only required B please.

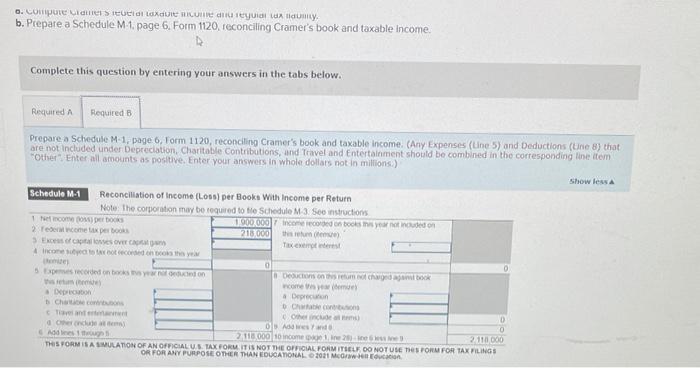

Cramer Corporation, a calendar year, accrual basis corporation, reported $1.90 million of net income after tax on its financial statements prepared in accordance with GAAP The corporation's books and records reveal the following Information Cramer's federal income tax expense per books was $218,000. Cramer's book income included $28,000 of dividends received from a domestic corporation in which Cramer owns a 25 percent stock interest, and $13,000 of dividends from a domestic corporation in which Cramer owns a 5 percent stock interest Cramer recognized $28,000 of capital losses this year and no capital gains Cromer recorded $17000 of book expense for meals not provided by a restaurant and $19.000 of book expense for entertainment Cromer's depreciation expense for book purposes totaled $418,000. MACRS depreciation was $475,000 . costs Required: o. Compute Cramer's federal taxable income and regular tax liability b. Prepare a Schedule M1, page 6, Form 1120. reconciling Cramer's book and taxable income O. cope > CXUIE Uyid Aldum, b. Prepare a Schedule M1. page 6. Form 1120, reconciling Cramer's book and taxable income. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a Schedule M-1, page 6, Form 1120, reconciling Cramer's book and taxable income. (Any Expenses (line 5) and Deductions (tine 8) that are not included under Depreciation Charitable Contributions, and Travel and Entertainment should be combined in the corresponding tone tem "other" Enter all amounts as positive. Enter your answers in whole dollars not in milions.) Show less Schedule M-1 Reconciliation of Income (1.055) per Books With Income per Return Note: The corporation may be required to tle Schedule Ma. See instructions 1 he comes 1900.0097 Income on books arded on 2 recome per 218.000 this Excess of capitales o Taxexes Income to conto the year 0 perecorded onbon Donged this come me De # Depreca Chorus Chat Othetic One And Addres 2.000 10 income 2011 000 THIS FORM SA ULATION OF AN OFFICIALUS TAX FOR IT IS NOT THE OFFICIAL FORMITELE DO NOT USE THE FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2021 Merwe 0