Answered step by step

Verified Expert Solution

Question

1 Approved Answer

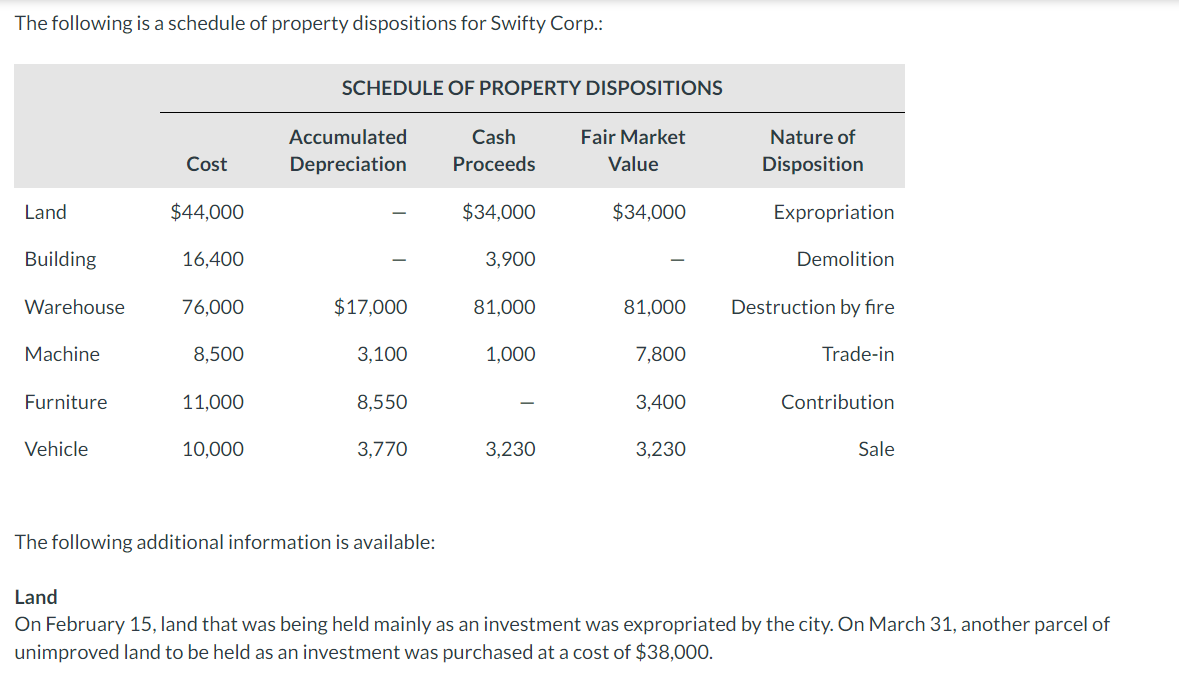

Only the entries for the building which are posted are needed!! The following is a schedule of property dispositions for Swifty Corp.: The following additional

Only the entries for the building which are posted are needed!!

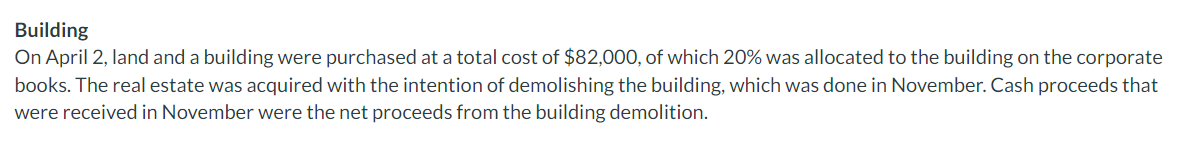

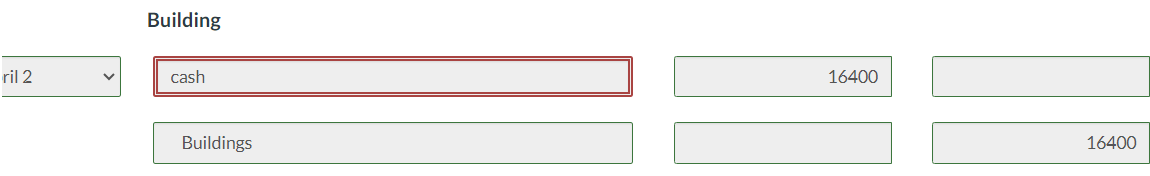

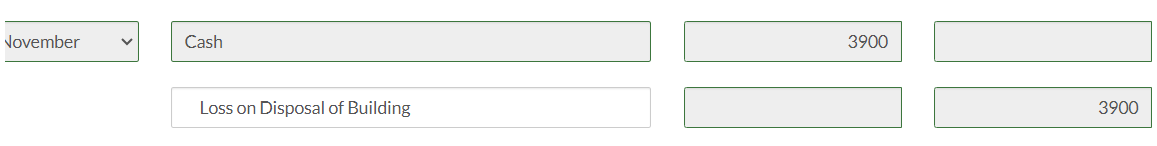

The following is a schedule of property dispositions for Swifty Corp.: The following additional information is available: Land On February 15, land that was being held mainly as an investment was expropriated by the city. On March 31, another parcel of unimproved land to be held as an investment was purchased at a cost of $38,000. Building On April 2, land and a building were purchased at a total cost of $82,000, of which 20% was allocated to the building on the corporate books. The real estate was acquired with the intention of demolishing the building, which was done in November. Cash proceeds that were received in November were the net proceeds from the building demolition. Building ril 2 \begin{tabular}{||l|l|} \hline \hline cash & 16400 \\ \hline Buildings & \\ \hline \end{tabular} Vovember v Cash 3900 4 Loss on Disposal of Building 3900Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started