only refer to last 4 clear pictures.

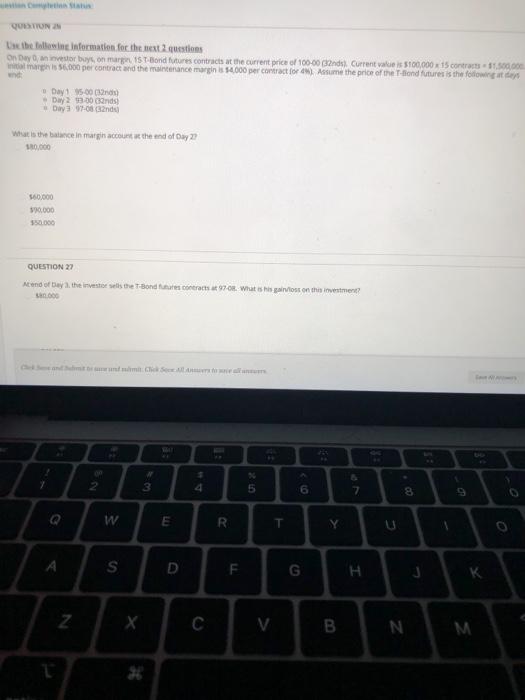

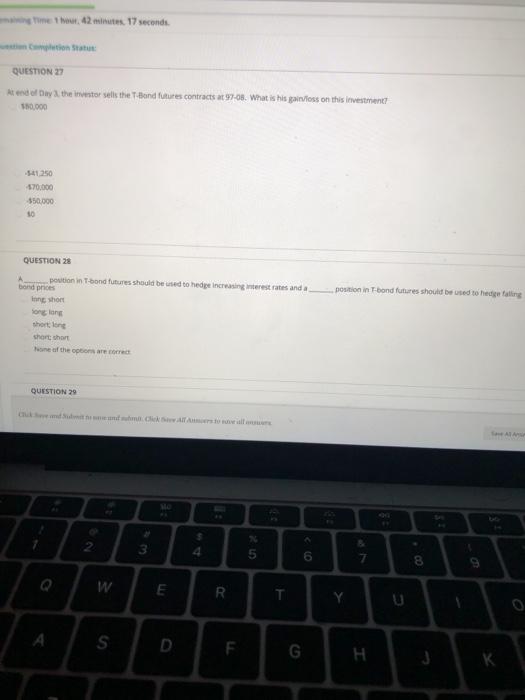

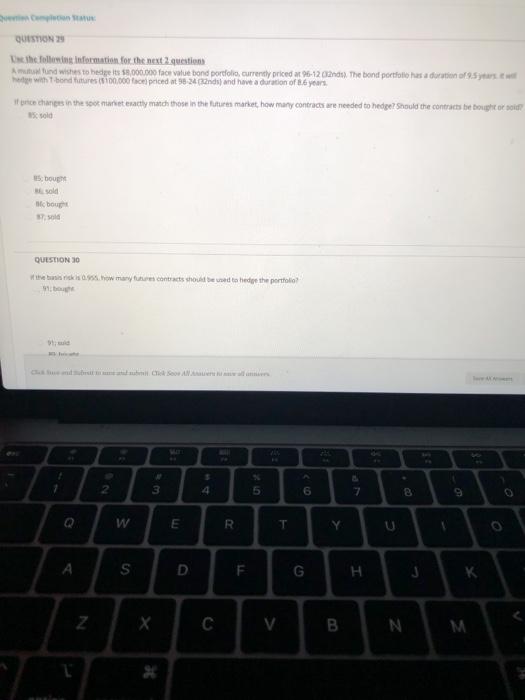

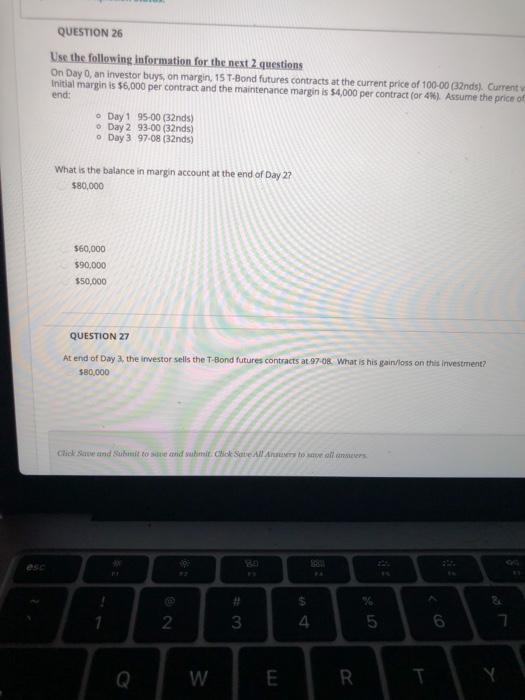

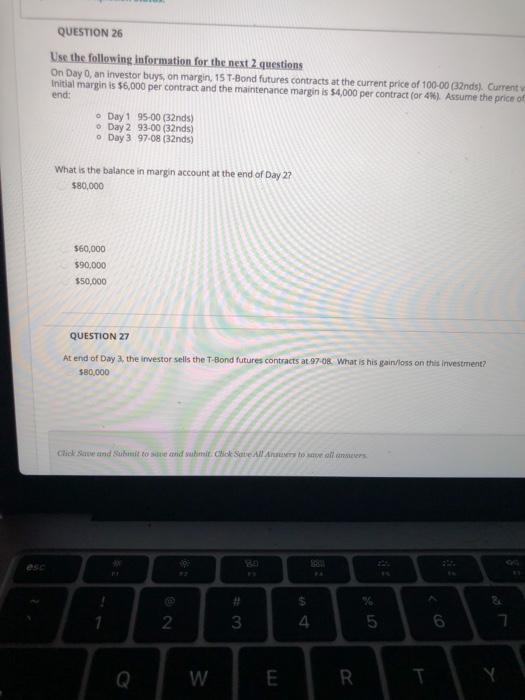

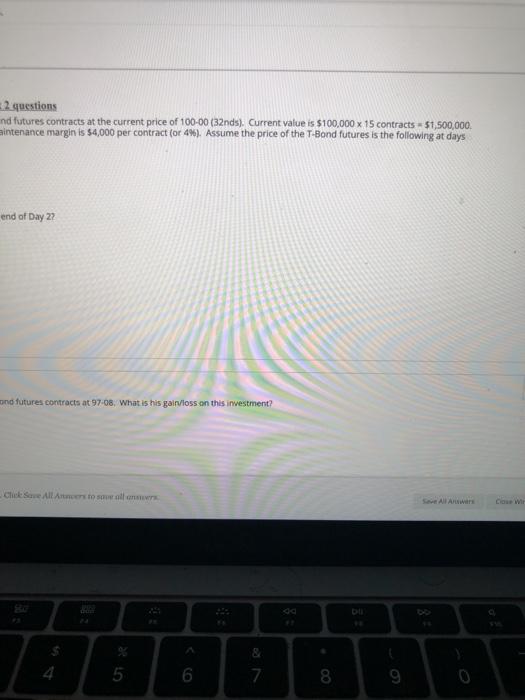

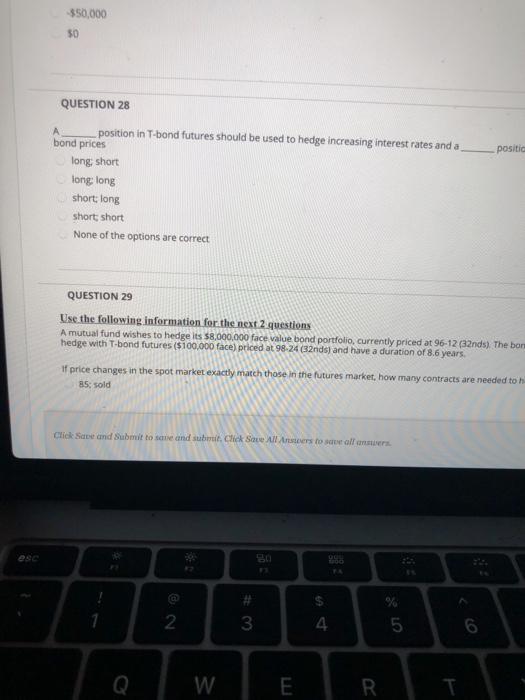

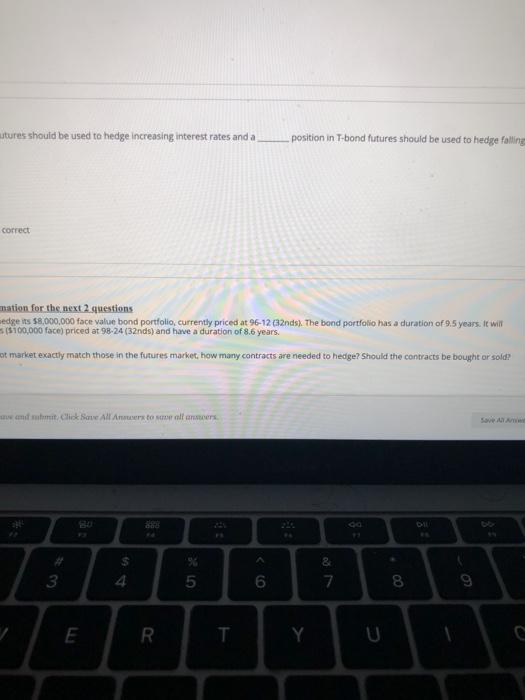

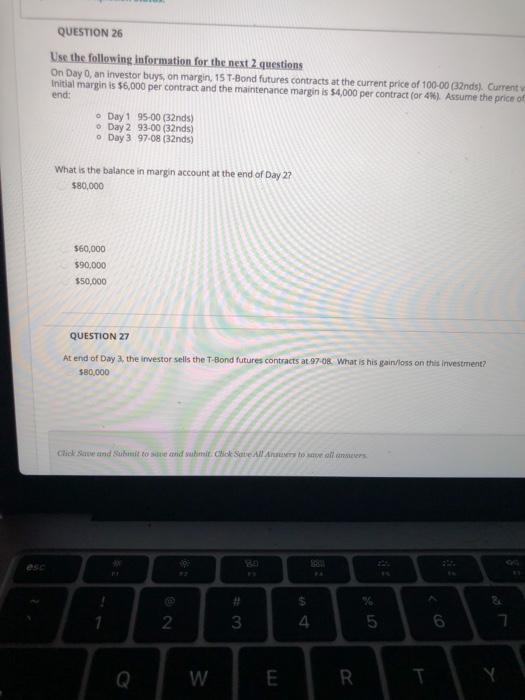

QOTION Lathe information for the next questions on Day investor buys on marge 15 T-Bond futures contracts at the current price of 100.00 2nd Current value is $100.000 x 15 contra 1.500.000 margs 56,000 per contract and the maintenance margins 54.000 per contract for Assume the price of the T-Bond futures is the following and Day 1 500 (32) Day2 23:00 Gands Day 17-08 2nd What is the balance in margin account the end of Day 2 10.000 550.000 90.000 QUESTION 27 Nend of Bayathe is the Bondare contrats 97-0. Wat is his lost on this investment? w 3 5 6 7 8 W E R T 0 S D F . Z V B N met hour 42 mit 17 seconds QUESTION 27 At end of Day the investor sells the Band future contracts at 97-08. What is his gaiss on this investment 190.000 -541250 570.000 350.000 10 QUESTION 28 position in Tbond futures should be used to dealing A position in T-bond futures should be used to hedge increasing terest rates and a bond proces in short son los short long short short an of the options are QUESTION 29 3 4 6 W E R T Y S F. G H QUESTION 29 the following information for the next questions Attund wishes to hedge is 58.000.000 face value bond portfolio, currently priced at 6-12 ans. The band portfolios adoration of a wishondres (100.000 price 24 ans and have a duration of 16 years trice changes in the sook market aty match those in the future market how many contracts are needed to hedge? Should the contracts be bought or sold bot sold co QUESTION 30 the basis how many contracts should be used to hedge the portfolio 5 4 2 3 6 7 B 0 W E R T Y u . S D F G H K Z C V B N QUESTION 26 Use the following information for the next 2 questions On Day 0, an investor buys on margin, 15 T-Bond futures contracts at the current price of 100-00 (32nds). Current Initial margin is $6,000 per contract and the maintenance margin is $4,000 per contract (or 4). Assume the price of end: Day 1 95-00 (32nds) Day 2 93-00 (32nds) o Day 3 97.08 (32nds) What is the balance in margin account at the end of Day 2? $80,000 $60,000 590,000 $50,000 QUESTION 27 At end of Day 3, the investor sells the T-Bond futures contracts at 97-08. What is his gair loss on this investment? $80,000 Click and Suits and submit Chick Save All Aromers # 2 3 4 5 6 Q W R 2 questions ind futures contracts at the current price of 100-00 (32nds). Current value is $100,000 x 15 contracts $1,500,000 intenance margin is $4,000 per contract for 4%). Assume the price of the T-Bond futures is the following at days end of Day 22 and futures contracts at 97-08. What is his gain/loss on this investment? Click Save All Arnetowell & 5 6 7 8 9 350,000 50 positi QUESTION 28 position in T-bond futures should be used to hedge increasing interest rates and a bond prices long short long: long short long shorts short None of the options are correct QUESTION 29 Use the following information for the next 2.questions A mutual fund wishes to hedge its $8,000,000 face value bond portfolio, currently priced at 96-12 (32nds) The bom hedge with T-bond futures ($100.000 face) priced at 98-24 (32nds and have a duration of 8.6 years If price changes in the spot market exactly match those in the futures market, how many contracts are needed to h 85: sold Click Save and Submit to save and submit Click Save All Antall ese 50 TA 3 $ 4 2 5 6 W E R utures should be used to hedge increasing interest rates and a position in T-bond futures should be used to hedge falling correct mation for the next 2 questions edge its $8,000,000 face value bond portfolio, currently priced at 96-12 (32nds). The bond portfolio has a duration of 9.5 years. It will 15100,000 face) priced at 98-24 (32nds) and have a duration of 8.6 years. mot market exactly match those in the futures market, how many contracts are needed to hedge? Should the contracts be bought or sold? www ammit. Click Save All Amers to see all ansers Save A 83 DO 8 3 5 6 7 8 9 E R . Y