Answered step by step

Verified Expert Solution

Question

1 Approved Answer

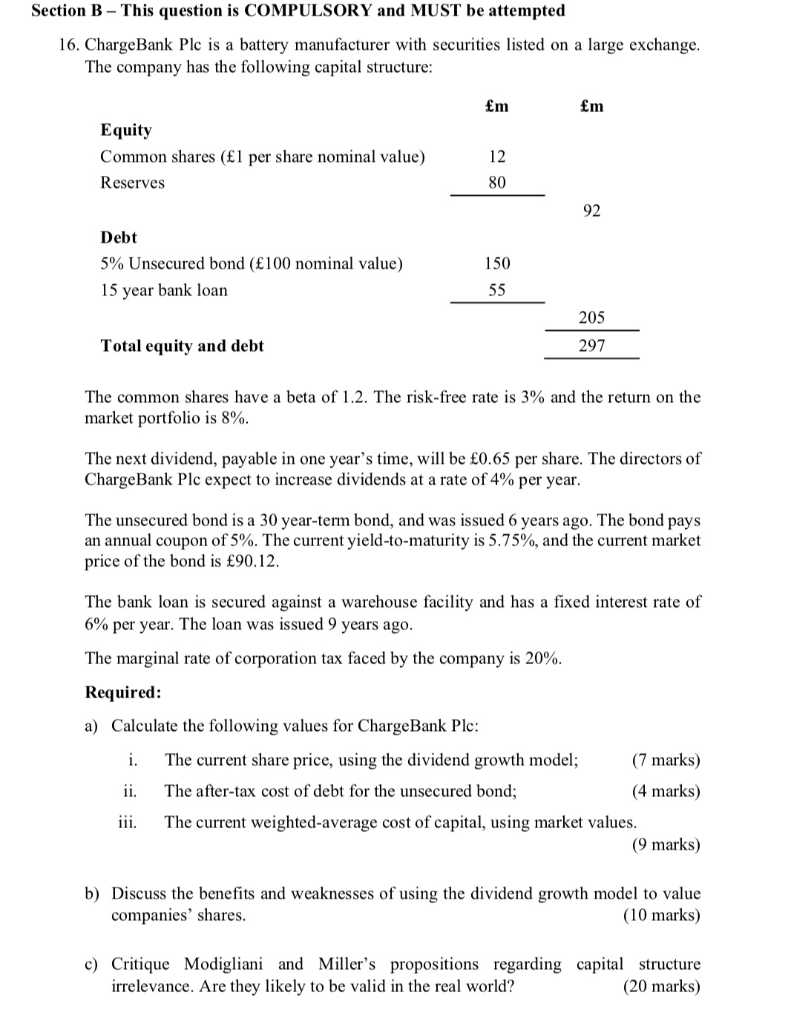

only question b and c Section B - This question is COMPULSORY and MUST be attempted 16. ChargeBank Plc is a battery manufacturer with securities

only question b and c

Section B - This question is COMPULSORY and MUST be attempted 16. ChargeBank Plc is a battery manufacturer with securities listed on a large exchange. The company has the following capital structure: mm Em Equity Common shares (1 per share nominal value) Reserves Debt 5% Unsecured bond (100 nominal value) 15 year bank loan 150 55 205 297 Total equity and debt The common shares have a beta of 1.2. The risk-free rate is 3% and the return on the market portfolio is 8%. The next dividend, payable in one year's time, will be 0.65 per share. The directors of ChargeBank Plc expect to increase dividends at a rate of 4% per year. The unsecured bond is a 30 year-term bond, and was issued 6 years ago. The bond pays an annual coupon of 5%. The current yield-to-maturity is 5.75%, and the current market price of the bond is 90.12. The bank loan is secured against a warehouse facility and has a fixed interest rate of 6% per year. The loan was issued 9 years ago. The marginal rate of corporation tax faced by the company is 20%. Required: a) Calculate the following values for ChargeBank Plc: i. The current share price, using the dividend growth model; (7 marks) ii. The after-tax cost of debt for the unsecured bond; (4 marks) iii. The current weighted average cost of capital, using market values. (9 marks) b) Discuss the benefits and weaknesses of using the dividend growth model to value companies' shares. (10 marks) c) Critique Modigliani and Miller's propositions regarding capital structure irrelevance. Are they likely to be valid in the real world? (20 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started