Answered step by step

Verified Expert Solution

Question

1 Approved Answer

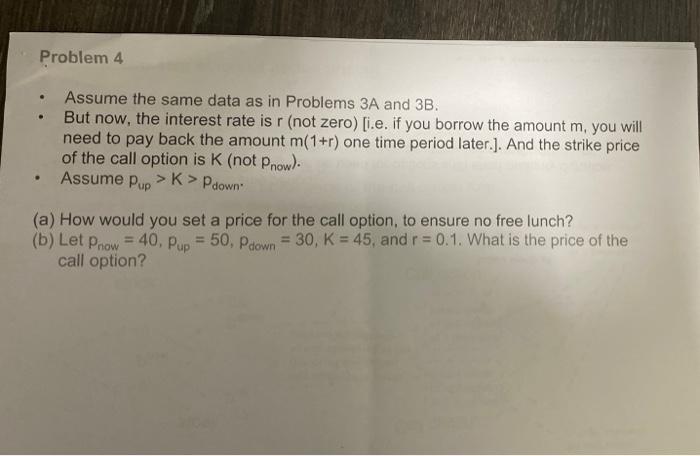

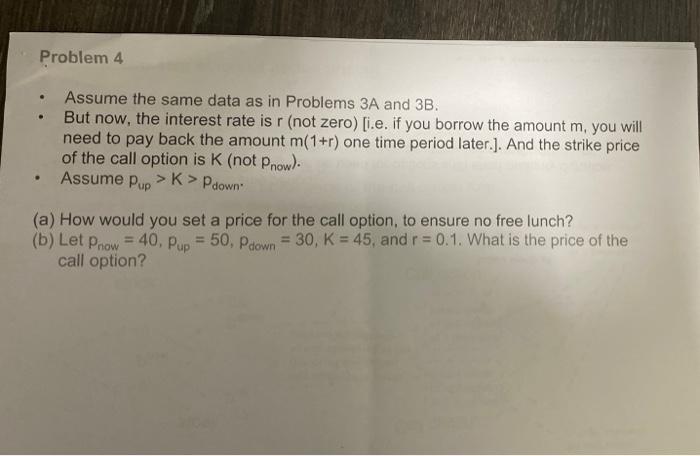

only problem 4 Problem 4 Assume the same data as in Problems 3A and 3B. But now, the interest rate is r (not zero) [i.e.

only problem 4

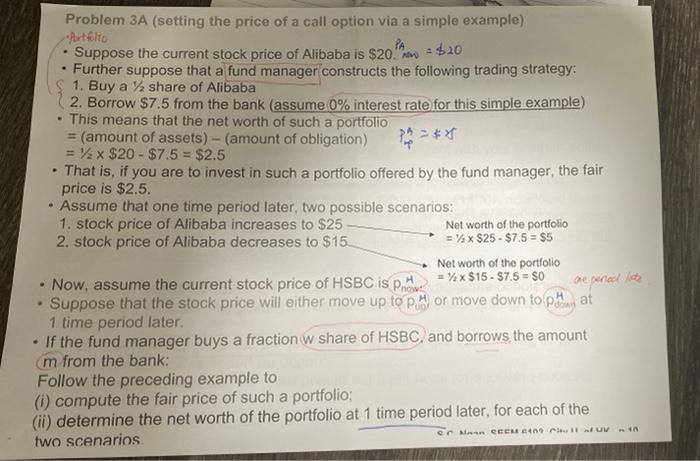

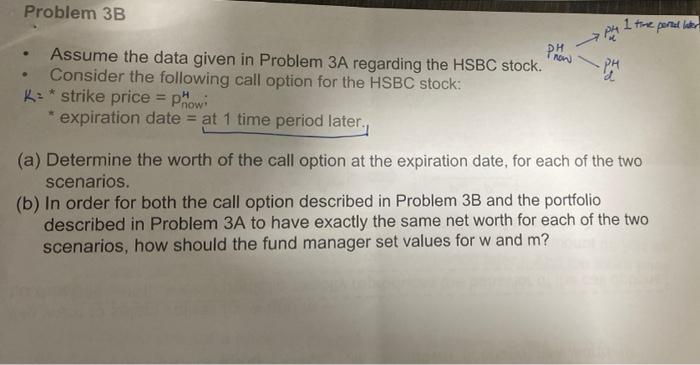

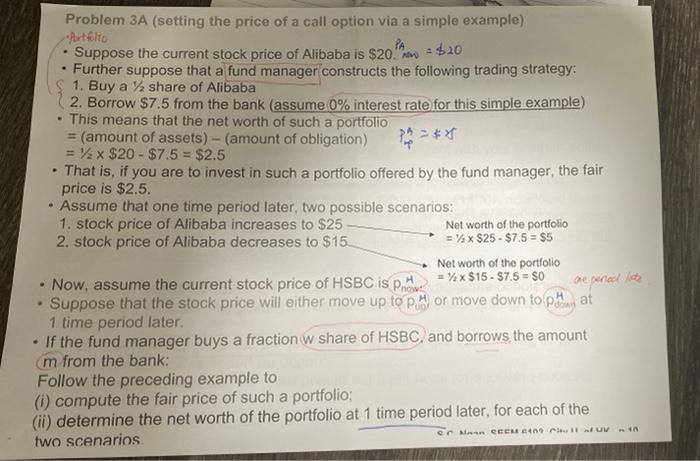

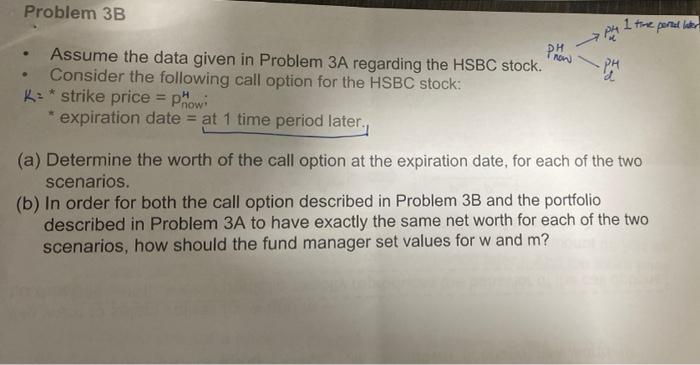

Problem 4 Assume the same data as in Problems 3A and 3B. But now, the interest rate is r (not zero) [i.e. if you borrow the amount m, you will need to pay back the amount m(1+r) one time period later.]. And the strike price of the call option is K (not Pnow). Assume >K> . Pup Pdown (a) How would you set a price for the call option to ensure no free lunch? (b) Let Prow = 40, Pup = 50, Pdown = 30, K = 45, and r = 0.1. What is the price of the call option? 3 . Problem 3A (setting the price of a call option via a simple example) Art folto Suppose the current stock price of Alibaba is $20 A $20 PA Further suppose that a fund manager constructs the following trading strategy: 1. Buy a Va share of Alibaba 2. Borrow $7.5 from the bank (assume 0% interest rate for this simple example) This means that the net worth of such a portfolio = (amount of assets) - (amount of obligation) p2 = x = 2 x $20-$7.5 = $2.5 That is, if you are to invest in such a portfolio offered by the fund manager, the fair price is $2.5. Assume that one time period later, two possible scenarios: 1. stock price of Alibaba increases to $25 Net worth of the portfolio 2. stock price of Alibaba decreases to $15 = 7x $25 - $7.5 = $5 Net worth of the portfolio Now, assume the current stock price of HSBC is po = %* $15 - $7.5 = $0 ae pened lote Suppose that the stock price will either move up to pH or move down to pay at 1 time period later. If the fund manager buys a fraction w share of HSBC, and borrows the amount m from the bank: Follow the preceding example to (i) compute the fair price of such a portfolio: (ii) determine the net worth of the portfolio at 1 time period later, for each of the two scenarios H . CM CCC Unitatu Problem 3B per i tre portal later PH . Tron PH Assume the data given in Problem 3A regarding the HSBC stock. Consider the following call option for the HSBC stock: KE* strike price = powi expiration date = at 1 time period later. (a) Determine the worth of the call option at the expiration date, for each of the two scenarios. (b) In order for both the call option described in Problem 3B and the portfolio described in Problem 3A to have exactly the same net worth for each of the two scenarios, how should the fund manager set values for w and m

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started