ONLY THE BOTTOM HALF STARTING AT 4C

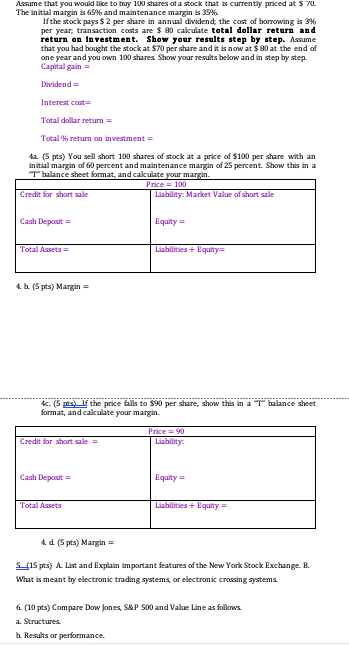

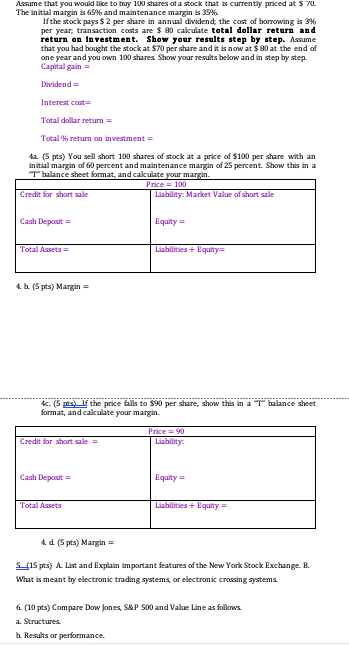

Assume that you would like to buy 100 shares of a stock that is currently priced at 5 7 The initial margin is 65% and maintenance margin is 39% If the stock pays $2 per share in annual dividend the cost of borrowing is 3% per year, transaction costs are $ 90 calculate total dollar return and return on investment. Show your results step by step. Assume that you had bought the stock at $70 per share and it is now at $90 at the end of one year and you own 100 shares Show your results below and in step by step Capital gain Dividend Interest cost Total dollar return = Total return on investment ta (5 pts) You sell short 100 shares of stock at a price of $100 per share with an initial margin of 60 percent and maintenance margin of 25 percent. Show this in a "T" balance sheet format, and cakulate your margin. Price = 100 Credit for short sale Liability: Market Value of short sale Cash Deposit Equity = Total Assets = Liabilities + Equity 4 h (5 pts) Margin= tc. (5 pts) If the price falls to $90 per share, show this in a T balance sheet format, and calculate your margin. Price = 90 Liability Credit for short sale Cash Deposit Equity = Total Assets Liabilities + Equity 4d (5pts) Margin- 115 pts) A List and Explain important features of the New York Stock Exchange. B. What is meant by electronk trading systems, or electronk crossing systems 6 (10 pts) Compare Dow Jones, S&P 500 and Value Lane as follows a Structures h Results or performance. Assume that you would like to buy 100 shares of a stock that is currently priced at 5 7 The initial margin is 65% and maintenance margin is 39% If the stock pays $2 per share in annual dividend the cost of borrowing is 3% per year, transaction costs are $ 90 calculate total dollar return and return on investment. Show your results step by step. Assume that you had bought the stock at $70 per share and it is now at $90 at the end of one year and you own 100 shares Show your results below and in step by step Capital gain Dividend Interest cost Total dollar return = Total return on investment ta (5 pts) You sell short 100 shares of stock at a price of $100 per share with an initial margin of 60 percent and maintenance margin of 25 percent. Show this in a "T" balance sheet format, and cakulate your margin. Price = 100 Credit for short sale Liability: Market Value of short sale Cash Deposit Equity = Total Assets = Liabilities + Equity 4 h (5 pts) Margin= tc. (5 pts) If the price falls to $90 per share, show this in a T balance sheet format, and calculate your margin. Price = 90 Liability Credit for short sale Cash Deposit Equity = Total Assets Liabilities + Equity 4d (5pts) Margin- 115 pts) A List and Explain important features of the New York Stock Exchange. B. What is meant by electronk trading systems, or electronk crossing systems 6 (10 pts) Compare Dow Jones, S&P 500 and Value Lane as follows a Structures h Results or performance