Answered step by step

Verified Expert Solution

Question

1 Approved Answer

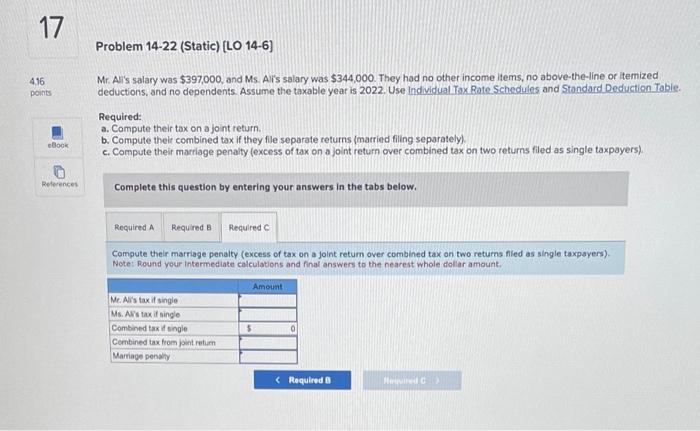

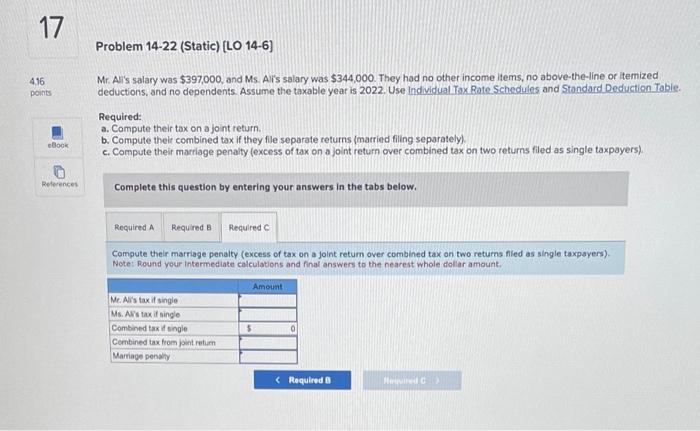

only requirement C Mr. Ali's salary was $397,000, and Ms. Ali's salary was $344,000. They had no other income ltems, no above-the-line or itemized deductions,

only requirement C

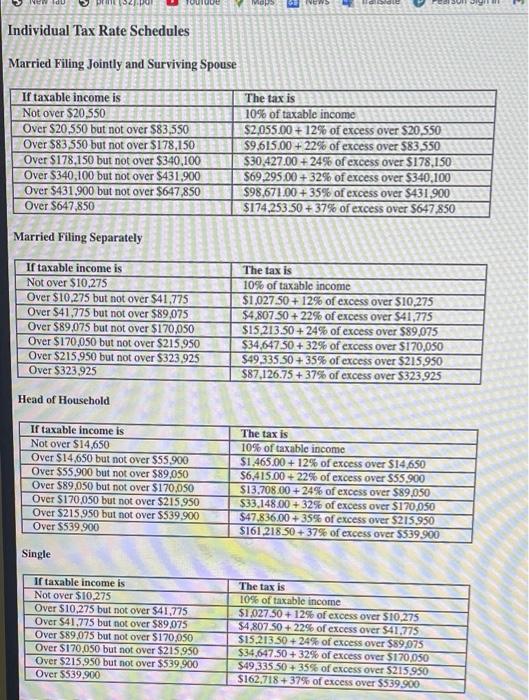

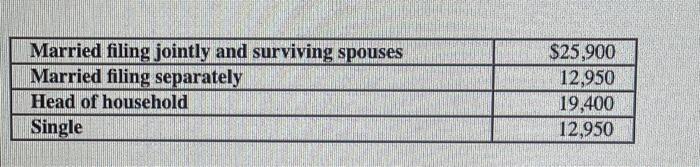

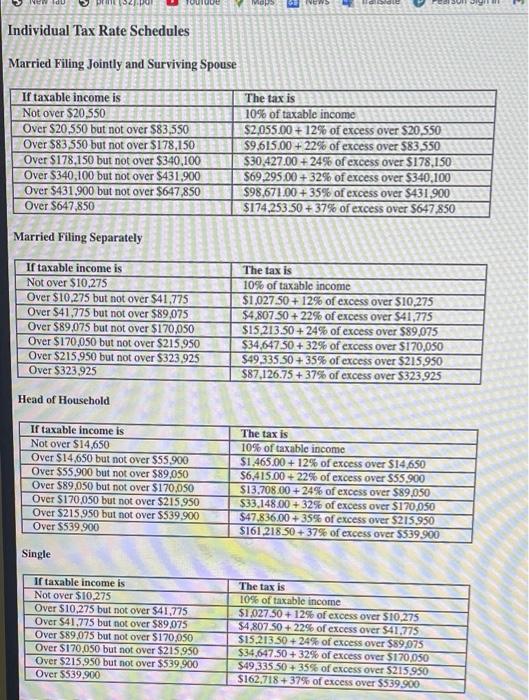

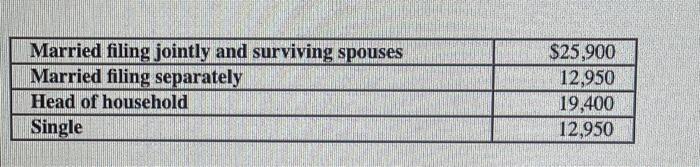

Mr. Ali's salary was $397,000, and Ms. Ali's salary was $344,000. They had no other income ltems, no above-the-line or itemized deductions, and no dependents. Assume the taxable year is 2022. Use Ind vidual Tax Rate. Schedules and Standard Deduction Table. Required: a. Compute their tax on a joint return. b. Compute their combined tax if they file separate returns (matried filing separately). c. Compute their marriage penaity (excess of tax on a joint return over combined tax on two returns filed as single taxpayers). Complete this question by entering your answers in the tabs below. Compute their marriage penalty (excess of tax on a joint retum over combined tax on two returns fled as single taxpayers). Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Individual Tax Rate Schedules Married Filing Jointly and Surviving Spouse Married Filing Separately Head of Household Single \begin{tabular}{|l|r|} \hline Married filing jointly and surviving spouses & $25,900 \\ \hline Married filing separately & 12,950 \\ \hline Head of household & 19,400 \\ \hline Single & 12,950 \\ \hline \end{tabular}

Mr. Ali's salary was $397,000, and Ms. Ali's salary was $344,000. They had no other income ltems, no above-the-line or itemized deductions, and no dependents. Assume the taxable year is 2022. Use Ind vidual Tax Rate. Schedules and Standard Deduction Table. Required: a. Compute their tax on a joint return. b. Compute their combined tax if they file separate returns (matried filing separately). c. Compute their marriage penaity (excess of tax on a joint return over combined tax on two returns filed as single taxpayers). Complete this question by entering your answers in the tabs below. Compute their marriage penalty (excess of tax on a joint retum over combined tax on two returns fled as single taxpayers). Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Individual Tax Rate Schedules Married Filing Jointly and Surviving Spouse Married Filing Separately Head of Household Single \begin{tabular}{|l|r|} \hline Married filing jointly and surviving spouses & $25,900 \\ \hline Married filing separately & 12,950 \\ \hline Head of household & 19,400 \\ \hline Single & 12,950 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started