Only parts 3/4

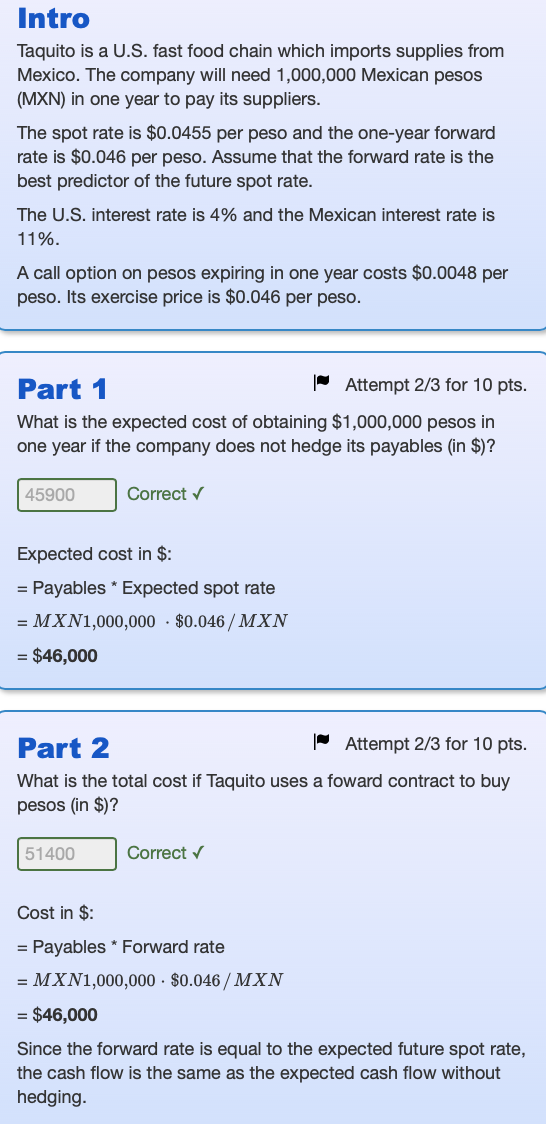

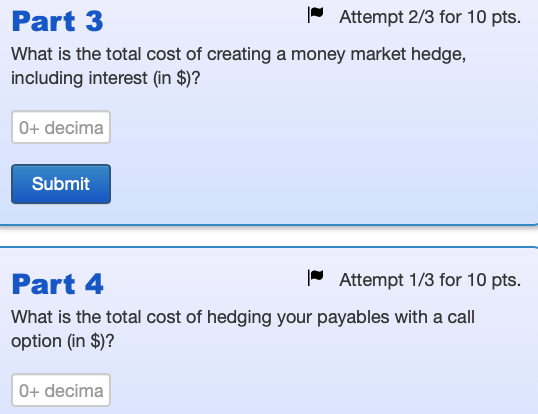

Intro Taquito is a U.S. fast food chain which imports supplies from Mexico. The company will need 1,000,000 Mexican pesos (MXN) in one year to pay its suppliers. The spot rate is $0.0455 per peso and the one-year forward rate is $0.046 per peso. Assume that the forward rate is the best predictor of the future spot rate. The U.S. interest rate is 4% and the Mexican interest rate is 11%. A call option on pesos expiring in one year costs $0.0048 per peso. Its exercise price is $0.046 per peso. Part 1 "Attempt 2/3 for 10 pts. What is the expected cost of obtaining $1,000,000 pesos in one year if the company does not hedge its payables (in $)? 45900 Correct Expected cost in $: = Payables * Expected spot rate = MXN1,000,000 - $0.046/MXN = $46,000 Part 2 Attempt 2/3 for 10 pts. What is the total cost if Taquito uses a foward contract to buy pesos (in $)? 51400 Correct Cost in $: = Payables * Forward rate = MXN1,000,000 - $0.046 / MXN = $46,000 Since the forward rate is equal to the expected future spot rate, the cash flow is the same as the expected cash flow without hedging. Part 3 Attempt 2/3 for 10 pts. What is the total cost of creating a money market hedge, including interest (in $)? 0+ decima Submit Part 4 Attempt 1/3 for 10 pts. What is the total cost of hedging your payables with a call option (in $)? 0+ decimaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started