Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only Provide solution to the question attached above as fast as possible within 15 to 20 mins. Thanks You The Watts Company has just recently

Only Provide solution to the question attached above as fast as possible within 15 to 20 mins. Thanks You

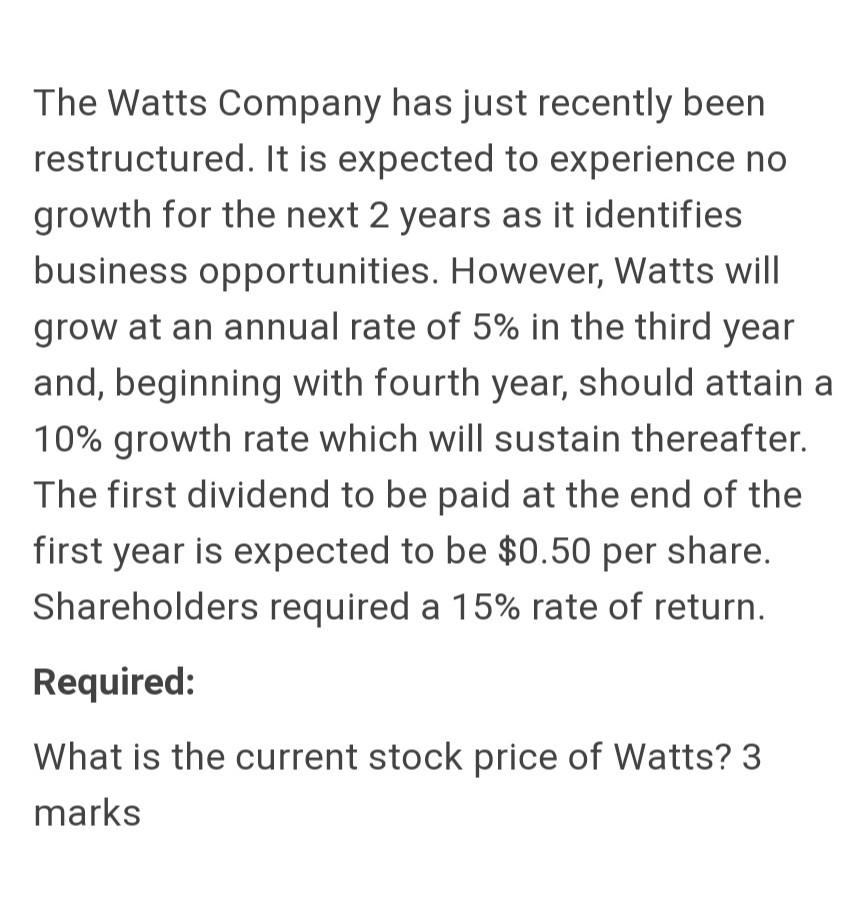

The Watts Company has just recently been restructured. It is expected to experience no growth for the next 2 years as it identifies business opportunities. However, Watts will grow at an annual rate of 5% in the third year and, beginning with fourth year, should attain a 10% growth rate which will sustain thereafter. The first dividend to be paid at the end of the first year is expected to be $0.50 per share. Shareholders required a 15% rate of return. Required: What is the current stock price of Watts? 3 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started