Only Requirement 1 & 2.

Only Requirement 1 & 2.

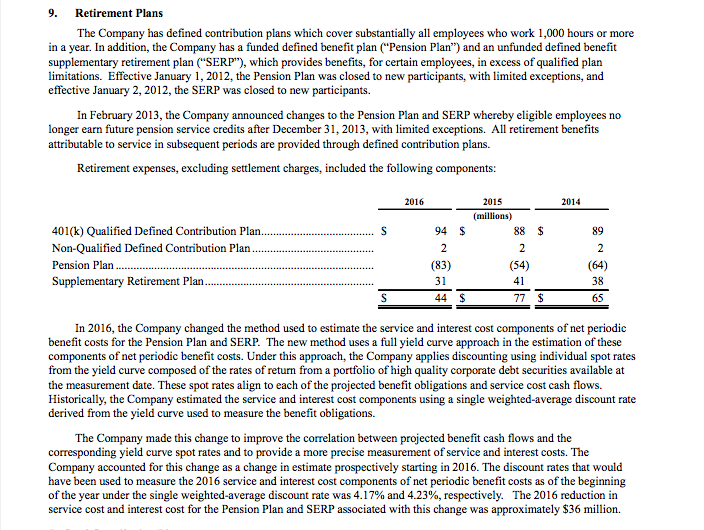

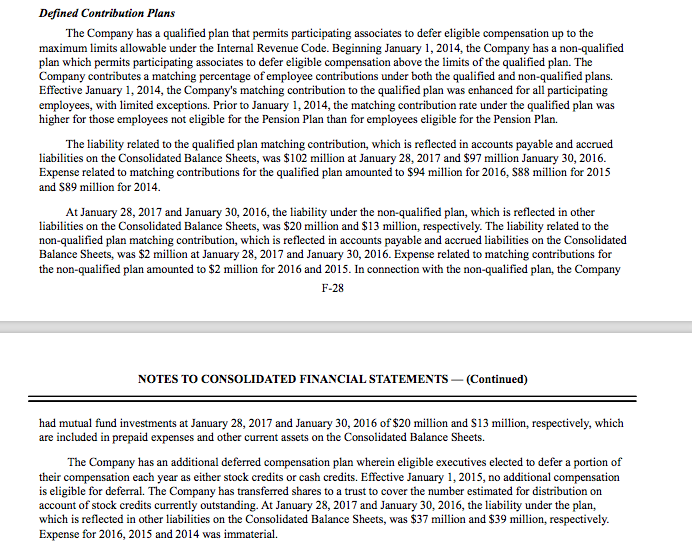

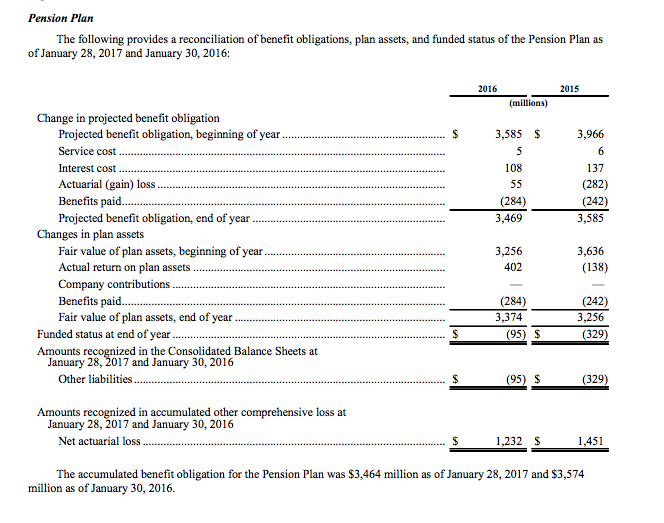

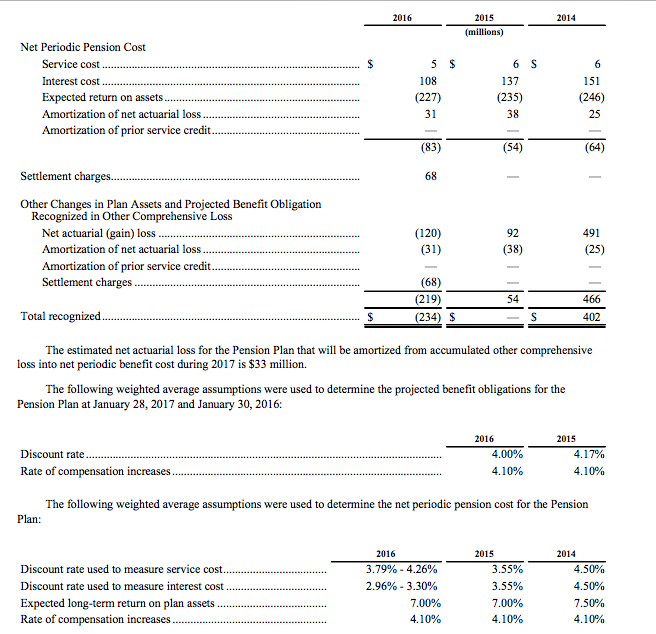

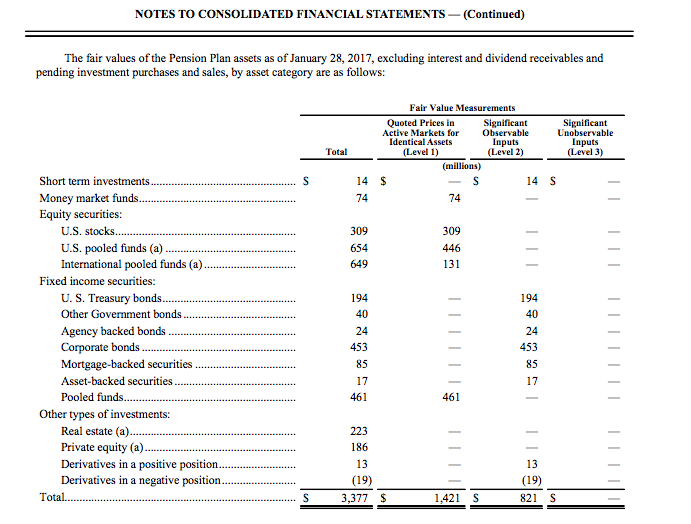

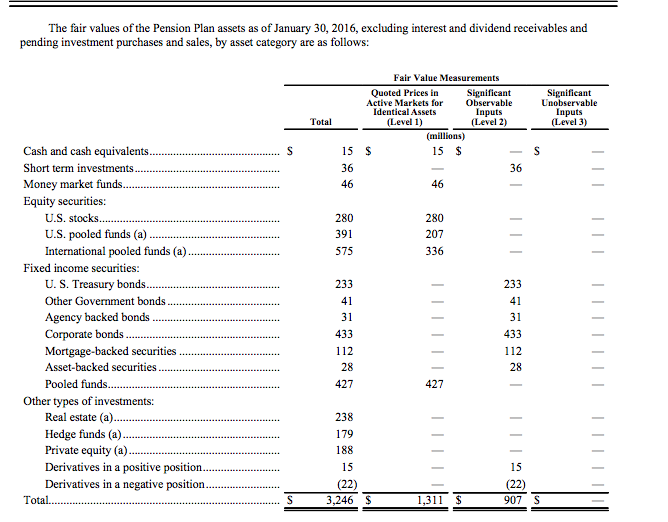

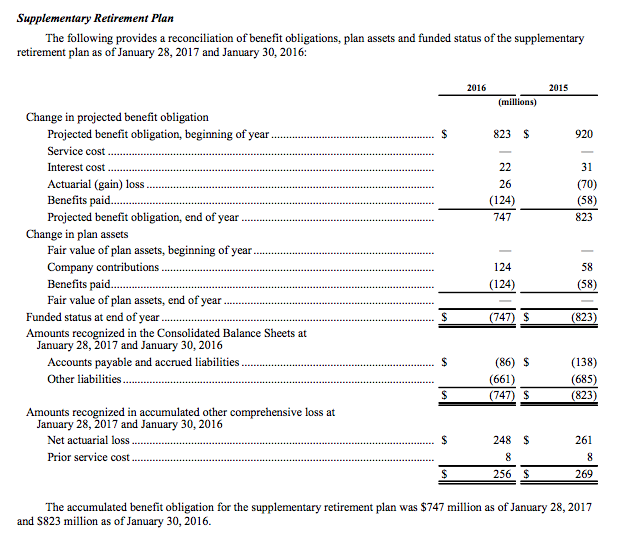

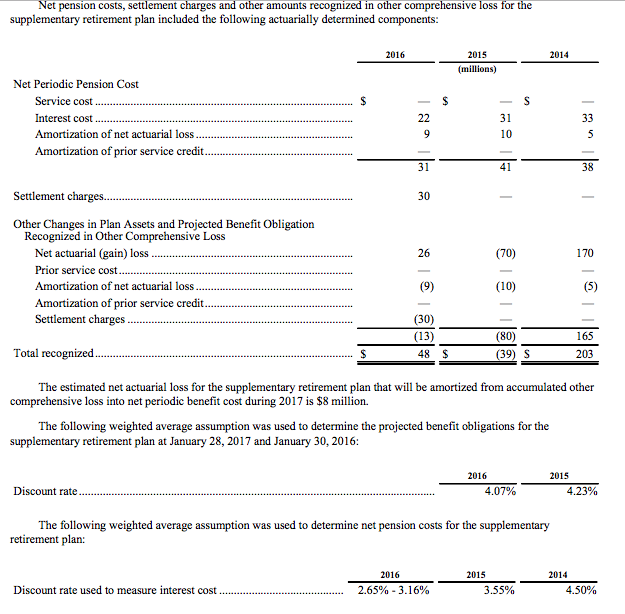

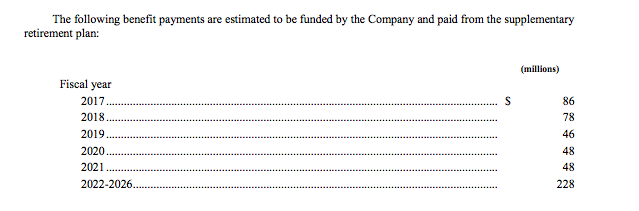

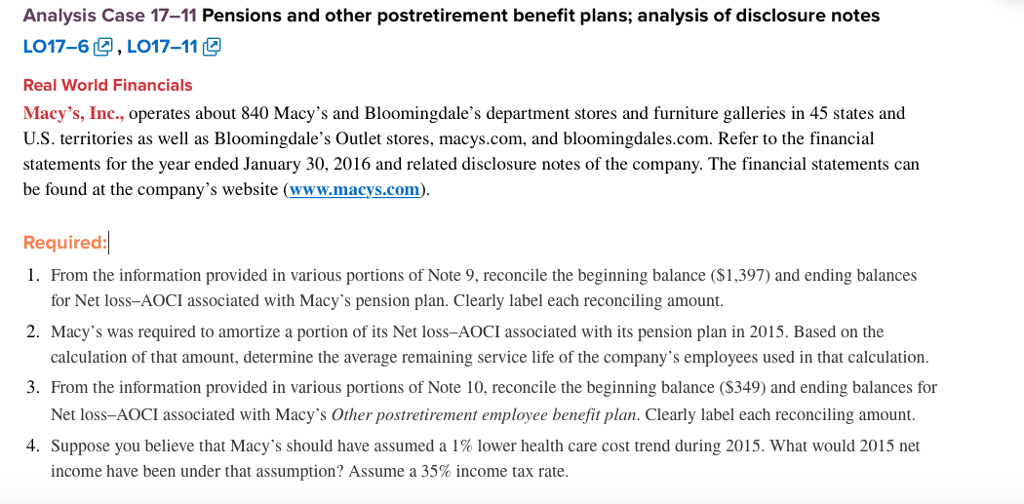

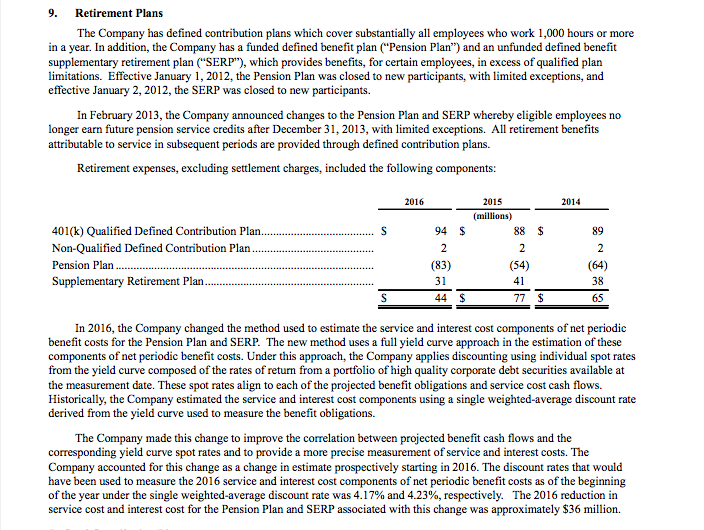

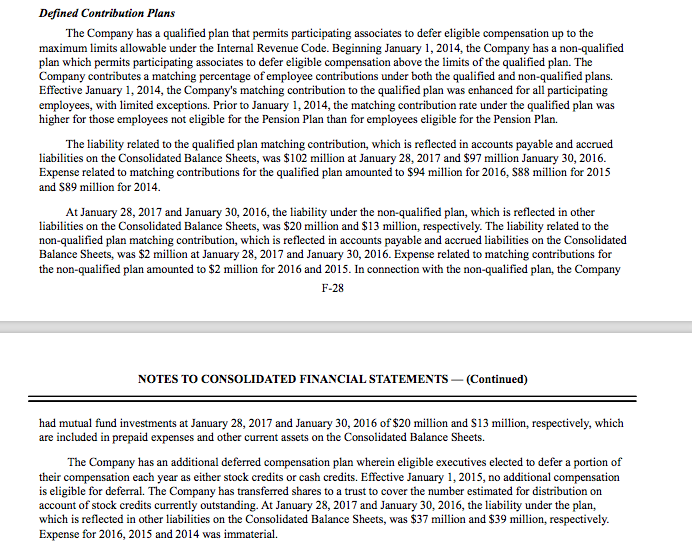

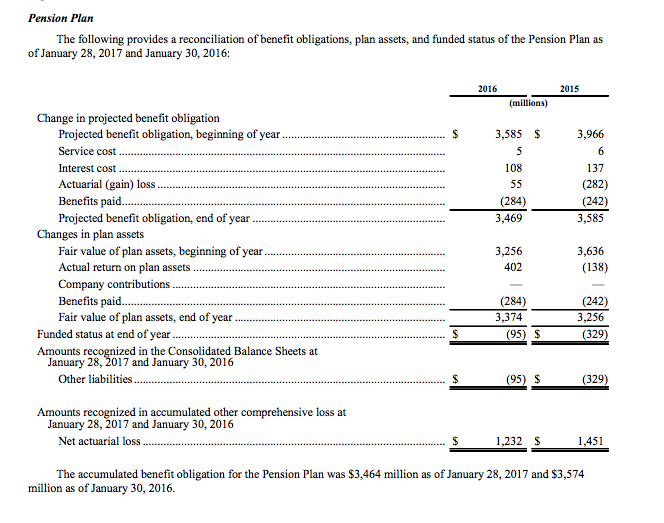

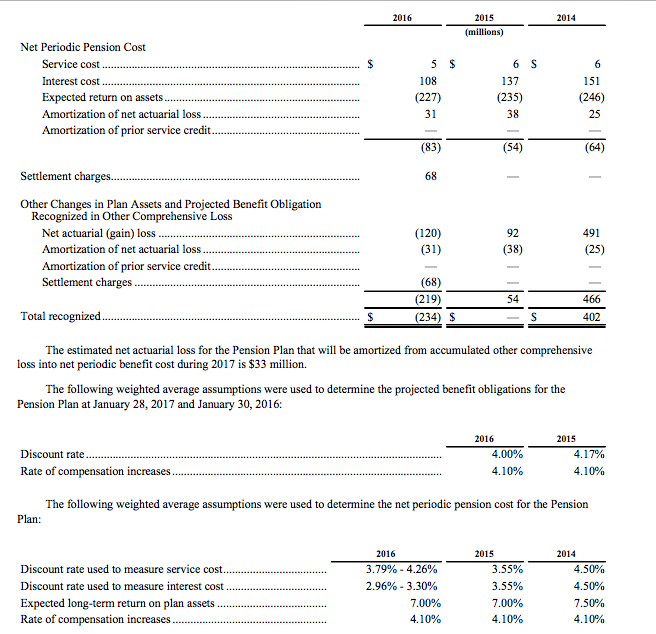

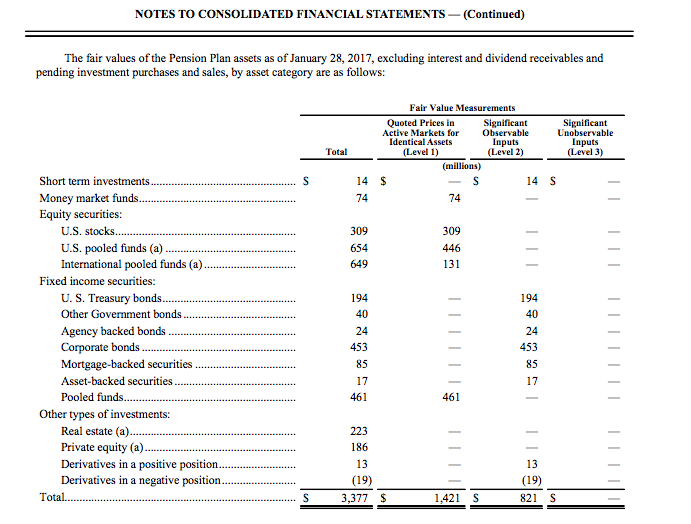

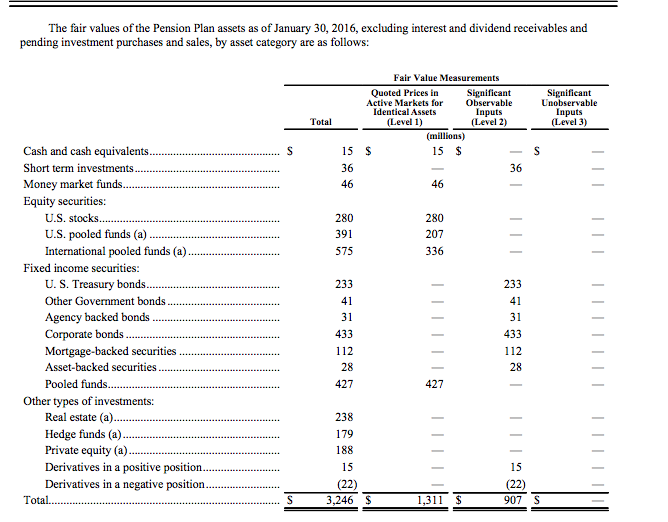

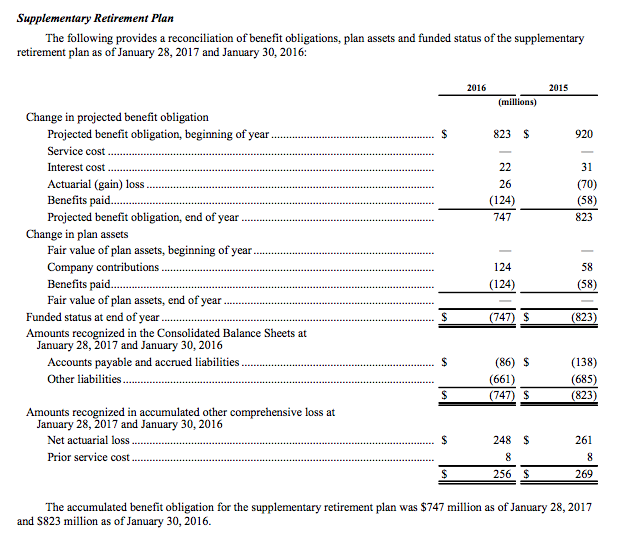

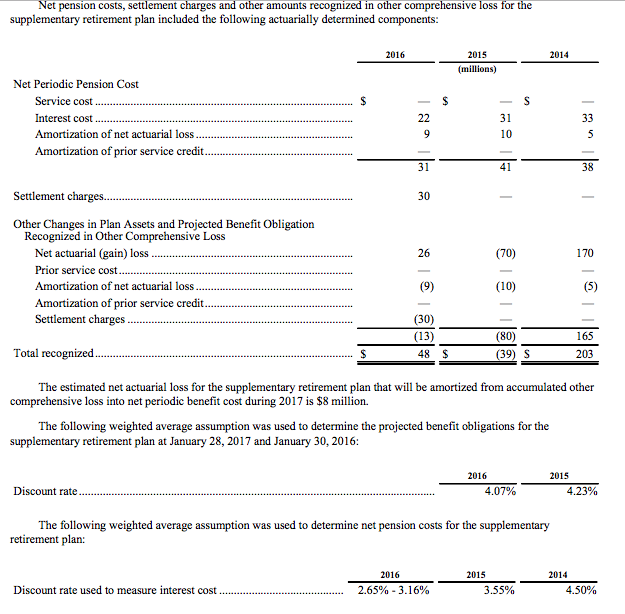

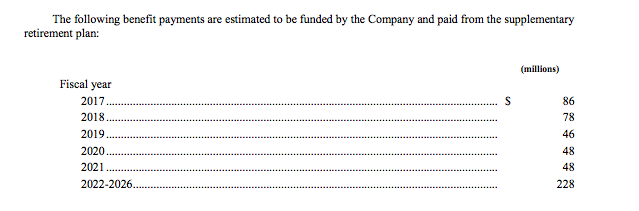

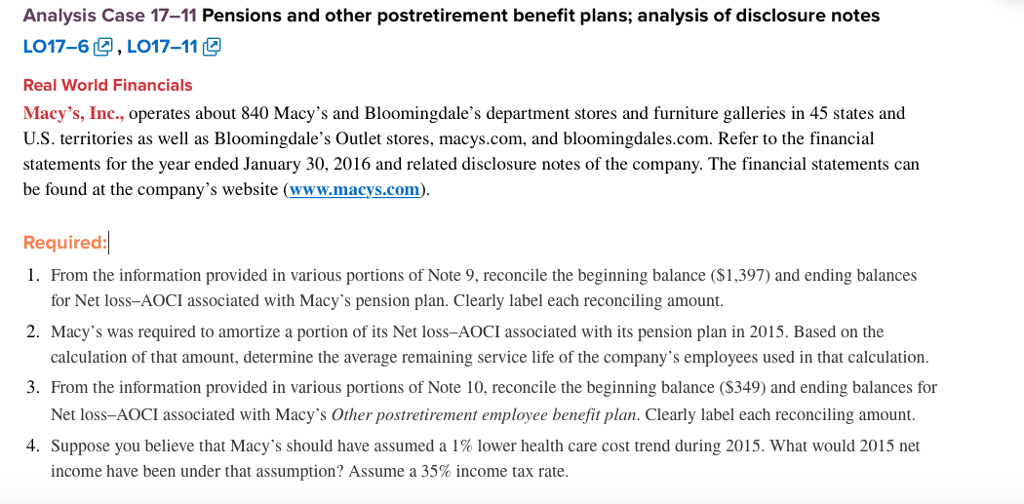

Analysis Case 17-11 Pensions and other postretirement benefit plans; analysis of disclosure notes 017-6 @ , LOI7-11 @ Real World Financials Macy's, Inc., operates about 840 Macy's and Bloomingdale's department stores and furniture galleries in 45 states and U.S. territories as well as Bloomingdale's Outlet stores, macys.com, and bloomingdales.com. Refer to the financial statements for the year ended January 30, 2016 and related disclosure notes of the company. The financial statements can be found at the company's website (www.macys.com). Required 1 I. From the information provided in various portions of Note 9, reconcile the beginning balance ($1,397) and ending balances 2. Macy's was required to amortize a portion of its Net loss-AOCI associated with its pension plan in 2015. Based on the 3. From the information provided in various portions of Note 10, reconcile the beginning balance ($349) and ending balances for 4. Suppose you believe that Macy's should have assumed a 1% lower health care cost trend during 2015, what would 2015 net for Net loss-AOCI associated with Macy's pension plan. Clearly label each reconciling amount. calculation of that amount, determine the average remaining service life of the company's employees used in that calculation. Net loss-AOCI associated with Macy's Other postretirement employee benefit plan. Clearly label each reconciling amount. income have been under that assumption? Assume a 35% income tax rate. Analysis Case 17-11 Pensions and other postretirement benefit plans; analysis of disclosure notes 017-6 @ , LOI7-11 @ Real World Financials Macy's, Inc., operates about 840 Macy's and Bloomingdale's department stores and furniture galleries in 45 states and U.S. territories as well as Bloomingdale's Outlet stores, macys.com, and bloomingdales.com. Refer to the financial statements for the year ended January 30, 2016 and related disclosure notes of the company. The financial statements can be found at the company's website (www.macys.com). Required 1 I. From the information provided in various portions of Note 9, reconcile the beginning balance ($1,397) and ending balances 2. Macy's was required to amortize a portion of its Net loss-AOCI associated with its pension plan in 2015. Based on the 3. From the information provided in various portions of Note 10, reconcile the beginning balance ($349) and ending balances for 4. Suppose you believe that Macy's should have assumed a 1% lower health care cost trend during 2015, what would 2015 net for Net loss-AOCI associated with Macy's pension plan. Clearly label each reconciling amount. calculation of that amount, determine the average remaining service life of the company's employees used in that calculation. Net loss-AOCI associated with Macy's Other postretirement employee benefit plan. Clearly label each reconciling amount. income have been under that assumption? Assume a 35% income tax rate

Only Requirement 1 & 2.

Only Requirement 1 & 2.