Answered step by step

Verified Expert Solution

Question

1 Approved Answer

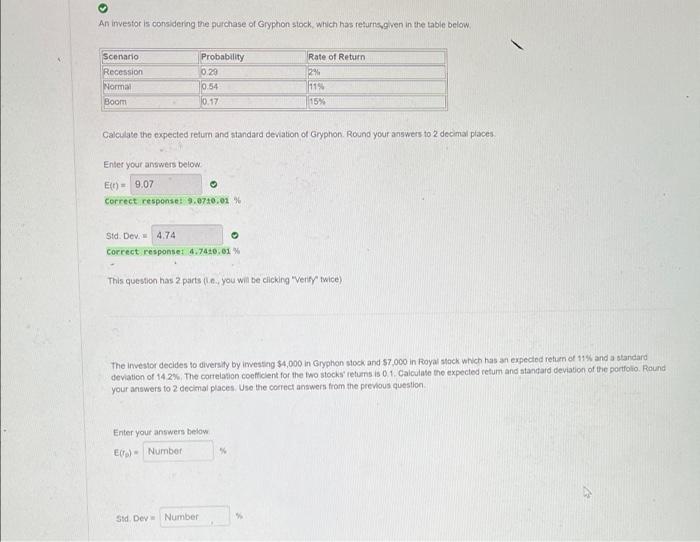

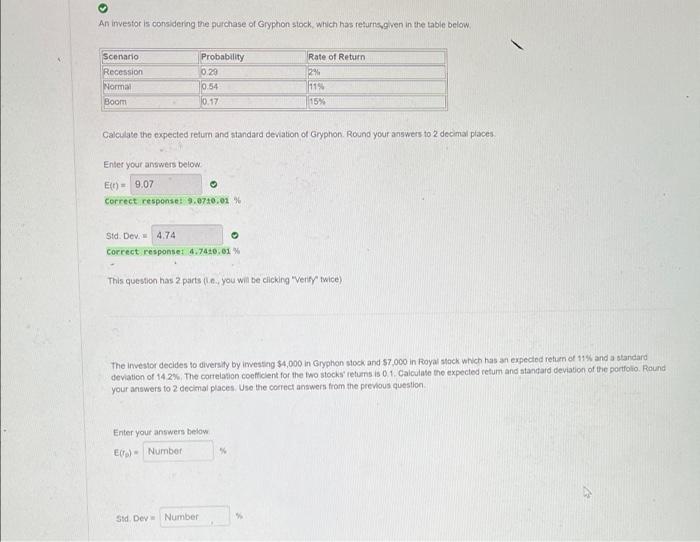

Only second part is needed An investor is considering the purchase of Gryphon stock, which has returns given in the table below Probability 029 Scenario

Only second part is needed

An investor is considering the purchase of Gryphon stock, which has returns given in the table below Probability 029 Scenario Recession Normal Boom Rate of Return 24 119 15% 0.54 10.17 Calculate the expected return and standard deviation of Gryphon. Round your answers to 2 decimal places Enter your answers below E) 9.07 Correct response! 9.0710.01% Std. Dev 4.74 Correct responset 4.7420.01% This question has 2 partsyou will be clicking "Verity twice) The investor decides to diversity by investing $4,000 in Gryphon stock and $7,000 in Royal stock which has an expected return of 11 and a standard deviation of 14 2%. The correlation coefficient for the iwo stock returns is 0.1. Calculate the expected retum and standard deviation of the portfolio Round your answers to 2 decimal places. Use the correct answers from the previous question Enter your answers below E) Number Sid Dey Number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started