Answered step by step

Verified Expert Solution

Question

1 Approved Answer

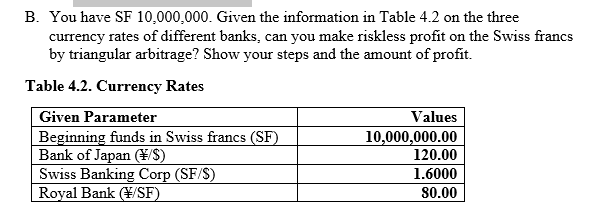

Only really need someone to tell me how the cross-rate is calculated here, as there is another example already completed. B. You have SF 10,000,000.

Only really need someone to tell me how the cross-rate is calculated here, as there is another example already completed.

B. You have SF 10,000,000. Given the information in Table 4.2 on the three currency rates of different banks, can you make riskless profit on the Swiss francs by triangular arbitrage? Show your steps and the amount of profit. Table 4.2. Currency Rates Given Parameter Values Beginning funds in Swiss francs (SF) 10,000,000.00 Bank of Japan /$) 120.00 Swiss Banking Corp (SF/S) 1.6000 Royal Bank (ASF) 80.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started