only solve bottom 2 questions ignore first one

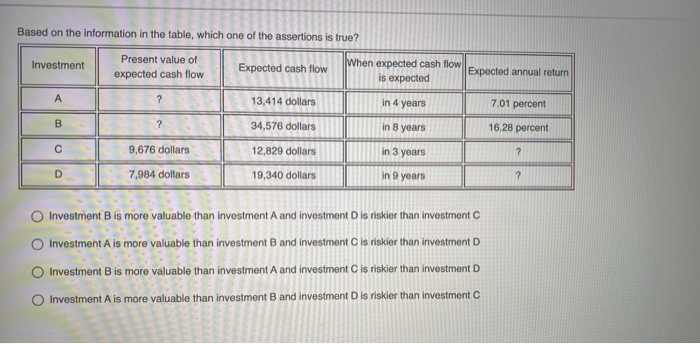

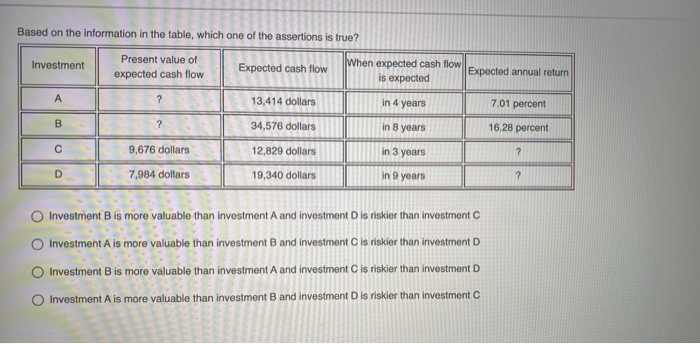

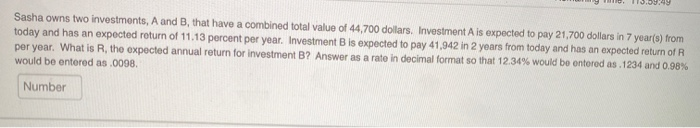

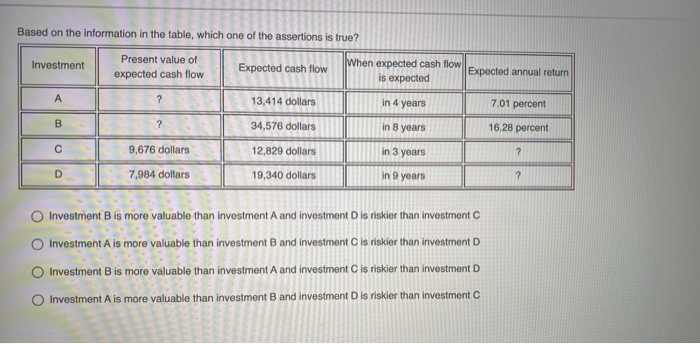

Fairfax Paint is planning to sell its McLean, Springfield, and Falls Church stores in Tyears from today. The firm expects to sell its Springfield store for a cash flow of H dollars, its Falls Church store for a cash flow of H dollars, and its McLean store for a cash flow of M dollars. The cost of capital for the Falls Church store is W percent, the cost of capital for the Springfield store is a percent, the cost of capital for the McLean store is Q percent, H>M>0,Q>W>0; and T >0. The cash flows from the sales are the only cash flows associated with the various stores. Based on the information in the preceding paragraph, which one of the following assortions is true? Two of the three stores have equal value and those two stores are more valuable than the third store or all three stores have the same value None of the other assertions is true The Springfield store is the most valuable of the 3 stores The McLean store is the most valuable of the 3 stores The Falls Church store is the most valuablo of the 3 stores Based on the information in the table, which one of the assertions is true? Investment Present value of expected cash flow Expected cash flow When expected cash flow is expected Expected annual return A ? 13,414 dollars in 4 years 7.01 percent B ? 34,576 dollars in 8 years 16.28 percent O 9,676 dollars 12,829 dollars in 3 years ? D 7,984 dollars 19,340 dollars in 9 years ? o O Investment B is more valuable than investment A and investment Dis riskier than investment C Investment A is more valuable than investment B and investment C is riskier than investment D Investment B is more valuable than investment A and investment C is riskier than investment D Investment A is more valuable than investment B and investment D is riskier than investment O Sasha owns two investments, A and B, that have a combined total value of 44,700 dollars. Investment A is expected to pay 21,700 dollars in 7 year(s) from today and has an expected return of 11.13 percent per year. Investment B is expected to pay 41,942 in 2 years from today and has an expected return of R per year. What is R, the expected annual return for investment B? Answer as a rate in decimal format so that 12.34% would be entered as 1234 and 0.98% would be entered as .0098. Number